Lionstone Investments to Offload $5.5B in Assets

This decision comes seven years after Ameriprise subsidiary Columbia Threadneedle acquired the company.

Lionstone Investments, a Houston-based subsidiary of financial services giant Ameriprise Financial, is in the process of winding down, currently transitioning its assets to other firms. Lionstone has about $5.5 billion in institutional commercial real estate assets in major U.S. metros.

In releasing a statement about the matter, Ameriprise said that it had come to the decision about shutting down Lionstone after a strategic evaluation, but offered no details. The company added, however, that the winding down of its U.S. real estate business would have no material financial impact on Ameriprise.

Lionstone has been part of Ameriprise since 2017, when Ameriprise subsidiary Columbia Threadneedle Investments, based in Boston, acquired it with a plan to expand its U.S. commercial real estate footprint.

Reportedly the decision to shut down Lionstone came amid disagreements between that company and parent Columbia Threadneedle, but specific points of disagreement have not been confirmed or denied by the participants. Neither Lionstone nor Columbia Threadneedle/Ameriprise have responded to queries from Commercial Property Executive on the matter.

Lionstone’s portfolio mostly includes office, multifamily, retail and mixed-use properties, among other asset types. The company has a heavy concentration in Texas, including seven properties in Austin; as well as in California, with nine assets in Greater Los Angeles; and North Carolina, with six assets. Other properties are in Atlanta, Denver, Nashville, Tenn., Pittsburgh and Washington, D.C.

READ ALSO: Politics Aside, the US Economy Is Holding Strong

As recently as this year, Lionstone was an active buyer and seller of commercial real estate. Ameriprise’s other business lines include alternative assets, U.K. and European real estate, as well as hedge funds, CLOs and private equity.

In April, Lionstone sold the 112,162-square-foot Muse Shops at Midtown, a value-add retail center in Dallas. In June, Lionstone acquired The James, 344-unit multifamily property in Houston’s River Oaks submarket.

CRE cycle may see upturn

The move to wind down Lionstone comes on the cusp of what PwC and the Urban Land Institute call an upturn in the U.S. commercial real estate cycle, in the 2025 edition of Emerging Trends in Real Estate. Such an upturn would help spur investor interest in various property types.

The key moment for the sluggish commercial real estate market was the recent reduction in interest rates by the Federal Reserve, though that act by itself did little to bring down borrowing costs. Still, owners and investors took it as a signal that financial conditions will improve. After two years of anemic transaction and lending activity, along with falling property prices, conditions seem to have stabilized, PwC reported.

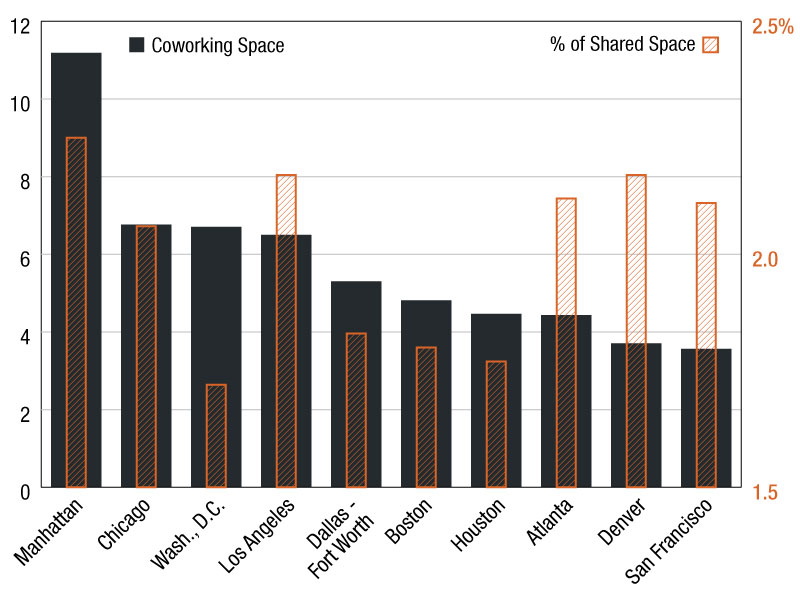

The upturn will probably be slow and gradual, the report posited. Still, some markets will see greater commercial real estate activity, including investment, than others. Most of the top markets to watch are still in the Sun Belt, with Dallas-Fort Worth emerging as the number-one spot for 2025, PwC reported.

You must be logged in to post a comment.