DLC Locks In Loan for Chicagoland Retail Buy

A commercial bank provided the financing.

DLC has obtained $41.7 million in acquisition financing from Webster Bank for Danada Square West, a 314,819-square-foot grocery-anchored shopping center in Wheaton, Ill.

The firm had purchased the asset from PGIM Real Estate for $61.7 million earlier this month, in a joint venture with Crow Holdings Capital and Temerity Strategic Partners. JLL represented the borrower in arranging the five-year, fixed-rate note.

Completed in 1988, Danada Square West was 92.7 percent leased at closing. The property is part of a major retail cluster at Butterfield Road and Naperville Road in west suburban DuPage County, roughly 30 miles from downtown Chicago.

A Jewel-Osco grocery store, which has been a tenant since the property opened, anchors the shopping center. The roster also features a mix of national retailers, including TJ Maxx, HomeGoods, Burlington, The Paper Store, Ulta and Five Below.

The new owner is focusing on filling the nearly 23,000 square feet that are vacant, with letters of intent already under review. In addition, recent upgrades and leasing momentum from national tenants have set the stage for the property’s further appreciation.

JLL Senior Managing Director Scott Aiese, Managing Director Christopher Knight and Director Alex Staikos led the Capital Markets’ Debt Advisory team representing DLC.

READ ALSO: What’s in Store for Retail in 2025?

The acquisition of Danada Square West was DLC’s first deal with Crow Holdings Capital and its 10th with Temerity Strategic Partners. The firm has acquired more than $400 million in open-air shopping centers in the last 12 months.

In one of the more recent purchases, DLC paid $76.3 million for a shopping center portfolio in metro Columbus, Ohio, in partnership with Principal Asset Management. The two properties total 622,000 square feet.

Chicago retail development soft, rents are up

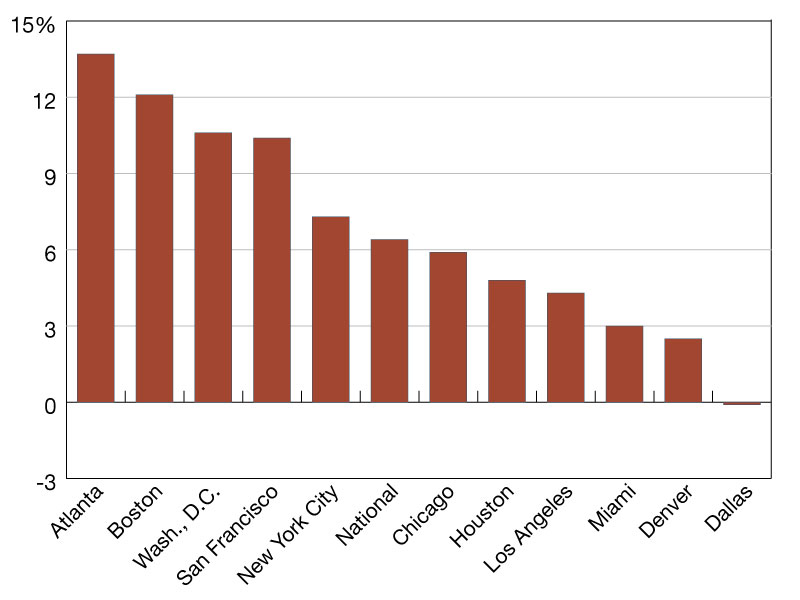

Chicago has a tight retail market, despite sluggish population and income growth recently in the metro area. By mid-2024, the vacancy rate dropped to a new record low of 5.1 percent, the result of seven consecutive quarters of decline, according to a Marcus & Millichap report. The lowest vacancy rate previously was 5.9 percent in 2018.

The reason for the current market climate, according to the brokerage, is that developers put the brakes on during the pandemic, combined with the higher cost of construction and construction financing in the years immediately after the pandemic.

Strong net absorption in recent quarters has driven up single-tenant asking rents for Chicago retail, reaching an average of $20.13 per square foot, Marcus & Millichap reported.

You must be logged in to post a comment.