What the AI-Driven Hiring Surge Means for CRE

Recruitment is ramping up at both technology and non-tech companies.

Despite an overall slowdown in tech talent employment in 2023, demand for workers in fields related to artificial intelligence has increased considerably, according to CBRE’s annual Scoring Tech Talent Report.

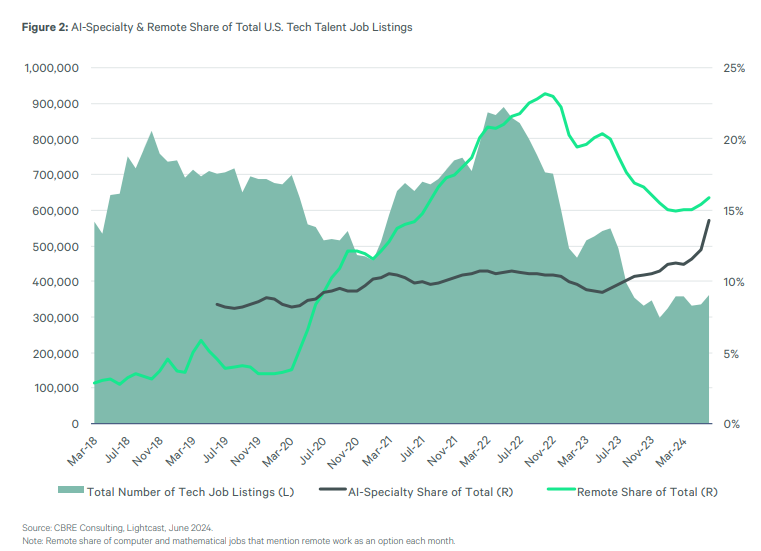

Last year, tech talent-related employment grew by 213,000 jobs, a 3.6 year-over-year percent increase that is less than half of 2022’s 7.3 percent uptick. At the same time, hiring for AI-related workers grew by roughly twice this amount, with jobs postings in June of this year alone ticking up to 14.3 percent, a 590-basis-point increase over the last five years.

But much of this demand is not within the high-tech sector itself. Over the same yearlong period, non-tech employers, particularly those in professional & business services, as well as the transportation, warehousing & wholesale sectors increased their tech talent headcounts by 49,760 and 45,390 jobs, an average of 18,597 more employees than the high-tech sector itself. This is the first such occurrence in the report’s 11-year history, and reflects a persistent interest in artificial intelligence outside of industries traditionally associated with tech. This is not without effects on office market fundamentals.

The office sector’s saving grace?

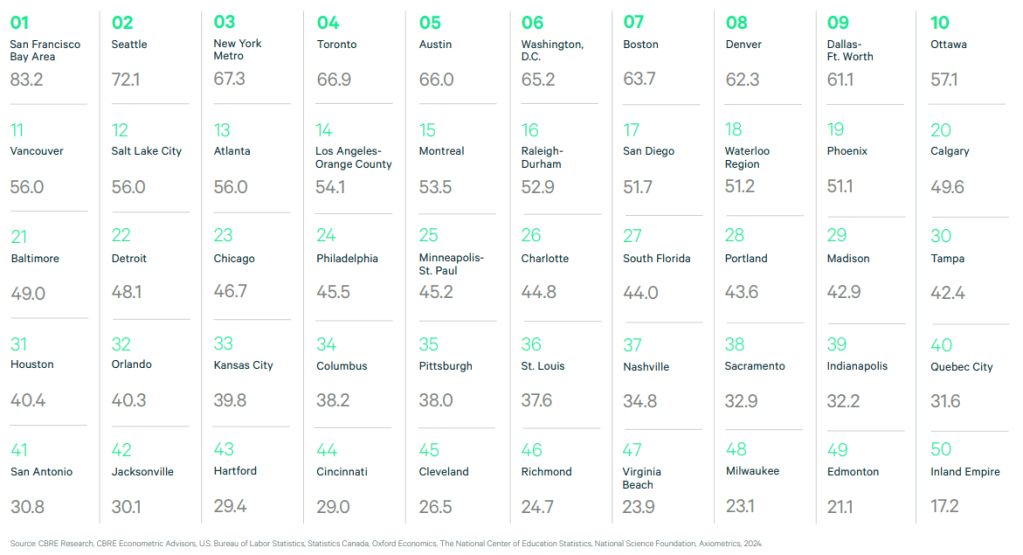

Not all AI-related jobs and job-filled metros are created equal, and some stand to benefit from this demand more than others. The Scoring Tech Talent Report surveys 75 markets across North America and ranks the top 50 with scores that are a tallied average of 13 weighted metrics involving skilled workers in technology-focused jobs. These include but are not limited to employee saturation, wages, tech degree completions and average office rents.

