Single-Tenant Deals Get a Boost

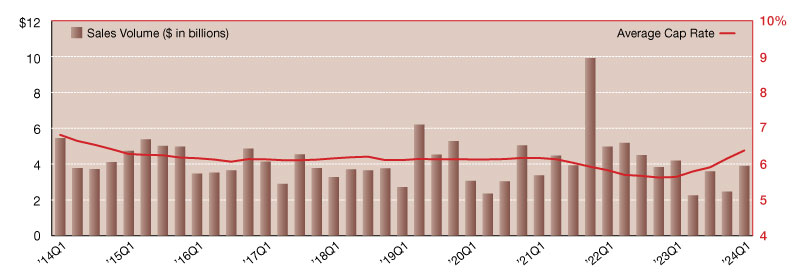

2024 Net Lease Retail Sales Volume & Cap Rates

After an up-and-down year in 2023, the single-tenant net lease retail sector started 2024 on a strong note. In the last three months, investment sales volume totaled $3.9 billion, jumping nearly 59 percent quarter-to-quarter. This marks the sector’s strongest reporting period since this time last year and puts the market on track to exceed last year’s annual performance, as long as activity remains consistent.

As the year progresses, however, it’s possible we will see another few quarters of inconsistent transaction volume. Actions by the Fed suggest interest rate cuts are still a ways off, and the bulk of private investor activity is likely to be driven by forced timelines in order to satisfy 1031 exchanges. This opens the door for other investor groups to act opportunistically, and with new net lease retail development still happening across the U.S.—especially for markets with high population growth and stronger economies—activity from public REITs, institutional investors, and international buyers may influence this year’s buyer distribution trends.

Cap rates continued their upward climb, rising 23 basis points from year-end. At an average of 6.38 percent, rates are now 74 basis points higher year-over-year. Interest rates continue to impact investor appetite, especially for private and individual investors who regularly capture the lion’s share of net lease retail acquisitions. In the first quarter 2024, however, we saw public REITs account for over half of all single-tenant retail buyers, reducing private investor activity to only 32 percent of the market.

Investors across all groups should be encouraged by the planned growth and expansion of many retailers that have become net lease favorites. Gas stations, discount retailers, quick service restaurants, and more are among the more aggressively expanding tenants, with some brands committing to open hundreds of new locations in the near-term. Existing stores too are generating opportunities for investors, as companies like Walmart, Starbucks and Dollar General invest billions to renovate and modernize stores, adding value for current owners.

You must be logged in to post a comment.