Commercial and Multifamily Mortgage Debt Outstanding Increased in Fourth-Quarter 2023

Details from the Mortgage Bankers Association’s latest report.

The level of commercial and multifamily mortgage debt outstanding at the end of 2023 was $130 billion (2.8 percent) higher than at the end of 2022, according to the Mortgage Bankers Association’s (MBA) latest Commercial/Multifamily Mortgage Debt Outstanding quarterly report.

MBA’s report found that total mortgage debt outstanding rose by 0.9 percent ($41.8 billion) to $4.69 trillion in fourth-quarter 2023. Multifamily mortgage debt grew by $25.0 billion (1.2 percent) to $2.09 trillion during the fourth quarter, and by $88.5 billion (4.4 percent) for the entire year.

The amount of commercial mortgage debt outstanding grew in the final quarter of 2023 and for the year as a whole. However, the increase was among the slowest paces since the mid-2010s. Every major capital source increased its mortgage holdings during the year. Mortgage originations were down by roughly 50 percent in 2023 compared to 2022, but that meant that few loans were paying off, helping maintain portfolio sizes even in the face of lower inflows.

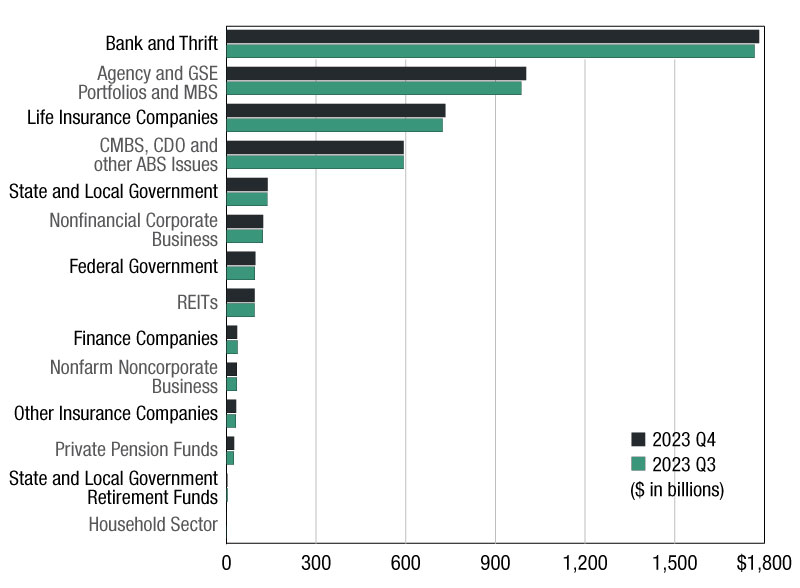

Commercial banks continue to hold the largest share (38 percent) of commercial/multifamily mortgages at $1.8 trillion. Agency and GSE portfolios and MBS are the second largest holders of commercial/multifamily mortgages at $1.0 trillion (21 percent of the total). Life insurance companies hold $733 billion (16 percent), and CMBS, CDO and other ABS issues hold $593 billion (13 percent).

In the fourth quarter of 2023, Agency and GSE portfolios and MBS saw the largest rise in dollar terms in their holdings of commercial/multifamily mortgage debt, with an increase of $15.5 billion (1.6 percent). Commercial banks increased their holdings by $14.8 billion (0.8 percent), Life insurance companies increased their holdings by $9.9 billion (1.4 percent), and nonfinancial corporate business increased their holdings by $1.3 billion (1.1 percent). Finance companies saw the largest decline (5.0 percent) at $1.9 billion.

You must be logged in to post a comment.