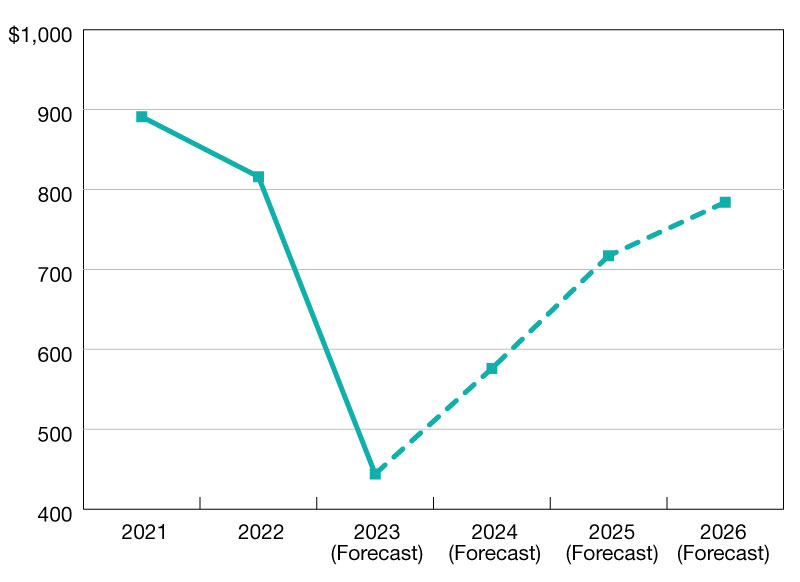

CREF Forecast: Borrowing and Lending Expected to Increase to $576B in 2024

Commercial and multifamily mortgage originations are expected to increase 29% from 2023’s estimated total.

Total commercial and multifamily mortgage borrowing and lending is expected to rise to $576 billion in 2024, which is a 29 percent increase from 2023’s estimated total of $444 billion. This is according to an updated baseline forecast released earlier this year by the Mortgage Bankers Association (MBA).

Multifamily lending alone (which is included in the total figures) is expected to rise to $339 billion this year—a 25 percent increase from last year’s estimate of $271 billion. MBA anticipates borrowing and lending next year will increase to $717 billion in total commercial real estate lending, with $404 billion of that total in multifamily lending.

2023 is likely to go into the record books as the slowest year for commercial real estate borrowing and lending in roughly a decade. As the markets reset—on interest rates, property values, some property fundamentals and other factors—those volumes should pick up marginally. While up from last year’s levels, we still expect borrowing and lending in 2024 to be below what was seen going back to 2017.

Commercial mortgage originations have historically followed property prices, and the uncertainty about the future path of interest rates has been a contributing factor to the current slowdown. If interest rates and cap rates were to fall, that should help boost values and promote borrowing. If they remain higher for longer, that will suppress activity. This uncertainty is a contributing factor in today’s slowdown.

You must be logged in to post a comment.