CIM Group Signs HQ Tenant in Los Angeles

The deal is the largest new office lease of 2024 in this key submarket.

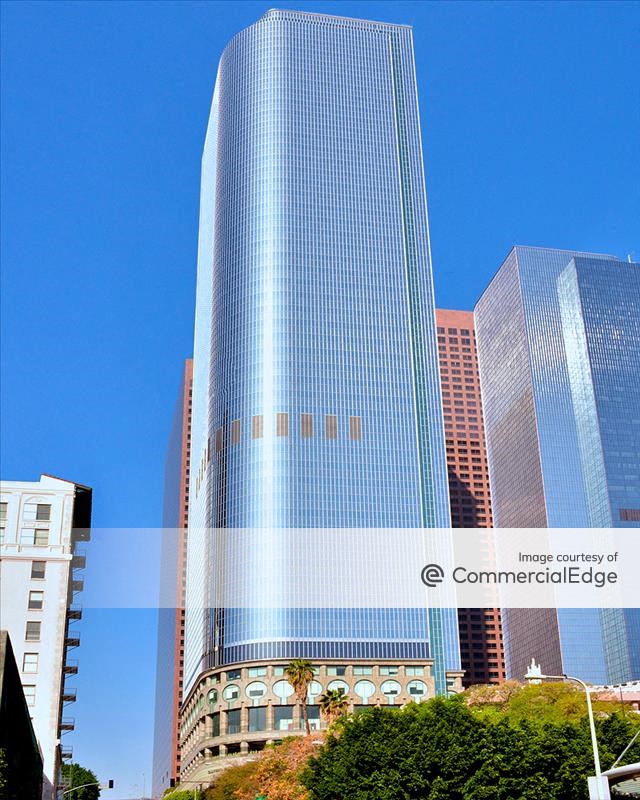

CIM Group has signed Southern California Gas Co. to a long-term lease for 198,553 square feet at its City National 2CAL office building in downtown Los Angeles.

The 1.4 million-square-foot, 52-story tower at 350 S. Grand Ave. in the Bunker Hill District will serve as the utility company’s new headquarters. SoCalGas will be relocating from its namesake downtown Los Angeles building, Gas Company Tower, where it has been since its opening in 1991.

Geno St. John from CIM Group’s in-house office leasing team represented the owner in partnership with Peter Hajimihalis and Hayley Blockley from JLL. Clay Hammerstein and Danny Rees from CBRE represented the tenant.

SoCalGas is the largest gas distribution utility in the U.S., serving approximately 21 million consumers across 24,000 square miles of Central and Southern California.

Since purchasing the property in 2014, CIM Group has undertaken a capital and operational improvements program at City National 2CAL. The entrances and plaza levels have been renovated to enhance the lobby’s appeal and improve pedestrian connectivity.

READ ALSO: Here’s a Surprising Shift in Remote Work’s Appeal

In addition to CIM Group’s ongoing capital and operational improvements, the company remains dedicated to sustainability. In 2023, City National 2CAL was recertified as LEED Platinum for another five years. The building also received the UL Verified Healthy Building Verification Mark for Indoor Air and Water, along with Fitwel®, ENERGY STAR, and WiredScore certifications.

Some ‘signs of life’ in the office sector

Eli Randel, Crexi’s chief operating officer, told Commercial Property Executive SoCalGas Co.’s new headquarters lease at CIM’s City National 2Cal shows some signs of market life. However, it’s a short downtown-to-downtown move for SoCalGas and doesn’t necessarily signal a significant trend.

“It illustrates the tenant’s desire for more modern amenity-rich space, with SoCalGas also retaining building signage rights,” Randel said. “Large companies continue to exhibit a commitment to the traditional office environment but recognize a space level-up might be appropriate to accommodate employees and clients better.”

According to Crexi’s marketplace data, there’s been a recent rise in Class A interest in the Los Angeles office. Since the beginning of 2023, asking lease rates have held relatively steady at around $2.50 per square foot per month.

“Effective rates dropped at the end of 2023 (potentially corresponding to fewer Class A amenity-rich spaces being scooped up) but have since rebounded—meaning that Class A spaces are back to playing a more prominent role in the market,” Randel said.

Separating ‘trophies’ and ‘trainwrecks’

Sonnet Hui, vice president & Los Angeles general manager, Project Management Advisors, told CPE that Southern California Gas Co. signing this substantial lease in Bunker Hill signals that office leasing activities are picking up now.

