Atlanta’s Office Market Sees Improvement

Record-breaking leases and growing sales volume are boosting the sector.

Fundamentals across Atlanta’s office market showed some signs of improvement throughout the first seven months of this year, but remained far behind historic averages, the latest CommercialEdge data reveals. Headwinds facing the office sector are not bound to slow anytime soon and office market players are shifting strategies to adapt.

Atlanta’s growing life science sector, along with some major mixed-use projects, promises to revitalize the office market to some degree. Meanwhile, investment volume grew year-over-year, although some significantly large buildings lost value. A few notable leases brought the market’s vacancy down since last year, while flexible space providers focus on the suburbs.

The market has one of the more limited office pipelines in the Southern region, with incoming projects accounting for less and less of existing inventory. With limited candidates for office-to-residential conversion, Atlanta’s office sector has limited means to curb value destruction. CommercialEdge’s Conversion Feasibility Index is a tool that helps identify the opportunity for these conversions at the property level, with a number of U.S. markets having large swaths of inventory as strong candidates for the operation.

Rate of development falls behind national average

Atlanta’s office market faced a slowdown in development, with 1.8 million square feet under construction in July, or 0.9 percent of existing stock. The metro fell just 20 basis points below the 1.1 percent national figure. Together with planned and prospective projects, the pipeline was at 2.5 percent of existing stock.

Compared with some of its Sun Belt peers, Georgia’s capital was ahead of Houston (0.7 percent of stock underway), but behind Austin, Texas (4.6 percent).

The largest office development underway in July was Portman Holdings’ Spring Quarter, taking shape in Midtown Atlanta. The mixed-use project will have 525,000 square feet of office, 40,000 square feet of retail, 370 luxury rental units, 600 market-rate units and 11,000 square feet of outdoor amenity space. Portman broke ground on Spring Quarter in 2022 and plans to bring it online next year.

Atlanta developers completed 1.1 million square feet of office space across six projects in the first seven months of the year. This represents a 0.5 percent expansion of existing stock, which was just 10 basis points above the national figure. In terms of completions relative to total inventory, Atlanta was behind Austin (0.9 percent of stock) and on par with Houston.

More developments aimed at Atlanta’s growing life science sector are taking shape in the metro. One of the largest office properties to come online year-to-date through July was Science Square Labs, adjacent to Georgia Tech’s Midtown campus. Trammell Crow Co. partnered with an affiliate of Georgia Institute of Technology for the development of an 18-acre life science district. The 368,258-square-foot office building—along with a 280-unit community—comprised the first phase of this ongoing project.

In April, Jamestown completed 619 Ponce, a mass-timber office building in Southeast Atlanta measuring 115,000 square feet. The four-story asset is part of the second phase of the Ponce City Market adaptive reuse. Jamestown is also developing two multifamily communities within the same project.

Investment volume more than doubles year-over-year

Investors traded $478 million in office assets during the first seven months of the year, which was a 167 percent increase year-over-year. A total of 23 properties changed hands in single-asset sales, encompassing 2.6 million square feet. Adding portfolio deals to the mix, the total was 28 properties and 3.6 million square feet.

Transactions across Atlanta’s office market this year brought the average price per square foot to $146, lagging the $173 national average. Compared to some of its Sun Belt peers, Atlanta was ahead of Houston ($103 per square foot) and Charlotte ($143), but significantly behind Austin ($432).

B Group Capital Management closed on two back-to-back deals in June for a combined $81 million. The company acquired a pair of office properties in separate transactions. Ameris Center at 3500 Piedmont Road NE traded for $38.8 million, while Ameris Center at 3490 Piedmont Road NE changed hands for $42.1 million. It is worth noting that both were exchanged for less than their previous sale values in 2015 ($43.1 million and $46.9 million, respectively).

Another notable transaction was Shorenstein Investment Advisers’ all-cash deal for 14th & Spring. Greenstone Properties and its equity partner Goldman Sachs put the 324,000-square-foot asset up for sale back in February. It has stood empty since its completion in 2022. The property is subject to a 13-year unsubordinated net ground lease held by the Development Authority of Fulton County, set to expire in 2032.

