Will Your Construction Costs Go Up in 2025?

How disasters, tariffs and immigration policies could impact prices.

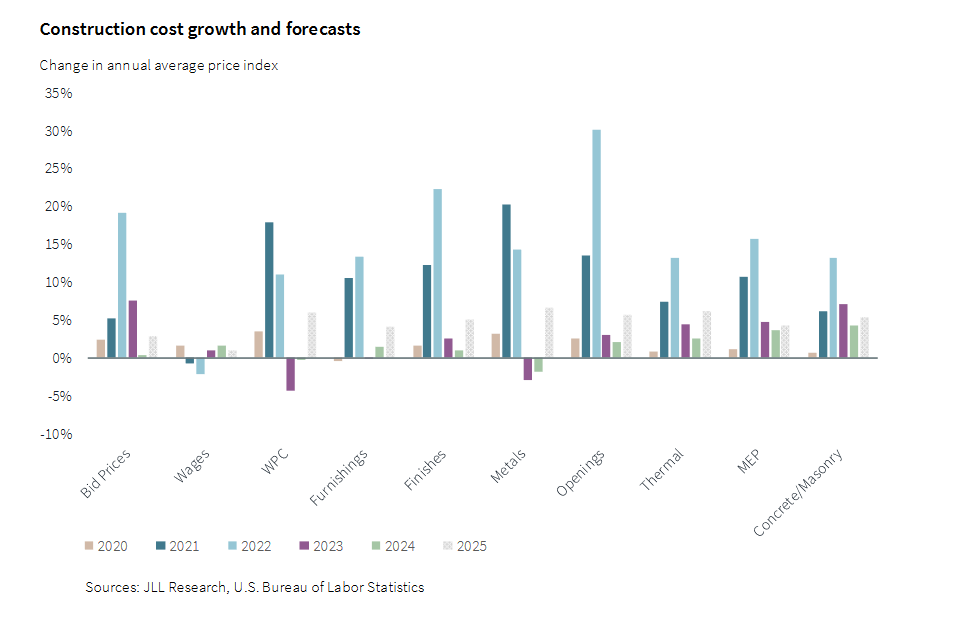

Commercial real estate investors and decision-makers will be paying more for projects than in 2024, when construction cost growth remained nearly flat year-over-year.

JLL’s 2025 U.S. Construction Outlook expects cost growth will be between 5 percent and 7 percent. The report notes increases will vary by materials, reflecting demand shocks from natural disasters, booming sectors like data centers and vulnerability to changing economic policy as a new Republican-led federal administration takes over in late January.

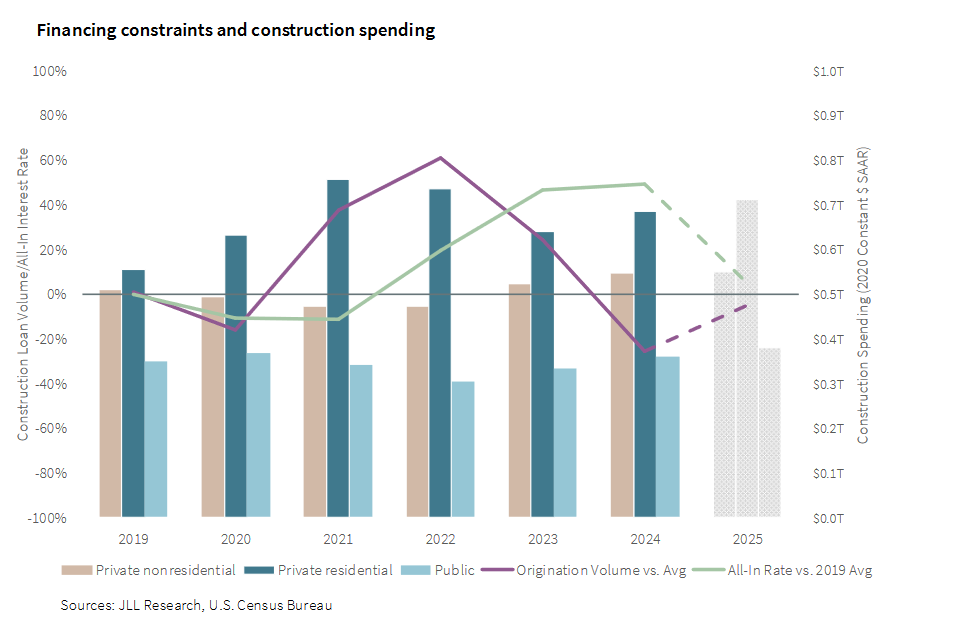

Aided by a strong pipeline of projects, the U.S. saw high levels of construction activity in 2024 despite a downturn in new starts due to a difficult financing environment. As the backlogs clear with fewer replacement projects, JLL’s annual forecast expects there to be a decline in construction spending in the early months of 2025 before a modest growth can occur by year-end.

