Retail’s Post-Pandemic Recovery

Prime urban corridors are seeing increased attention from both luxury retailers and investors, according to JLL.

Urban retail is emerging as a stellar post-pandemic sector, attracting both investors and prime tenants, in a trend driven by sturdy consumer spending, an increase in foreign tourism in major U.S. cities and an ongoing rise in office attendance, according to a new report by JLL.

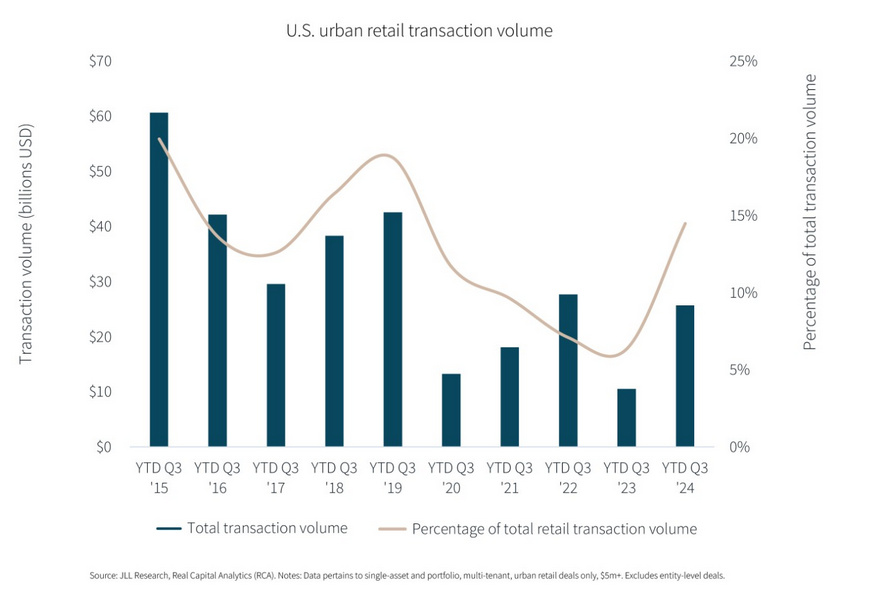

Let’s put some numbers on that. JLL reports that of the total multi-tenant, single-asset transaction volume, urban retail’s share hit a five-year peak in the year-to-date figures for the third quarter of this year: 14 percent of the total and a 180 percent year-over-year increase.

The report also cites Kastle Systems’ 10-city Back-to-Work Barometer, which indicates that weekly average office occupancy has nudged 61 percent, signaling a gradual return to the urban core.

As foot traffic in city centers increases, JLL forecasts, urban retail is poised for a strong recovery. Luxury brands such as Chanel, Gucci and Louis Vuitton are spearheading this revival by expanding their brick-and-mortar presence in top cities.

This in turn is helping to power leasing activity in prime urban corridors, such as Miami’s Design District and New York’s Meatpacking District, in sync with return-to-office numbers.

READ ALSO: How Dining Trends Are Reshaping Shopping Centers

As of October, most prime urban corridors saw year-over-year increases in foot traffic, making them increasingly attractive to investors. Examples include Miami’s Design District, Boston’s Newbury Street and Seaport, as well as Chicago’s Fulton Market and Wicker Park.

High Streets are still riding high

In the new report, JLL zeroes in on specific cities and retail streets where the resurgence of urban retail is most clearly visible.

For example, the Beverly Hills Triangle, with its highly coveted streets, especially Rodeo, Beverly and Brighton Way. Also, vacancy on Melrose and Robertson in West Hollywood is nearly nonexistent.

No new space is underway in these areas, as development is constrained by both zoning restrictions and limited availability of financing.

Areas such as Brickell and the Miami Design District are leading the strong demand in Miami’s urban core. According to JLL, the city never experienced a substantial drop in its downtown activity, because of the mix of hotels and residential with office space.

New York is also seeing a low enough vacancy in its prime retail submarkets, where rents have stabilized and are even growing in some locations.

Chicago is seeing a visible increase in demand for urban retail, especially in areas where foot traffic is up because of return-to-office trends, JLL reports.

You must be logged in to post a comment.