Fed Leaves Interest Rates Alone

"We don’t feel like we need to be in a hurry to make any adjustments," Fed Chair Powell said.

In its first meeting of 2025, the Federal Reserve Open Markets Committee voted to pause on changes to its interest rate policy, keeping the current target range at 4.25 to 4.5 percent.

Announced on Wednesday afternoon, the widely expected decision comes as the Fed continues to revise its monetary policy amid both a new presidential administration and an inflation rate that has proven to be a tougher nut to crack than anticipated. In December, the Consumer Price Index rose by 40 basis points to a 2.9 percent year-over-year increase.

At last month’s meeting, participants anticipated making two rate cuts this year. Currently, the Fed forecasts the next rate cut to be in June. Goldman Sachs Research anticipates that the first cuts could come this quarter, followed by restraint later in the year.

Fed Chair Powell shied away from decisive predictions around policy shifts, but pointed to the economy’s relative health as a cause for confidence. “We don’t feel like we need to be in a hurry to make any adjustments,” Powell said at a press conference following the announcement

Has the Fed misplayed its hand?

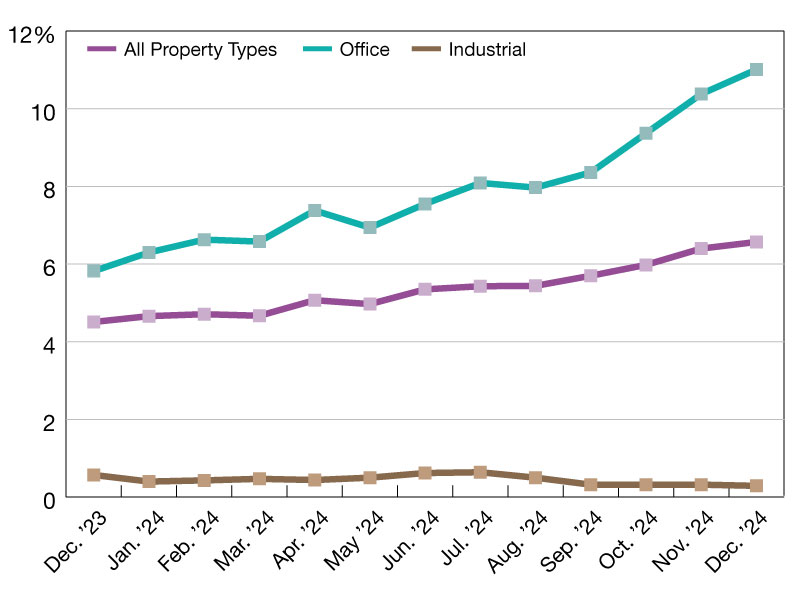

Ryan Severino, chief economist & head of U.S. research at BGO, believes that the Fed’s messaging and reads on the economy are contributing to less-than-optimal outcomes for commercial real estate investors. Following the initial 50-basis-point cut in September, he said, “We thought the Fed would be better off cutting slowly and leaving more in reserve for when needed, (and) we ultimately thought they’d cut by roughly 150 bps by the end of this year.”

READ ALSO: CBRE Survey Indicates Optimism by Investors

A different approach could have been taken, Severino suggested. “Based on their current guidance, that’s where they will get us. But the path to get there now looks front-loaded, with the Fed walking back previous guidance,” he said. “Some of this could be in response to potential changes in inflation expectations post-election. But it fundamentally looks like a misreading of the economy and labor market last year.”

Still, the Fed has good reason to bide its time and assess the impacts of strong employment growth, as well as Trump administration economic policies. Proposed tariffs on imports could have inflationary effects, while tax cuts may further increase demand for consumer goods. As Powell noted: “(There is) some elevated uncertainty because of significant policy shifts.”

You must be logged in to post a comment.