Unlocking the Sun Belt’s Retail Potential

Fueled by the region’s strong population growth, the asset class is starting to capture investors’ attention.

The Sun Belt’s well-documented rise in migration and economic activity has made it a darling of CRE investment for unsurprising reasons. The region’s retail potential hasn’t, however, shared that spotlight too much. As other asset classes are seeing a slowdown due to strong pipelines and cooling demand, retail is starting to turn more heads. Some of the experts we talked to say it was about time.

To simplify for the sake of fundamentals, retail depends on foot traffic, and foot traffic’s about people. While population growth has tapered to some degree, Sun Belt figures remain strong. The region has not only shown progress, but it has dominated the list of top markets for population growth from mid-2022 to mid-2023, U.S. Census data shows.

A recent JLL retail outlook emphasizes these gains, pointing out that this significant expansion, particularly in states such as Texas, Florida, North Carolina and Georgia, underscores the Sun Belt’s increasing appeal, boosting investor confidence.

READ ALSO: Retail Owners Gain Leverage

Demand for retail real estate has surged, with Sun Belt states recording 13 percent less available space than the national average, according to JLL. If the trend continues unabated, the region could house many of U.S. retail’s new hot spots.

The case for retail in Sun Belt states

“The region is experiencing an influx of resident and capital migration from California and New England,” said Andrew Ivankovich, associate vice president & associate director with Matthews. “As a result, the leading retail landscape needs to grow. Everyone from investors to tenants to consumers is looking to capitalize on the opportunities.”

While demographic gains started the trend, “It’s what’s driving the population growth—business-friendly government and weather—that’s setting this region apart as a retail hotbed,” added Ivankovich.

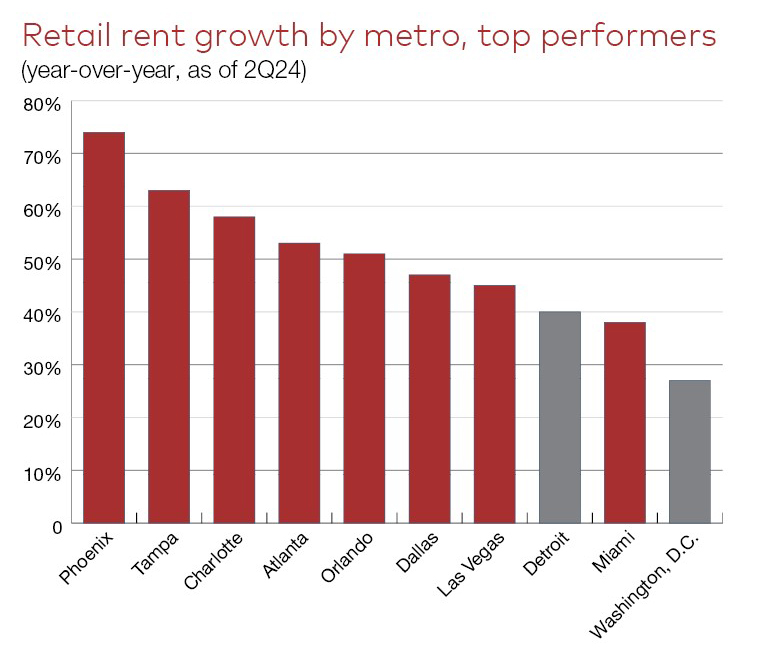

Retail investment has been increasing in the region, especially in the Southeast. Sun Belt metros also occupy eight out of the top 10 spots for rent growth nationally, with Phoenix (7.4 percent), Tampa (6.3 percent) and Charlotte (5.8 percent) leading year-over-year, according to JLL’s second-quarter retail outlook. And despite some recent store closures, value retailers such as TJ Maxx, Ulta, Burlington and Dollar Tree are expanding, signing new deals and acquiring leases.

READ ALSO: Street Retail Surges Toward Full Recovery

“This surge in activity has sparked growing confidence in retail capital markets, with an anticipated increase in investment activity in the second half and into 2025,” pointed out Thomas Kolarczyk, senior director with JLL. “The Southeast region offers promising opportunities for retail investors seeking to capitalize on exceptional fundamentals, (including) limited new retail construction, supply-constrained markets, mark-to-market opportunities and record low vacancy rates.”

Sun Belt retail: A rapidly changing market

The influx of people is reshaping the landscape, opening up a broader and more varied customer base.

“Luxury retail used to be something found relatively sparingly in Sun Belt markets, as there just wasn’t enough demand to invest in brick-and-mortar as compared to places like New York and Los Angeles,” noted Jamestown President Michael Phillips. However, recent demographic changes have made cities such as Atlanta more attractive to luxury retailers.

One good case study for this is the Buckhead Village District in Atlanta. “(It) is a great example of how diversity in tenancy and intentional, consumer-centric design can lead to a more engaging retail experience,” Phillips said. The design guides visitors through the property, moving from well-known national brands to local, independent retailers and communal spaces.

Suburban retail centers are also on the rise in Sun Belt cities. Jamestown’s planned acquisition of the Atlanta affiliate of North American Properties emphasizes this trend.

“At grocery-anchored centers specifically, Jamestown’s in-house leasing team works directly with local retailers to curate a healthy ecosystem and community-focused tenant mix that caters to both daily needs and an increasing suburban daytime population,” Phillips highlighted.

Sun Belt retail is particularly successful in the form of grocery-anchored lifestyle centers with appropriate population density, according to multiple research reports. Proximity to growing job and housing markets is also vital.

Potential risks still linger in the Sun Belt

CRE professionals generally see the region as a safe investment magnet. Even so, development in the Sun Belt comes with its own set of risks and challenges. The list can include zoning restrictions, market saturation and climate-change-related natural disasters.

“Factors such as rising development costs and a challenging labor market affect our retail industry nationwide,” noted Ivankovich. “Looking at the region specifically, there is a concern about overdevelopment, which will hinder the landlord’s growth in value in the future.”

The region is currently under-retailed primarily because it is reacting to the recent migration trends.

“CRE developments take years to complete—the acquisition, the permitting/entitlements, the construction and the lease-up,” Ivankovich said. “Plus, many developers in the retail sector avoid purchasing on speculation because of exposure to market conditions. In my opinion, the retail sector is reactionary to trends and those reactions take years to come to fruition.”

You must be logged in to post a comment.