Blueprint Special Report: Developers, Builders Feel the Pinch

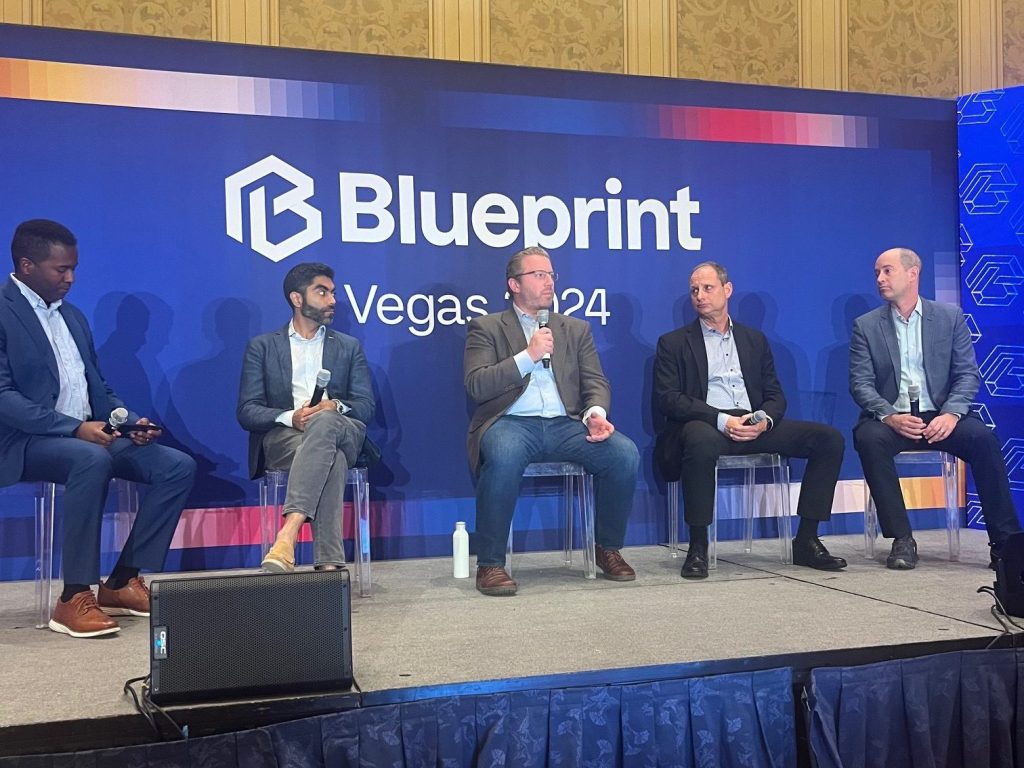

Panelists at the Blueprint Conference in Las Vegas debated the trials of development in 2024.

Kabir Seth, Presidio Bay Ventures; Peter Chavkin, Biddle Real Estate Ventures & Sun Homes; Stephen Trapp, Columbia Property Trust; Jeff Dvorett, Midwood Investment and Development

Beyond well-known hurdles such as interest rates and capital costs, developers are also being squeezed by rising costs—from land acquisition, government regulations and building complexity to employee retention and operational scale. Builders feel some of that pressure, too.

“The good news is that we know the next five years won’t be as bad as the last five,” Jeff Dvorett, president of Midwood Investment and Development, said last week at the Blueprint Conference in Las Vegas. “We seem to have finally caught a break in the second quarter, as property insurance costs fell for the first time in seven years—by 0.94 percent, according to Aon.”

And indeed, at least one survey showed construction costs were stabilizing. The national average increase was 1.12 percent over the previous quarter. The international property and construction cost consultancy firm Rider Levett Bucknall’s latest quarterly cost report shows that the U.S. national average increase in construction costs is approximately 5.41 percent year-over-year, compared to 5.85 percent year-over-year in the first quarter.

READ ALSO: Blueprint Conference ’24: Office Starts to See Momentum

Land costs grew about 10 percent annually from 2012 to 2020, shared Peter Chavkin, managing principal with Biddle Real Estate Ventures & Sun Homes, at the same event. “Land is not a commodity,” he mentioned. “The values have been escalating because they aren’t making any more land.”

What else are developers facing, trying?

Chavkin said his firm is buying and converting older office space and condos. “There is undervalued land, but the regulatory environment is in the way in New York,” he said. “Because of zoning, you end up paying so much more in terms of costs and time lag.”

Dvorett said some neighborhood officials want to improve the situation, “but it doesn’t happen overnight—it’s a five- to 10-year process,” he added.

READ ALSO: Cause for Optimism on the Tech Front

Stephen Trapp, executive vice president of development at Columbia Property Trust, said prefabricated modular construction design has been “Going through fits and starts for the last 15 years, but there is optimism that progress is being made with it (in asset classes such as student housing and multifamily).”

Meanwhile, technology and mechanization continue to increasingly making a difference in construction as well. Robotics perform repetitive lifting of dangerous objects and work as remote-controlled jackhammers.

“We think this technology will take off, and long-term innovation can make a difference,” Trapp said. “For example, 15 years ago, we had never heard of LED lightbulbs.”

You must be logged in to post a comment.