READ ALSO: Is the Rise in Construction Costs Decelerating?

The report details the opportunities, challenges and key focus areas for commercial real estate and the construction industry in the coming year. JLL advises investors and occupiers to anticipate market shifts and be prepared for changing economic conditions and potential project delays as the year evolves.

“The industry thrives with certainty, and delays into 2025 will reflect a combination of decision-makers waiting for clarity as well as other underlying complications in the materials and labor. We’ve seen this over the period of elevated rates and rapid inflation, where a ‘wait-and-see’ approach plus supply chain issues slow both the industry as a whole and individual projects,” Andrew Volz, research manager, project and development services at JLL, told Commercial Property Executive.

Volz was one of the forecast authors along with Amber Schiada, head of work dynamics research with JLL Americas.

Asked why 2024 construction costs were flat when last year’s JLL forecast had projected a 2 to 4 percent growth in total construction costs and a 2 to 6 percent rise in the overall cost of materials, Volz said it was due to a combination of material stability and margin compression.

READ ALSO: Designing Buildings With Conversion in Mind

“Construction material inventories for most goods were less stressed and commodity prices stayed stable or fell some,” he said. “Many contractors are most concerned with backlog building currently and are willing to compromise to ensure continuous activity now. They’re keenly aware of the overall pipeline as well as the potential for a significant uptick in work and are positioning for the future.”

Volz noted expectations for 2025 cost increases are related to disasters, tariffs and contractors reclaiming margins.

“Disasters tend to increase materials cost due to an immediate demand shock for plywood and emergency materials. This dissipates from a high peak but will drive the average cost of the year up a bit more than it otherwise would. This will move through other materials as the cost of rebuilding progresses,” Volz mentioned, referring to recent devastating hurricanes in Florida, Georgia, North Carolina and South Carolina.

Volz went on to say that tariffs—pitched often as an economic tool during the 2024 presidential campaign by now President-Elect Donald Trump—are “top of mind for materials as their targeting and magnitude are still unclear.”

“The specific impact of tariffs will vary by sector and how they are applied, and ongoing issues in global logistics makes it difficult to get ahead of the uncertainty,” Volz added.

Trump has also promised mass deportation of undocumented immigrants, which could exacerbate the ongoing problem of construction labor shortages.

Stating an estimated 30 percent of the construction labor force is foreign-born, with much higher shares in the highest-growth states of Texas, Florida and California, Volz said immigration policy will have a direct impact on the available workforce in the construction industry.

“The impact on residential will be larger than (on) commercial real estate, and in areas impacted by disasters across the Southeast, this could mean unwelcome delays in the already difficult process of rebuilding,” Volz said.

Embracing stability, innovation and resilience

The report also notes the push for green building practices and reduced carbon footprints continues to shape construction project requirements. All industries, particularly data center, health-care and industrial projects, are embracing both sustainability and technology as part of their growth.

The growing use and integration of advanced technologies like artificial intelligence, IoT and digital twins are redefining design, construction and building management, presenting opportunities for increased efficiency and value creation for commercial real estate investors and occupiers.

While their use in commercial real estate projects is growing, there are challenges such as the need for increasingly complex HVAC, electrical and systems controls and experienced labor to perform the complex work, Volz noted.

“Commercial real estate decision-makers need to critically evaluate the tools and the desired outcomes, making sure they’ve got the right toolkit to deliver along important axes. However, evaluating the tools, project and the people holistically is a technical skillset that isn’t common yet,” he stated.

In a section of the report entitled Building for People and Resilience, JLL noted where, what and how we build will play an increasingly important role in the economic future of the U.S. For example, compounding climate risks may alter existing patterns of growth and the commercial real estate industry will need to balance new policy priorities while managing a transition into the fifth industrial revolution. The report states commercial real estate leaders should focus on current and future resilience of their assets and the surrounding areas and be prepared for the impact of infrastructure investments. A single resilient project can foster broader regional resilience through interconnected development.

“We saw with the recent hurricanes how important resilience is to the future of individual assets as well as the extent of interconnectedness on a big stage. With the increasing frequency of high damage events and the compounding potential of our development patterns, this should be top of mind for municipalities, investors and occupiers,” Volz mentioned.

You must be logged in to post a comment.