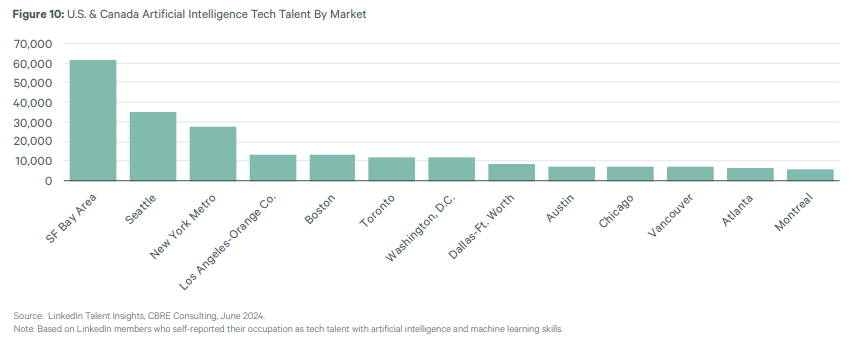

The San Francisco Bay Area, the home of OpenAI and other global tech companies, retained its top spot, with a score of 83.2, more than 10 points higher than Seattle on the second place. The report also cites data from CB Insights that states that the area has absorbed more than half of all AI-intended venture capital. Additionally, one quarter of recently-signed office leases downtown were in the hands of AI companies, according to LinkedIn and CBRE Research data cited by the report.

In a webinar accompanying the report, Luke Ogelsby, an executive vice president at the firm, cited these trends as a “remaking of the Bay Area market,” with 1 million square feet of positive net absorption on the part of AI companies taking place last year. “We predict that it will not only impact the Bay Area, but it will spill over to other markets as well,” Ogelsby said.

READ ALSO: AI Will Probably Boost Office Demand. And CRE at Large.

Alongside Ottawa, the San Francisco Bay Area had the highest concentration of tech talent, with 12.3 percent of its active workforce classified in the sector totaling 436,740 employees. On average, tech workers in the area make $178,000 per year, approximately $30,000 more than second-place Seattle.

Seattle and New York City retained their silver and bronze podium spots, with scores of 72.1 and 67.3, respectively. Toronto and Austin, Texas, have both inched up one spot from last year, beating out Washington, D.C., which had previously been at number four.

Sacha Zarba, a vice chairman working out of the firm’s Midtown Manhattan office, said at the webinar that New York City’s strength comes from both the diversity of companies working there, combined with a healthy appetite for artificial intelligence research and implementation. “(It) brings an extraordinary amount of energy and enthusiasm for smaller tenants to build an employee base that has longevity,” Zarba explained. “And we’re seeing that not just in tech, but in finance.”

READ ALSO: Manhattan Office Visits up Year-Over-Year: REBNY

Within a characteristically ailing market, tech talent is the “largest contributor of leasing volume in the city,” which Zarba believes will bode “extraordinarily well” for the five boroughs.

The Big Apple’s knowledge base is helping, too. In 2022, the New York metro’s 20,848 new graduates led the nation in terms of tech degree completions. Meanwhile, 78.3 percent of Seattle’s software engineers are in the tech industry, the highest proportion on the continent. New York added only 22,290 jobs from 2018 through 2022, while Seattle added 33,140 from 2019 through 2023. From 2018 through 2022, Seattle’s total number of hires outpaced degree completions by roughly 8,500.

According to Bill Cooper, a senior vice president working out of the Puget Sound region, the area’s climate, longstanding presence of research institutions and proximity to the University of Washington are all highly appealing to ambitious AI experts. “It’s created a deep talent base of expertise; I find that once they get here (and) they like the environment, they end up taking jobs here,” Cooper said.

All-in-all, the top three markets dwarf their competition for AI-focused tech talent, with their combined number of specialists accounting for 44 percent of the nation’s existing base of 285,235 jobs.

Surprises and revelations

Of the report’s top performers, the most dramatic score increases were in medium-to-larger office markets, some of which have recently seen both high-profile investments and corporate relocations. These include Houston, San Diego, Raleigh-Durham, N.C., Detroit and San Antonio, which saw a 5-point boost, while Salt Lake City, South Florida and Calgary saw their scores increase by 4 points. Nearly all these markets have seen recent investments, developments and office leasing from a host of biotech companies, semiconductor manufacturers and data centers.

