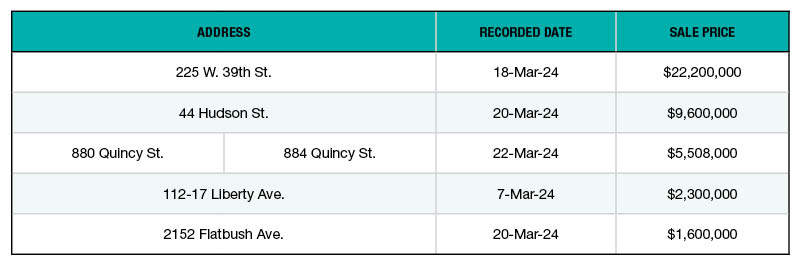

NYC’s Top 5 Office Property Sales

A roundup of recent major transactions put together by PropertyShark.

- 225 W. 39th St., Manhattan

Sale Price: $22,200,000

An entity connected to IHL Group, a women and children’s apparel company, has purchased the 88,100-square-foot office property in Manhattan’s Garment District. The seller is David Berley’s Walter & Samuels, Inc., that owned the 12-story asset since 1975. The office building, originally built in 1910, includes 6,000 square feet of retail space and is occupied by multiple tenants, such as DataVision, WeWork and Manhattan Fencing Center.

- 44 Hudson St., Manhattan

Sale Price: $9,600,000

A private investor affiliated with Regeneron Pharmaceuticals acquired the 12,900-square-foot office building in Manhattan’s Tribeca neighborhood. Columbia Pacific Advisors sold the five-story property, that last changed hands in 2018 for $14 million, from seller Dr. Coleman LipoStructure Inc., currently a tenant at the property.

- 880 Quincy St., Brooklyn

Sale Price: $5,508,000

Bank of America sold the 5,376-square-foot office building, together with an adjacent parcel at 884 Quincy St., situated within Brooklyn’s neighborhood of Bedford Stuyvesant. The buyer is an entity affiliated with Lian Wu Shao’s New World Mall. The one-story office property is originally built in 1918 and served as one of Bank of America’s locations.

- 112-17 Liberty Ave., Queens

Sale Price: $2,300,000

A private seller sold the 2,960-square-foot office building in Queens’ Richmond Hill to another private investor, affiliated with a Hicksville, N.Y.-based family medicine company. The office property became subject to a $940,000 acquisition loan held by Avid Commercial, and another $1.2 million loan originated by Morgan Stanley Bank. The two-story property is originally built in 1930 and last altered in 1996.

- 2152 Flatbush Ave., Brooklyn

Sale Price: $1,600,000

An entity affiliated with NineDot Energy, acquired the 4,000-square-foot office property in Brooklyn’s Marine Park neighborhood. The seller is a private investor. The property became subject to a $7.2 million loan held by SolaREIT, a financing solutions company providing capital for solar and battery energy storage developers and companies.

You must be logged in to post a comment.