Nashville’s Office Vacancy Drops, Prices Remain High

Large projects are boosting the market's pipeline, CommercialEdge data shows.

The Nashville office market had a consistent construction pipeline in August, underway space as a percentage of total stock outpacing the national rate, CommercialEdge data shows. The metro saw only two deliveries, while office investments showed a 31 percent year-over-year growth, placing the market among the best-performing ones in the U.S.

Some notable office deals closed in the metro in the first eight months of the year, the high sale prices pushing Nashville above some significant southern markets. Additionally, despite the growing vacancy rates trend across gateway and high-volume secondary markets, Nashville’s has shown signs of improvement so far in 2024.

As office inventories struggle with rising vacancy, owners are looking to offload assets, residential conversion being an emerging trend across the U.S. While Nashville is not among the nation’s top markets for office adaptive reuse, there are some opportunities. The Conversion Feasibility Index, a new tool developed by CommercialEdge, shows which markets have strong office-to-residential repurposing fundamentals, based on property-level scores and building classifications.

Significant projects added to Nashville’s pipeline

As of August, Nashville’s office market had 2.1 million square feet of space underway across nine properties, accounting for 3.6 percent of existing stock. The rate was way above the national figure of 1.0 percent as well as those recorded in most similar markets, such as Phoenix (0.4 percent), Houston (0.7 percent), Atlanta, (0.9 percent), Charlotte (1.5 percent) and San Diego (3.1 percent). Only Austin outperformed Nashville, with 4.1 percent.

In terms of space underway, Nashville outperformed Philadelphia (2 million square feet), Atlanta (1.9 million square feet), Houston (1.7 million square feet) and Charlotte (1.1 million square feet.

The market’s largest office development is the Pinnacle Tower at Nashville Yards, a 650,000-square-foot project that will rise 34 stories at 500 Platform Way in downtown Nashville. The project, developed by Southwest Value Partners, broke ground in 2021 and is expected to come online in 2025.

In February, Equitable Property Co. purchased a 44-acre site for the development of a mixed-use project that will include two medical office buildings totaling 400,000 square feet, up to 250,000 square feet of retail space, a 240-key hotel and 75 townhomes. Phase I of the project dubbed Sewart’s Landing is taking shape in in Smyrna, Tenn., with delivery expected in the first quarter of 2025.

Year-to-date through August, developers broke ground on 352,000 square feet of office space, while only 202,000 square feet were delivered across two properties.

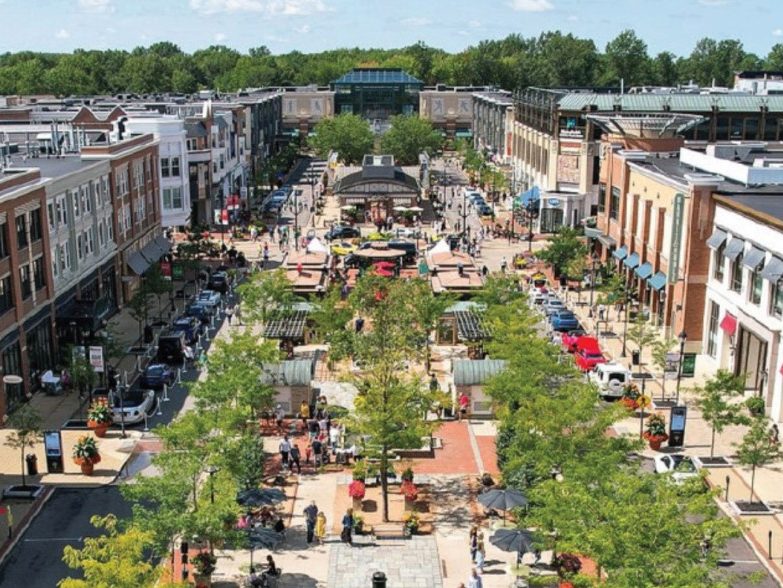

Completed properties included Educational Media Foundation’s new headquarters, a 170,000-square-foot, five-story office building at 2000 Reams Fleming Road in Franklin, Tenn., that came online in April, and The Office Lofts at Finery, a 49,000-square-foot, six-story development at 1 Merritt Ave., that opened in February. The latter is part of The Finery mixed-use project, developed by Hines Interests.

Growing office investments

A total of 951,316 square feet across nine office properties traded for $195 million in Nashville through the first eight months of the year. The amount marked a 31 percent year-over-year growth, putting Nashville ahead of similar metros such as Atlanta (29 percent) and Phoenix (26.7 percent), but behind Charlotte (32.9 percent).

In terms of sales volume, the market outperformed Orlando ($126 million) and Charlotte ($149 million). Dallas led with $812 million, followed by Austin ($644 million).

Notable office deals in Nashville included the $84.5 million acquisition of Truist Plaza, a 338,000-square-foot building at 401 Commerce St. Menlo Equities purchased the 13-story property from Eakin Partners in April.

Another significant transaction was Boyle Investment Co.’s $48.8 million purchase of The McEwen Building, a 175,262-square-foot, seven-story office asset in Franklin, Tenn. KBS sold the 2014-built property and the deal was part of the buyer’s expansion strategy in the Cool Springs submarket.

Nashville office assets traded at an average sale price of $205 per square foot, above the national average of $173 per square foot. Properties were pricier on average than those in Houston ($103 per square foot), Dallas ($125 per square foot), Charlotte ($133 per square foot) and Atlanta ($146 per square foot). Austin remained significantly more expensive, with prices at $376 per square foot.

Nashville’s office vacancy rates are dropping

Nashville’s office vacancy has been on a downward trajectory since the start of the year—from the 17.0 percent recorded in January to the 16.0 percent registered in July. As of August, the metro’s rate clocked in at 15.6 percent, down 60 basis points year-over-year.

The figure was below the national average of 19.4 percent. Meanwhile, similar metros such as Orlando (16.8 percent), Charlotte (18.6 percent), Atlanta (21.3 percent) and Dallas (22.9 percent) recorded higher values.

One of the most impactful announcements that stirred the Nashville office market involved software company Oracle. The Austin-based firm plans to move its world headquarters to the city, having already secured a 65-acre site in the East Bank section in 2021. While waiting for the completion of its $1.2 billion campus, Oracle will be leasing office space.

The coworking sector holds steady

Nashville’s coworking sector featured 1.8 million square feet of flexible office space in August, outpacing Charlotte (1.3 million square feet) and Orlando (1.1 million square feet). However, the volume was small when compared to Houston’s 4.3 million square feet.

The coworking space as percentage of all leasable office space reached 3.2 percent, one of the highest rates among similar markets and way above the national average of 1.8 percent. The metro outperformed Austin (1.6 percent), Charlotte (1.7 percent) and Denver (2.2 percent), but lagged Miami (3.7 percent).

The largest coworking operator in the metro was Spaces, with 218,000 square feet, followed by E|spaces (217,212 square feet) and Regus (202,940 square feet). Serendipity Labs (90,662 square feet) and Expansive (80,111 square feet) occupied the fourth and fifth position, respectively.

You must be logged in to post a comment.