Hines Sells Phoenix Office Asset for $100M

This is the market's largest transaction so far this year.

In the largest Greater Phoenix office sale of the year so far, Wide Open Excursions—a leisure service provider—acquired 24th at Camelback II for $97.9 million, public records show. Hines sold the 306,877-square-foot Class A asset with the assistance of JLL Capital Markets.

CommercialEdge data shows no other office asset traded for north of $97 million in the Valley since 2022. Back then, Aligned paid $115 million for Southwest Value Partners’ Continuum, a 231,829-square-foot property in Chandler, Ariz.

READ ALSO: H1 Office Deal Volume High in Phoenix

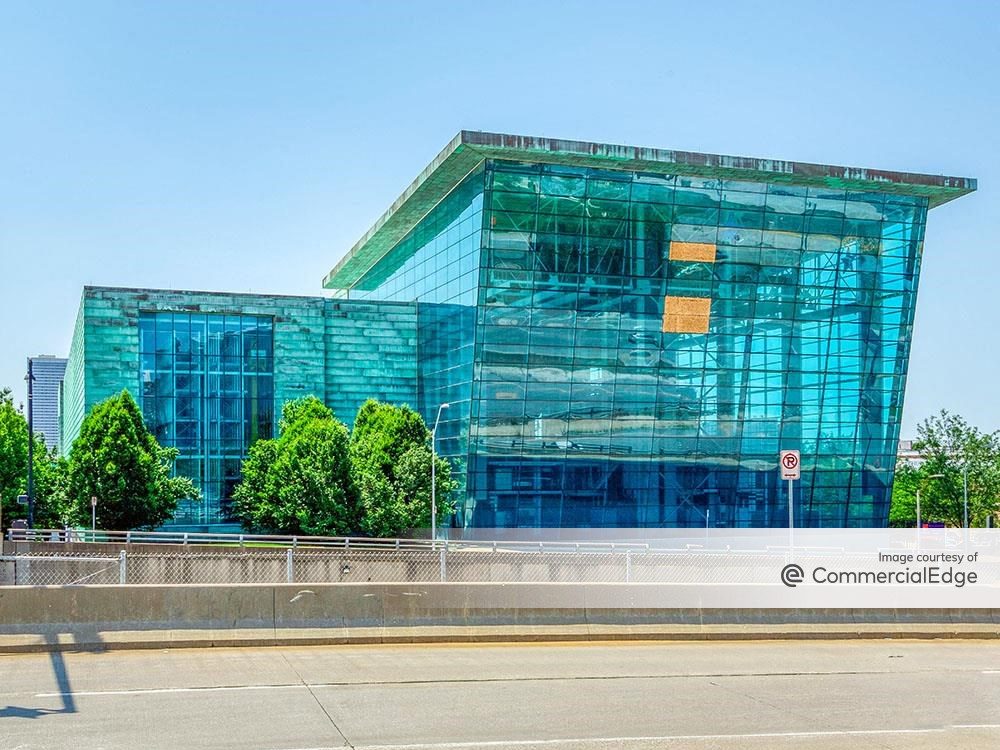

Designed by Pickard Chilton, 24th at Camelback II came online in 2009. The 11-story high-rise was 87.2 percent leased at closing, its tenant roster including Blue Origin, Dorsey & Whitney, Mercer, as well as Lucid and Squire Patton Boggs.

In alignment with green building trends, 24th at Camelback II attained LEED Platinum—the first multi-tenant office building to achieve such certification in Arizona—and Energy Star ratings through low-carbon emissions, water efficiency, waste reduction and renewable energy.

Located at 2325 E. Camelback Road, the office property is roughly 8 miles northeast of downtown Phoenix. A 314,000-square-foot open-air retail center, as well as multiple quick-service restaurants, are within walking distance.

The JLL team that spearheaded the sale on behalf of Hines included Senior Director Will Mast, Senior Managing Director Ben Geelan, Vice President Jack Miler and Analyst Gigi Martin.

Selling a renovated office campus

The office property is part of a two-building campus. In 2017, Hines began a repositioning effort focusing on the duo’s exteriors. One year later, the renovation efforts touched upon interiors. The overhaul included improvements to the lobby and common areas, conference room and suites.

In April, New York Life Real Estate Investors sold the campus’ other building, the 302,209-square-foot 24th at Camelback I, to Columbus Properties for $86.1 million, CommercialEdge data shows. New York Life Real Estate Investors had purchased it from Hines for $100 million in 2018.

Phoenix’s steady office investment scene

Year-to-date through September, the total office investment volume in Greater Phoenix reached $969 million, according to a CommercialEdge report. The metro ranked third for sales across Western markets. The Bay Area took the crown with $1.8 billion, followed by Los Angeles with $985 million.

In the Valley of the Sun, office assets sold on average for $174 per square foot during the first three quarters—slightly above the national average of $171 per square foot. Office properties were priciest in Los Angeles by a heavy margin ($345 per square foot), while the Bay Area’s figure of $278 per square foot lagged behind.

One other Great Phoenix office asset that changed hands this year was a 354,000-square-foot building in Scottsdale, Ariz. Net Lease Office Properties sold the asset for $71.5 million, using the proceeds to pay off existing debt.

You must be logged in to post a comment.