What’s Driving Construction Cost Increases

And where to focus risk mitigation strategies, according to Rider Levett Bucknall’s new research.

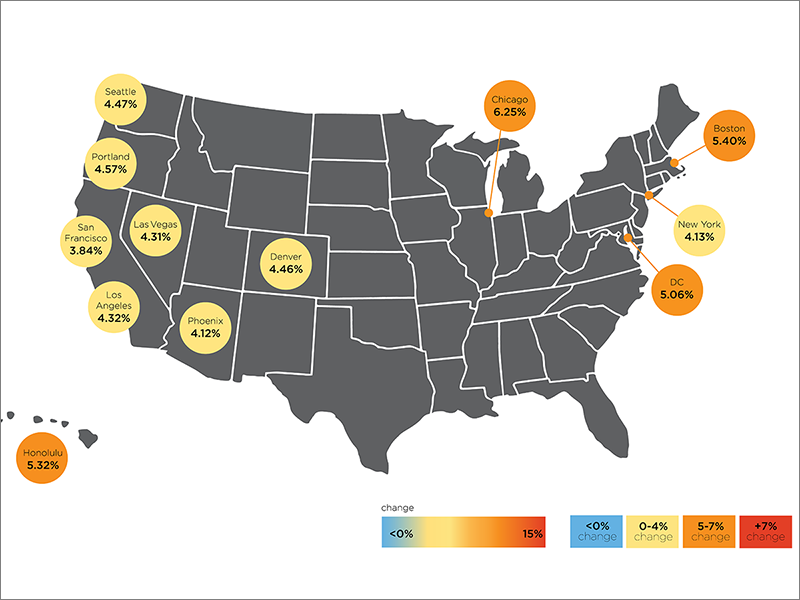

The quarterly national average increase in construction costs in the fourth quarter was stable at 1.11 percent, clocking in at 4.69 percent year-over-year, according to Rider Levett Bucknall’s latest report, which surveys 14 key markets.

Meanwhile, the construction unemployment rate was 3.7 percent, down one-tenth of a percent in the same period last year.

Honolulu, Seattle, Boston, Phoenix, Chicago, Las Vegas and Washington, D.C., experienced increases over the national average this quarter. New York City, Denver, Los Angeles, Portland, Ore., and San Francisco saw increases below the national average.

Following 20 months of decline, Rider Levett Bucknall’s Architectural Billings Index is 50.3, showing a balance between firms with increased and decreased billings.

In the third quarter, construction costs were up 1.07 percent nationally, the lowest increase in the past three years.

Inflation vs. tariffs

A key finding from the research highlights the relative impact of inflation versus tariffs on construction material costs, Paul Brussow, president of Rider Levett Bucknall, told Commercial Property Executive.

“When analyzing specific materials like rebar and structural steel, the data reveals that regional inflation has had a far greater effect on costs than tariffs,” Brussow said.

“Applying this trend to future forecasts suggests that efforts to mitigate financial risks should focus less on tariffs and more on regional inflation impacts, which consistently proves to be the primary driver of material cost increases.”

READ ALSO: Will Your Construction Costs Go Up in 2025?

Although he anticipates more volatility than last year, the construction industry is well-positioned to respond strategically, Andrew Volz, research manager of project and development services at JLL, told CPE.

“Some reliable bright spots are on the horizon, including data centers, health care, manufacturing, energy and other infrastructure,” Volz said. “These industries demand a lot from the construction industry, and those needs will continue evolving and growing for the foreseeable future.”

Volz added that commercial real estate is only increasing in complexity as we’re looking toward future economies, cities, and people living and working in them. The construction industry needs an incredibly ambitious plan and heaps of creativity to keep up with these demands.

A positive outlook for NYC

RLB’s latest quarterly cost report should be an encouraging sign for the New York City commercial real estate and development communities, according to Michael Webb, partner of the real estate group at Farrell Fritz.

Despite the looming presence of broader economic and socio-political uncertainties and pressure, construction costs in the New York region increased year-over-year at a rate less than the national average.

“Nationally, but particularly in our region, there is a well-documented shortage of all forms of housing, including multifamily.”

For example, it is currently estimated that the Long Island region requires an additional 150,000 housing units (if not more) to meet demand.

“Hopefully, stabilizing construction costs will spur developers to tackle and commence construction of all housing categories in 2025 to help balance the supply-demand equation.”

You must be logged in to post a comment.