Growth in Office Tenant Costs Moderates

Occupiers might start seeing declines next year, according to Savills’ latest research.

North America experienced a modest 0.4 percent increase in the net effective fit-out costs for office spaces in the third quarter, according to a new report from Savills.

The region also saw a slight dip in gross rents this past quarter, with a -0.9 percent decrease, primarily influenced by several East Coast markets. However, rents across North America remained 6 percent higher year-over-year.

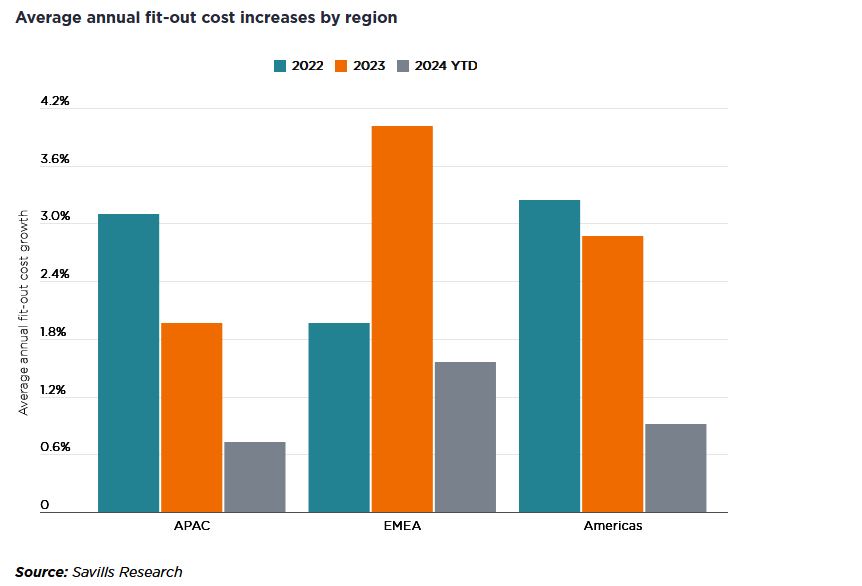

On a global level, the report found that for the first time since the end of the pandemic, office fit-out costs are slowing. Year-to-date increases vary between 0.7 percent and 1.6 percent, well below the increases in 2023 and 2022.

Rents for prime office space rose 0.2 percent globally in the third quarter, while fit-out costs increased by 0.3 percent, bringing the average year-over-year growth in net effective costs to 3.1 percent.

What to expect for the U.S.

“Price increases across the industry have been modest over the year, and we predict final increases rising by just 1 percent for the year. Materials have been remarkably stable, and contractors have been willing to absorb costs to build backlog,” Andrew Volz, research manager of project and development services at JLL, told Commercial Property Executive.

“We expect prices [of materials] to resume more normal growth in 2025, including for office projects. As activity accelerates, materials are likely to increase by 5 percent to 7 percent, with potential higher short-term growth due to recent hurricanes Milton and Helene.”

Volz said that as new ways of working evolve, so does office design, which will alter the cost dynamics for these projects.

“While office fit-out prices increased modestly over the last year, design-heavy factors increased well above the baseline, at 8 percent year-over-year. We expect this uneven pattern of cost increases within projects to continue, especially as projects become more specialized and dynamic to the working needs of organizations.”

Build-outs feasibility

Tenant improvement allowances have caused a noticeable stalemate between today’s tenants and landlords, according to Grant Bollman, vice president of Lee & Associates in Illinois.

He told CPE that while it’s true that build-out costs are beginning to flatten, they remain so high that many landlords don’t want to, or can’t, fund build-outs.

READ ALSO: Top California Markets for Office Transactions

“We’re seeing tenants in new leases having to accept existing space conditions, or foregoing relocation altogether,” Bollman said.

Corporate relocations have dipped in Chicago, Bollman observed, and unless a tenant needs to grow or shrink their footprint significantly, they are likely to remain in place.

“An added challenge for getting new deals to pencil out is the expectation from today’s tenants that they can get a great deal on rent, as there has been no shortage of headlines about distress and high vacancy in the office sector,” Bollman added.

He said tenants are often disappointed that they probably won’t be able to score the cheap rate they are hoping for.

“Unfortunately, to make build-outs feasible again, we need to see construction costs go down or rents go up. Until that happens, we will continue to see a lot of frustration at the deal table.”

The flight-to-quality factor

As we head into the last quarter of 2024, flight to quality and competition for talent will continue to drive companies to seek prime office spaces, according to the report. With fit-out costs stabilizing for the first time in recent history alongside the general fall in inflation, occupiers may start to experience stagnating or even declining net effective occupancy costs.

In the first quarter, occupiers’ costs for prime top-tier offices worldwide were primarily steady, with the “all-in” cost rising only 1.1 percent from the previous quarter, according to Savills’ latest Savills Prime Office Costs report.

Researchers from Savills said the slight rise in net effective costs—which include tenant-improvement costs, rents, service charges and property taxes—for the top 30 global office markets was largely due to the flight-to-quality trend and continuing desire for best-in-class office spaces for occupiers and their staff.

The report concluded that prime office space remains a coveted asset for businesses worldwide, despite widespread economic uncertainty impacting long-term decisions.

You must be logged in to post a comment.