Vacancy improves with some record-breaking deals

Atlanta’s overall vacancy rate fell 30 basis points year-over-year, to 18.4 percent as of July. Although higher than the national figure—which declined 100 basis points to 18.1 percent—the metro experienced healthy demand, considering the overall state of the sector.

Atlanta fared better for office vacancy than some of its Sun Belt peers. It was followed by Austin (22.9 percent) and Houston (23.8 percent).

A few large leasing deals closed across the metro year-to-date through July. In April, Lionstone Investments signed a 164,221-square-foot agreement with Piedmont Healthcare Inc., which at the time was the largest lease of the year. The tenant plans to consolidate three of its offices at Lionstone’s 540,000-square-foot building at 271 17th St. in Northwest Atlanta.

In June, this record was broken when Building and Land Technology secured a 180,000-square-foot lease with Newell Brands Inc. at its Concourse Office Park in Sandy Springs, Ga. The new tenant will relocate and expand its headquarters, planning to open by mid-2025.

Hoping to boost its 2022-acquired asset, Granite Properties hired Stream Realty Partners as exclusive leasing agent for 3630 Peachtree in Atlanta’s Buckhead submarket. The 438,000-square-foot tower’s current roster includes VML, Amwins Insurance Brokerage and Crescent Wealth Advisory, among others.

Suburban coworking thrives

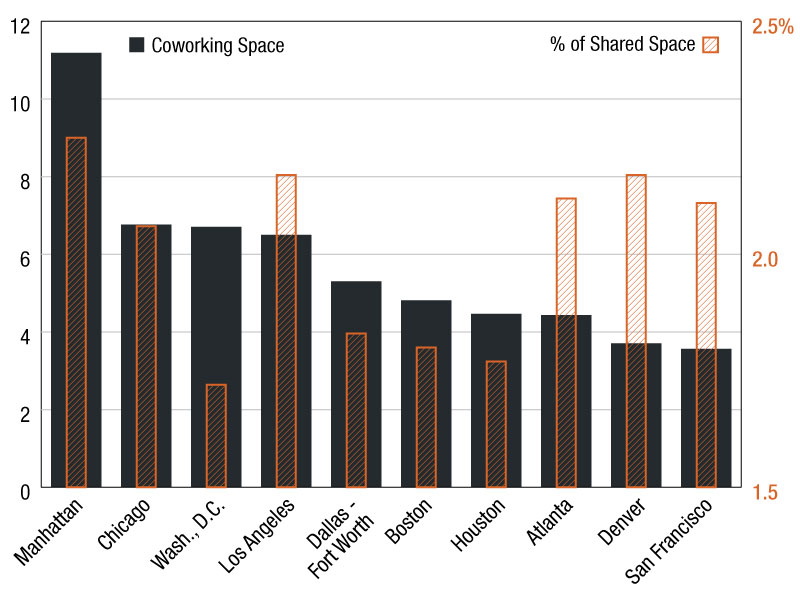

Atlanta had 4.4 million square feet of flexible office space in July, which was a 2.1 percent share of its entire rentable office inventory. This highlighted strong performance for the coworking segment, as this share was above the national figure (1.8 percent), as well as ahead of Austin (1.5 percent), Charlotte (1.6 percent) and Houston (1.7 percent).

Around three quarters of Atlanta’s flexible office space was in suburban areas. According to recent report from CoworkingCafe, suburbs and smaller cities can offer providers an avenue to a higher rate of success. Over the past 12 months, coworking operators expanded their footprint by 9 million square feet in suburban areas across the U.S., the same source shows.

THRIVE | Coworking is an Atlanta-based flexible office provider that operates mostly in suburban areas. It currently has 85,257 square feet across eight locations. The metro’s largest providers were Regus (566,900 square feet), Industrious (332,200 square feet) and WeWork (285,100 square feet).

You must be logged in to post a comment.