RCLCO Market Index Points to Optimism for 2025

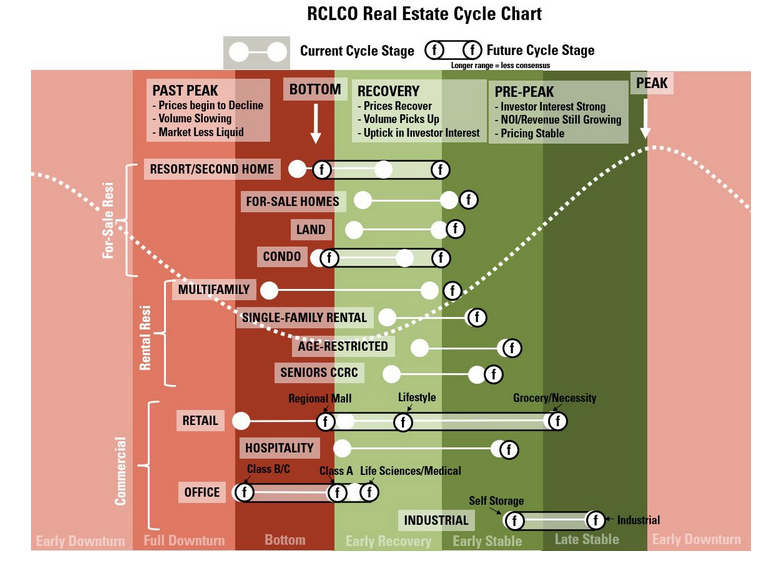

A majority of survey participants see sectors solidly climbing out of recovery territory.

Commercial real estate investment sentiment has risen convincingly in the second half of the year, according to RCLCO’s real estate market index, which registered a 25 percent increase.

After sputtering for the past few years, it’s now at 65, solidly into recovery territory. An RMI above 60 is typically indicative of positive or improving market conditions.

Some 68 percent of this survey of highly experienced real estate professionals from across the country and the industry have worked in the real estate industry for 20 years or more, with an average respondent tenure of approximately 25 years; and 82 percent of respondents are C-suite or senior executives in their organizations.

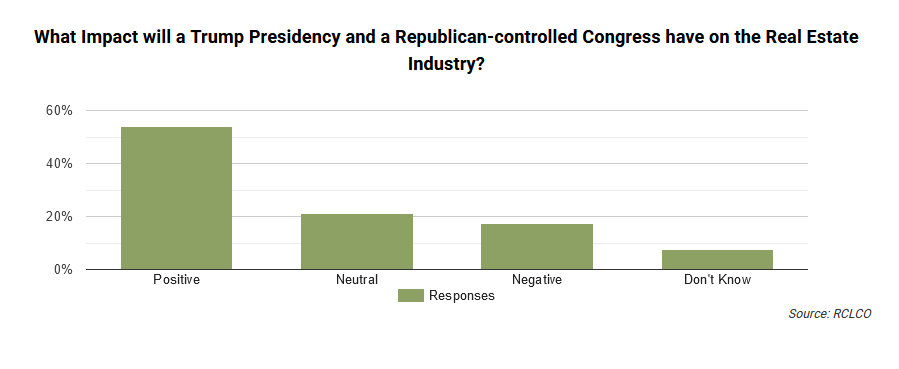

Even more, the RMI is forecast to increase to 82 over the next 12 months. More than half (54 percent) credit the incoming Trump Administration for their favorable view.

Niche sectors—such as self storage, industrial, grocery/necessity retail—are likely to show resilience, having overcome downturn conditions this cycle.

“A renewed sense of optimism is apparent across all aspects of commercial real estate, including multifamily, industrial, retail and office,” Michael Romer, co-founding partner, Romer Debbas, told Commercial Property Executive.

“You can actually see the smiles again at holiday parties. There’s optimism for 2025.”

America was built on big dreams and self-belief, and that has returned, according to Kyle Gulock, founder & managing partner at Century Partners.

“Once the new policy is in place, we expect a swift uptick in overall investment [at least] until the middle part of the year,” he said.

Trump policies are ‘a wild card’

President-elect Trump’s second term throws a potential wild card into the outlook, according to Kevin Thorpe, global chief economist, Cushman & Wakefield.

“The policy changes encompass a wide range of macroeconomic influences, including regulatory conditions, fiscal policies such as taxation and government spending, trade policies and immigration policies,” Thorpe said.

Many policies the Trump administration is pursuing in his second term—such as restrictive immigration, tariffs and tax cuts—mirror the same pursued during his first term and, despite the whipsaw in policy, the U.S. property sector performed well, Thorpe observed.

READ ALSO: Is This the Start of CRE’s New Growth Cycle?

He added that some of these policies will have a more immediate impact, for example, on the financial markets. Others have a more lagged impact on the economy and financial markets and are, therefore, more likely to influence leasing fundamentals and the capital markets down the road.

“Although many of the changes to policy could be significant, they also have the potential to exert offsetting forces to economic growth and inflation,” Thorpe said. “Our baseline assumes that the expected changes in policy will not significantly alter the trajectory of the economy or the property sectors’ performance in 2025.”

The Federal Reserve’s 50-basis-point rate cut in September 2024 spurred transaction activity in the real estate sector, Robert Martinek, director at EisnerAmper, told CPE.

“Many felt this confidence has continued with additional 25-basis-point cuts in November and December,” he said. “Many market participants feel that Trump has ‘business-first’ policies and he will cut red tape and expand business opportunities.

“For healthy sectors of the market (multifamily and industrial), most of the new construction that entered the market has been absorbed. With new and planned development expected to slow, vacancy rates will move lower while rental rates should increase.”

Outlook for 2025

Looking to next year, regarding retail, rising insurance costs, construction pricing, debt and equity, and the financing and refinancing landscapes affect the trading volume, according to Meghann Martindale, principal & director, market intelligence, retail at Avison Young.

“Renewed port negotiations or strikes could also impact the movement of goods, prices and retailer operations. And it is yet to be seen whether consumer spending can remain resilient—although tariffs may trigger renewed inflation pressure, U.S. consumers have not stopped spending through recent inflation and rising interest rates, so tariffs may not deter spending to the levels some are fearing.”

As for energy, Howard Huang, analyst, market intelligence, data centers at Avison Young, told CPE that the incoming administration has expressed support for nuclear energy development. “If realized, this policy could significantly enhance energy availability in the U.S., benefiting the growth of data centers and other industries reliant on stable power infrastructure.”

Across office, industrial and retail, Garett Bjorkman, co-chief executive officer at PEG Cos., said he anticipates positive trends and continued flight to quality for new office leasing, and older vintage product being converted to alternative uses such as residential and hospitality.

“Given the strength of consumer spending, we expect retail to continue improving, which will, in turn, lead to more industrial and logistics demand,” Bjorkman said.

You must be logged in to post a comment.