RICS Monitor: Pace of Improvement in CRE Sentiment Slows Down

Although there are pockets of optimism, the overall picture remains quite cautious, Senior Economist Tarrant Parsons says in this podcast.

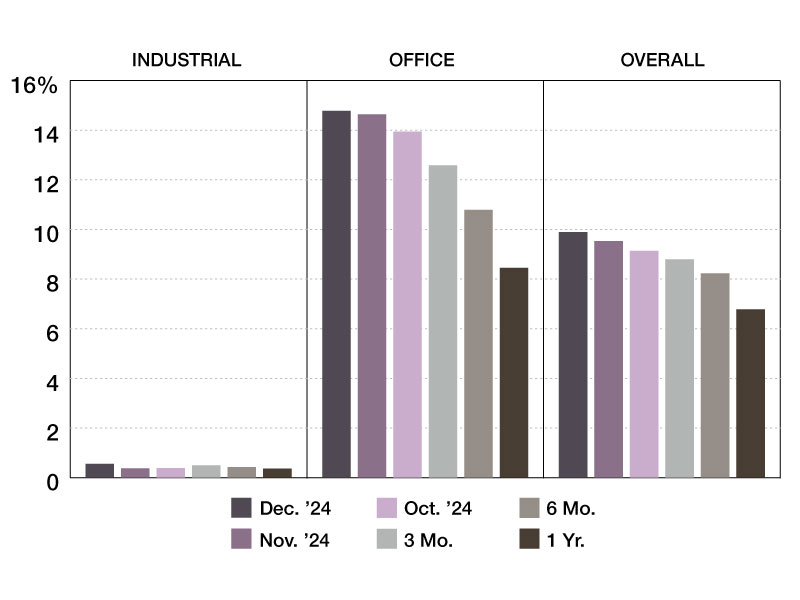

Globally, sentiment toward real estate in 2024 was a bit of a mixed bag. The first three quarters saw steady improvement, but then sentiment softened in the last three months of the year, mainly due to the rise in bond yields.

“But even so, it’s worth noting that investor inquiries did rise slightly in several markets, which could be taken as a more positive sign,” said Senior Economist Tarrant Parsons of the Royal Institution of Chartered Surveyors in London in the latest RICS Monitor podcast episode hosted by Commercial Property Executive Senior Editor Laura Calugar.

In the Americas, nearly half of the survey respondents who participated in RICS’s Global Commercial Property Monitor survey in the fourth quarter believe their market is in the upturn phase of the cycle. The U.S. in particular is showing signs of a recovery, with more and more respondents now seeing good value in investing in commercial real estate. In fact, investment inquiries for offices saw a sharp increase in the last quarter of the year, but industrial and retail also attracted interest.

READ ALSO: How Geopolitics Will Shape CRE Investment in 2025

In terms of best-performing asset types, data centers are still the most sought-after, along with senior housing and traditional multifamily properties, but retail and office assets in prime locations are also on the mend. “While alternatives are leading the way generally, there are still opportunities in mainstream assets, especially in prime assets,” Parsons said.

Here are all the topics he touched on:

- Global real estate sentiment in 2024 (0:45)

- Credit conditions (2:15)

- Perceptions regarding market cycle (3:50)

- Why investment appetite is beginning to re-emerge (4:46)

- Expectations for other alternative asset classes (6:10)

- Survey results for the APAC region (7:46)

- Why Europe continues to portray a relatively underwhelming picture (9:32)

- One of the best performing regions in the world: the Middle East and Africa (10:54)

- Survey results for North America (12:43)

- How 2025 is shaping up (14:18)

Follow, rate and review CPE’s podcasts on Spotify and Apple Podcasts!

You must be logged in to post a comment.