Interra Capital Acquires Houston Portfolio

JLL Capital Markets arranged the transaction.

BGO has sold Remington Square, a three-building, Class A office complex totaling 392,357 square feet in northwest Houston.

JLL Capital Markets represented the seller and procured the buyer, locally based Interra Capital Group. The transaction highlights the area’s strong demand for Class A office assets, of which there is a limited supply in Houston.

“The trophy office segment continues to outperform the market, with 848,000 square feet of positive absorption at the end of the third quarter 2024,” Wade Bowlin, principal & managing director for Avison Young’s Houston office told Commercial Property Executive.

Tenants are increasingly drawn to these high-quality buildings, which offer superior amenities and modern features in prime locations, according to Bowlin.

“However, there is a limited supply in the Houston market, and within the next few years, just 543,000 sf of new office space is under construction and slated for delivery, causing strong demand for the limited options available.”

READ ALSO: How AI Firms Are Reviving Office Space Demand

Remington Square was completed in 2008 and 2015. The site comes with a restaurant with catering, a fitness center with locker rooms, a tenant lounge, and a conference facility on a 16.78-acre parcel that has room to develop a fourth building.

The property is situated along Beltway 8 at 10603, 10613 and 10713 W. Sam Houston Parkway, near 16.2 million square feet of retail space, as well as executive and employee housing options.

Managing Directors Kevin McConn and Marty Hogan and Senior Director Rick Goings led the JLL Capital Markets Investment Sales and Advisory team that represented the seller in the transaction.

Flight-to-quality trend drives investment

“While quality alone is no longer a guarantee of property value, retention and appreciation of performance due to shifting office sector dynamics, it remains the best hedge in an office market that is finding its new equilibrium inventory size given the quasi-permanent downward change in office space demand due to flexibility in work locations,” Ermengarde Jabir, Moody’s director of Economic Research, told CPE.

In the context of the flight-to-quality trend, the adage of ‘location, location, location’ rings truer than ever, Jabir observed.

“Firstly, a quality office building in a metro where the general work culture is to go into the office more often than not is a prime property,” Jadir continued. “Then, beyond that, the location within a metro that provides easy access to commuters, whether via public transport or car, is also highly sought after. The obvious physical characteristics of a building are primary in determining quality, including age/newness, architecture, amenities, etc.”

Tenant quality also factors in as part of quality, with investors seeking office buildings of the highest physical quality along with stabilized properties with high occupancy rates and strong projected NOI growth, Jabir explained. Mixed-use properties and neighborhoods also play a key role in the flight to quality, as cohesive communities offering a live-work-play model tend to foster stronger demand resilience.

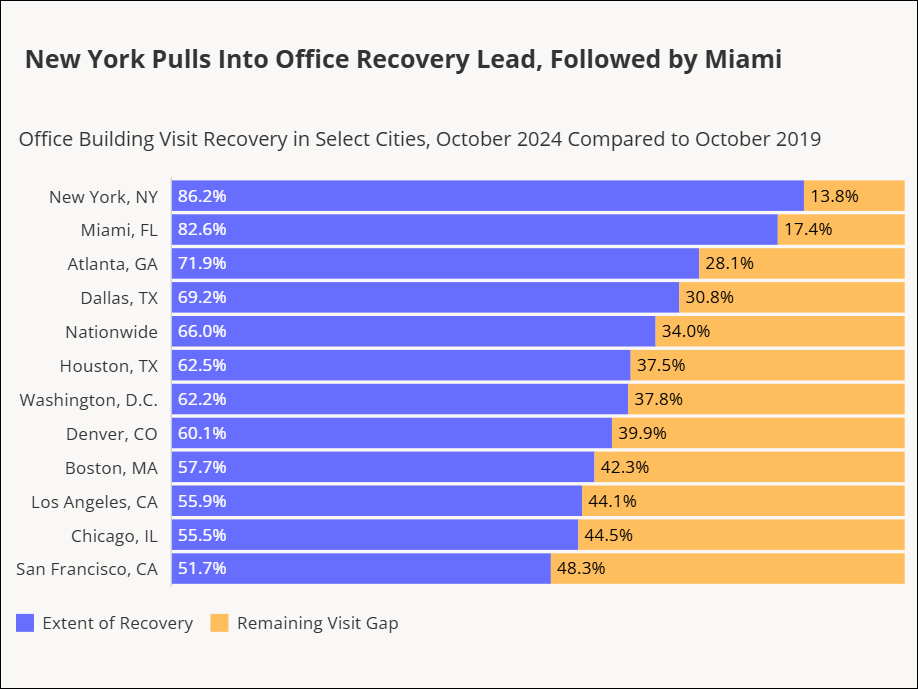

Carrie Szarzynski, senior managing director & head of management services at Oakbrook Terrace, Ill.-based Hiffman National, said that Houston and other Texas cities continue to lead the nation in office occupancy, and tenants are gravitating to buildings that check all the boxes for finishes, amenities and concierge-level management services.

“We’re increasingly finding that on-site conveniences such as food and beverage offerings, fitness centers and social lounges are must-haves for companies in search of buildings whose common areas can serve as an extension of their own private offices,” Szarzynski said.

“This flight to quality has made it essential for landlords to offer a high-touch, high-tech workplace experience that’s differentiated from home and other remote work environments.”

Earlier this month, a Class A office building in Houston, Twentyfour25 Galleria, sold in a bankruptcy deal for $27 million.

You must be logged in to post a comment.