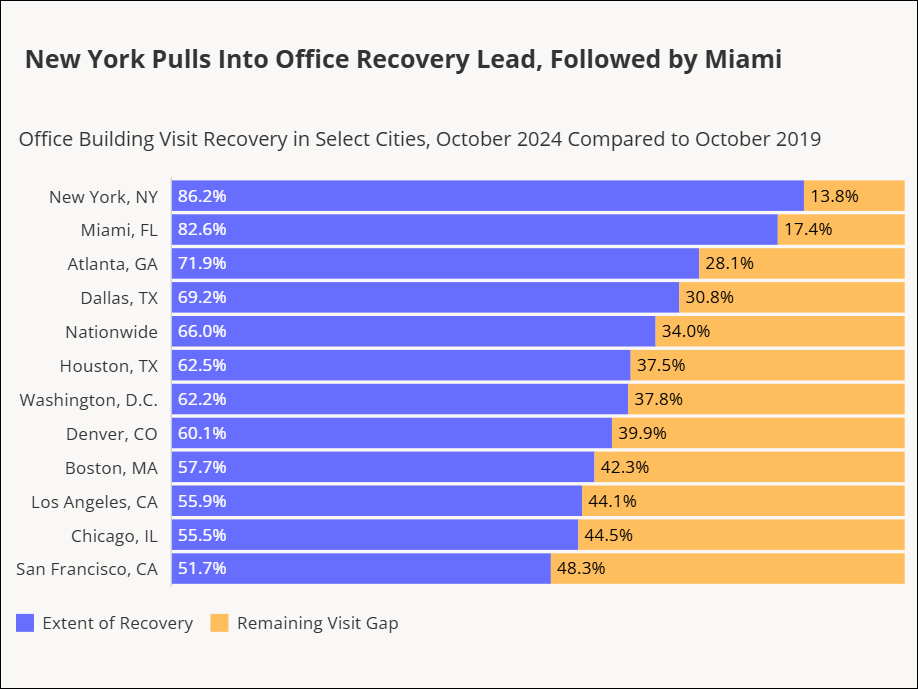

“Tenants are shopping for much better deals,” Hui said. “Right now, office vacancies are higher in DTLA than in the last recession (2009). The Los Angeles office market is at an inflection point where we’re seeing the bottom of the market, and it’s finally starting to pick up in certain cities steadily. This means that the office market is incredibly competitive, separating the Class A from the Class B and Class C asset types: the trophies vs. the trainwrecks.”

She said long-standing tenants are sufficiently motivated to look elsewhere when long leases are up for renewal, and brokers are aggressive in offering multiple attractive options.

“Tenants are looking for better locations, better rents and better amenities for their employees,” according to Hui.

“Companies are also looking for buildings that offer more sustainable features as tenants and employers focus on their employees’ health and wellbeing. This is a good incentive for commercial office landlords to upgrade their facilities and grab the attention of potential tenants. Savvy landlords that invest in upgrading their facilities will likely attract new, better, and larger tenants.”

Cole Martinez, principal of Unispace, said: “In today’s challenging office market, Southern California Gas Company’s landmark lease serves as a reminder that, even when times are tough, business still needs to get done—and that business gets done in the workplace.”

“For downtown Los Angeles, this lease is an example of a good opportunity to capitalize on within the market. It also demonstrates a concept that has been in doubt since the shift to remote work: companies still require office space to conduct their business and continue day-to-day operations, and these offices continue to serve as the foundation of company culture for employees.”

READ ALSO: Los Angeles Office Market Still Pricey

According to Martinez, Southern California Gas Co.’s relocation to the Bunker Hill District of DTLA from its namesake tower also demonstrates a commitment to continuing to have a footprint in DTLA, a critical milestone as downtown areas grapple with identity crises around the country. “Ultimately, SoCal has always had great market fundamentals, and an office lease of this size in DTLA shows that we can expect resiliency in the office market for 2025,” Martinez added.

Adding green space

Beyond renovating the interiors of the SoCalGas building, CIM Group played a key role in the extensive transformation of The Yard—a 1.5-acre central courtyard and performance plaza shared with 1 CAL and the Omni Los Angeles Hotel.

The park-like plaza features expanded, welcoming public green spaces with gathering spots on the lawn, enriching the audience experience during outdoor Grand Performances.

This SoCalGas lease follows CIM Group’s December 2023 lease to Shepard Mullin for 119,217 square feet at City National 2CAL, which marked Downtown Los Angeles’ largest new office lease transaction in 2023.

The law firm will relocate its headquarters at the property starting mid-2025 and will occupy floors 39 through 42 and some 7,000 square feet on the plaza level. JLL represented the owner, while CBRE worked on behalf of the tenant.

According to CommercialEdge data, the landlord acquired the 52-story office tower, formerly Two California Plaza, in a seven-property portfolio transaction in February 2014.

You must be logged in to post a comment.