How Infrastructure Investment Drives Industrial Space Growth

And why some markets are expected to benefit more than others, according to Newmark’s latest research.

Infrastructure investment and demand for U.S. industrial space are strongly correlated, and accelerated public spending on infrastructure in the 2020s will act as a spur to further growth in the industrial sector, according to Newmark’s Road Work Ahead report.

Infrastructure investment drives industrial market activity through a number of channels, some direct—such as space needed for infrastructure construction-related requirements, outdoor storage and service facilities.

Other channels are more indirect, as more efficient transportation infrastructure supports population and freight growth. Indeed, Newmark posits, for the U.S. supply chain to function optimally, infrastructure improvements are essential.

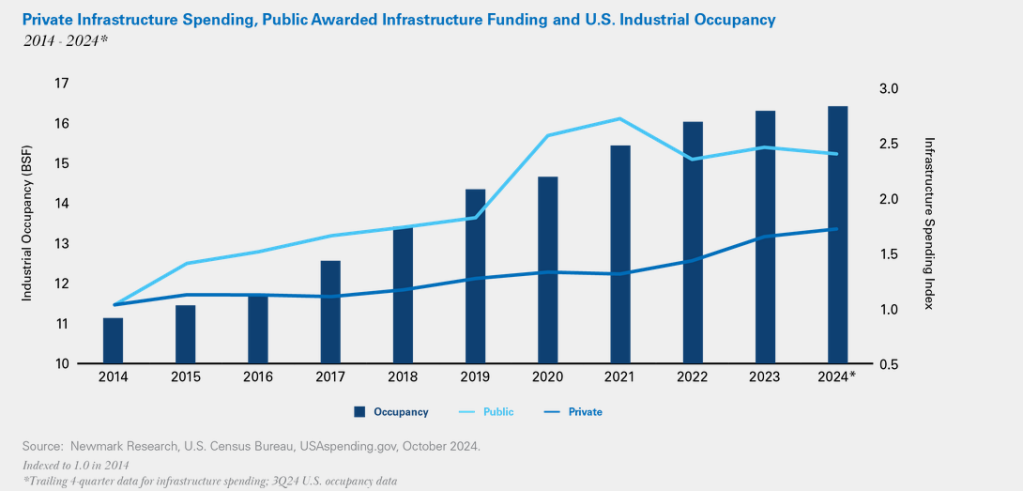

During the period from 2014 to 2024, total U.S. industrial occupancy has grown from about 11 billion square feet to roughly 16 billion square feet, the report notes, citing Newmark Research and Census Bureau data.

During the same period, both public and private infrastructure spending ballooned. Especially public spending: if 2014 represents a public infrastructure spending index of 1.0, the index for 2024 is nearly 2.5.

The $1.2 trillion Bipartisan Infrastructure Law, signed into law in 2021, is key to further industrial market growth, the report explained. So far only about 40 percent of the infrastructure funding provided by the act has been allocated. The rest will be doled out by 2027, at the same time as interest rates are expected to ease, further unlocking investment in the sector.

READ ALSO: Remedies Are Available for Last-Mile NIMBYism

More specifically, the federal government has prioritized investments in transportation infrastructure over the last five years, even before the BIL, namely for roads and highways. Those projects function to boost job creation, modernize outdated systems and improve connectivity. Private sector participation has also been significant, with private transportation infrastructure construction spending up 32 percent since mid-2019, Newmark reported.

Industrial deliveries will rise in parallel with infrastructure. “While speculative industrial development will moderate into 2025, total occupied industrial space is forecast to continue growing due to sustained positive net absorption and a shift in the pipeline to build-to-suit and owner-built deliveries,” according to the report.

The acceleration of industrial development isn’t a new trend. Over the past 20 years, the U.S. experienced a 25 percent increase in domestic freight volume, driven by economic and population growth, as well as the rise of e-commerce. That dynamic has fueled a 35 percent expansion of the nation’s logistics inventory since 2003, Newmark found.

The trend will continue, with freight tonnage projected to increase by 42 percent by 2050, undergirded by onshoring, nearshoring and the further embedding of e-commerce in American life. Without improvements in infrastructure, especially transportation, that growth would be constrained.

Not all industrial markets will benefit equally

“Infrastructure spending, freight volumes, and industrial real estate form a complex, interconnected ecosystem where markets’ ability to meet demand varies significantly based on a host of regional dynamics,” Newmark Vice Chairman Adam Faulk told Commercial Property Executive.

Markets like Dallas and Atlanta have greater regulatory flexibility and available land to accommodate growth-driven development, while coastal hubs like Los Angeles and New Jersey face significant constraints due to land scarcity, high costs and regulatory restrictions, often relying on inland adjacent markets for expansion, according to Faulk.

“While infrastructure spending supports demand growth across markets, the capacity to meet it will heavily depend on the specific regulatory environment, availability of suitable sites, and legislative landscape, among other factors,” Faulk said.

Though overall industrial market growth correlates with infrastructure investment, and will continue to do so on a national level, the report noted, not all markets will see similar levels of growth in the coming years. In international trade, a paradigm shift is underway, and that will drive space use in some places more than others.

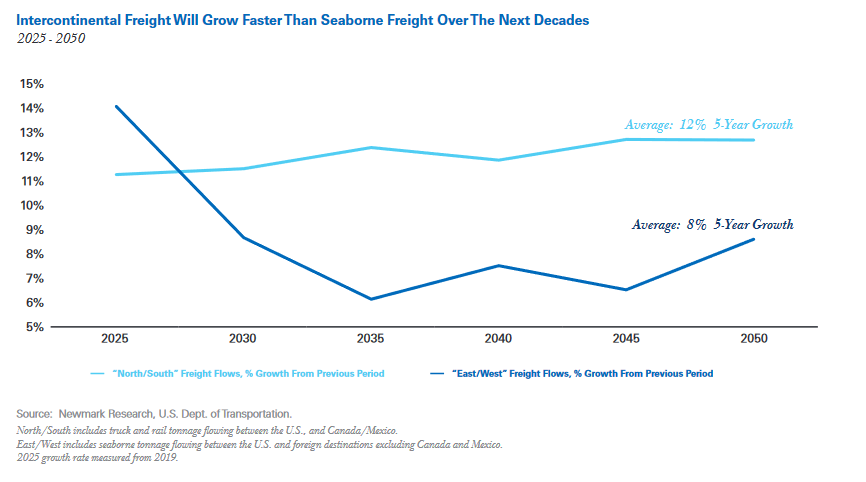

In the last few decades—during the age of massive outsourcing to East Asia in particular—global trade patterns benefited ocean port volume growth over interior freight growth, creating a domestic “east/west” paradigm for freight flows, Newmark said. This paradigm drove the expansion of maritime gateways such as Los Angeles and Northern New Jersey.

“Looking ahead, a ‘north/south’ shift in freight flows is ascendant, as the growth of land-based goods transport is expected to surpass the growth of sea-bound goods due to nearshoring of production,” the report says, meaning such markets as Chicago, Atlanta and Dallas. “However, seaborne volumes will remain larger in absolute tonnage and are of vital importance to the U.S. economy.”

You must be logged in to post a comment.