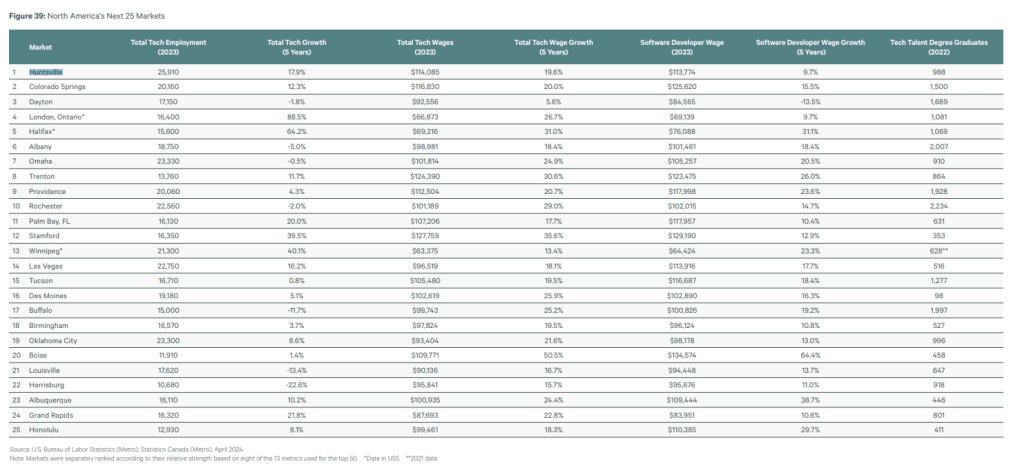

Some markets that did not make the top 50 yet have shown continuous promise for tech talent include Huntsville, Ala., Colorado Springs, Colo., and Dayton, Ohio, all of which posted figures north of 15,000 employed tech workers last year. Huntsville and Colorado Springs both saw tech employment growth of 17.9 and 12.3 percent respectively, while wages for both markets grew by 19.6 and 20 percent.

Obstacles to surmount

The data points to a consistent, yet more refined demand for tech talent. Most of the new hires were software developers and programmers, which made up 72 percent of all tech talent hires last year. Overall job postings ticked up by 5 percent to 342,000, a marginal quarter-over-quarter increase that is still a far cry from 2022’s peak of nearly 900,000.

But where the work is taking place tells a different story. Of these offerings, approximately 15 percent were offered as fully remote, a trend that has trickled down to an office market reeling from a spree of recent tech layoffs. According to data from TrueUp, there have been 824 tech layoffs this year alone, which have affected 211,341 workers.

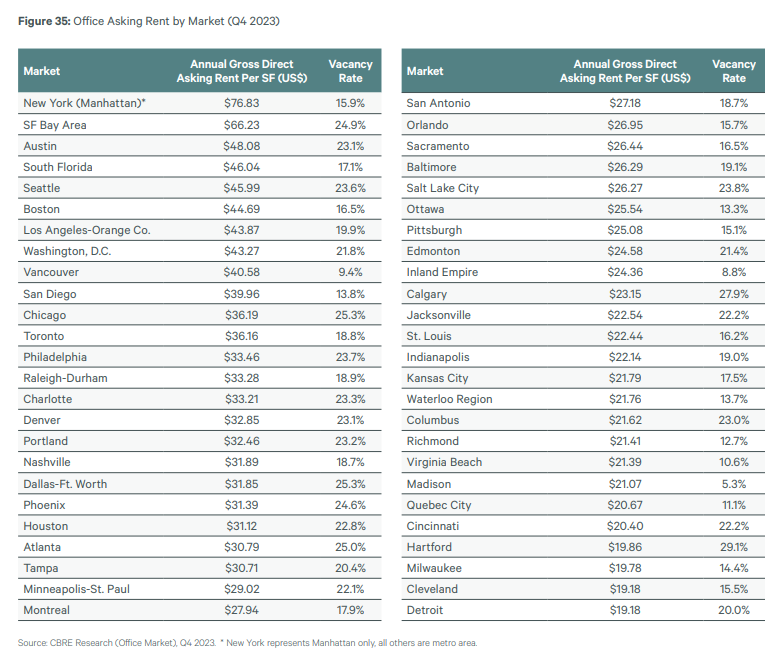

Alongside the shrinkage in hiring, office markets around the country have seen mixed returns on their rents and vacancy rates, in part due to the persistence of working from home. The San Francisco Bay Area, for example, saw a 10 percent drop in average rents in the fourth quarter of last year, with a vacancy rate of 24.9 percent, 660 basis points over the national average at the time. But AI could improve in-person work headcounts, especially on the research and development front. “We’re seeing a lot more collaboration in office work, due to the need for sharing knowledge,” Cooper observed.

In spite of these shortcomings, Ogelsby is enthusiastic about the metro’s future, given its dominance of the market by nearly every measurable quantity, coupled with the strength of its life science market. “(It) reinforces that San Francisco is the biggest market in the world for tech talent, and we anticipate that it will continue to lead. It feels like the early innings of the next great innovation cycle,” Ogelsby concluded.

You must be logged in to post a comment.