Is the DeepSeek Scare Impacting Data Center Demand?

Amid a booming U.S. pipeline, experts consider what energy-light models mean for real estate.

In late January, a bolt from the blue struck the tech world—and, indirectly, commercial real estate. Chinese startup DeepSeek claimed its AI model not only outperformed OpenAI’s data-intensive model, but also that training took a tiny fraction of the resources, including computing power.

If these assertions hold at least some water, one conclusion can be that data center demand might take a big hit, rather than the expansive increase foreseen by virtually everyone just one month prior. That would, in theory, negatively impact development, which has lately been in overdrive.

… Or would it?

Data center experts are skeptical that DeepSeek’s announcement will make much of a dent in the development boom. For one thing, the company’s vaunted efficiency might be over-hyped. More fundamentally, even if DeepSeek’s claims are true, and other AI developers start employing similar data-saving methods, the pace of AI growth is still too relentless to slow down appetite.

In fact, more efficient AI might even add to data center demand, industry veterans said.

READ ALSO: Are Data Centers Immune to CRE Market Forces?

“This is going to make things easier, faster and cheaper—a classic Jevons Paradox in action,” Howard Berry, principal, national data center solutions at Avison Young, told Commercial Property Executive. He’s referring here to an economic theory saying that increasing efficiency associated with a particular resource can counterintuitively lead to increased consumption of that resource, as lower costs lure more buyers into the market.

“We anticipate an overall increase in technology usage and investment, since more affordable and open-source AI technology will attract more participants to the AI market, which will boost data center demand even more than the unprecedented demand we’re currently witnessing,” Kristen Vosmaer, managing director with JLL Data Center Work Dynamics, said.

In speaking with customers and tracking activity following the news, the consensus is that, while models such as DeepSeek may optimize resources at a facility level, there’s still a global, long-term data center capacity shortage, Vosmaer added.

“If the technology delivers as promised, we should fully expect U.S.-based companies to develop similar models, especially with open-source access,” Berry said. “The bottom line is that demand for data center space isn’t going anywhere—if anything, this kind of advancement will drive even more need for high-performance infrastructure.”

There’s more to data centers than AI

DeepSeek’s innovations might shake things up, but AI is only one part of data center demand. Still a very significant driver, indeed, but even optimistic scenarios say that AI will represent less than 50 percent of data center demand by 2030, JLL reported. Lower-intensity workloads such as data storage and cloud-based applications are bound to drive most of total demand.

“All industries are susceptible to innovation-driven disruption, as we’ve seen that play out time and again,” John McWilliams, head of data center insights at Cushman & Wakefield, pointed out. “It’s reasonable to conclude that AI is susceptible to optimization and efficiency gains, and we should probably expect it.”

That said, McWilliams noted that it’s still too early to tell if claims of a vastly cheaper way to produce LLMs will fully shake out. Also, pre-AI demand drivers are still around, and they would have gained steam either way.

“AI catalyzed the need for more cloud infrastructure and network expansion, but it isn’t fundamental to demand for hyperscale and colocation space,” McWilliams said. “Instead, it represents additional demand that runs on top of all that.”

READ ALSO: The Stargate Project Promises a Data Center Boom. Can It Deliver?

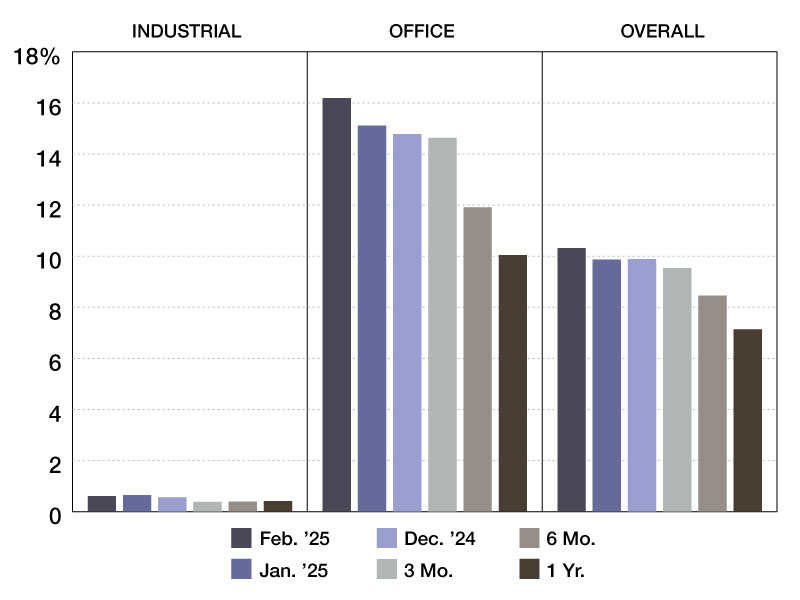

The U.S. data center market is tight right now, with vacancy at 4.2 percent. AI efficiency gains could merely increase power availability for other data center needs if existing LLMs were just maintained and not improved, McWilliams also pointed out.

“More likely than not, though, AI firms will continue to improve the quality of their existing LLMs and produce more powerful AI. While each query may require less energy, overall power requirements will likely not see a reduction as demand for AI continues to grow.”

Data center innovation still needed

It’s still time to invest in data center innovation, regardless of DeepSeek or similar models, said Jennifer DiMambro, Arup’s Americas and Global science, industry and technology leader. Rather than slowing down the industry, innovations will only accelerate its growth, Berry added.

More than $500 billion globally has been invested in data centers over the last three years, Vosmaer noted, and these multi-year construction projects are powering through. There will be ongoing refinement in size and power, as is normal in a growing industry, but the underlying premise of growth in AI, cloud and IoT will continue to spur innovation in real estate development and operations.

READ ALSO: Why Big Data Centers Are Going Nuclear

“The most common way companies overpay for data centers is through purchasing too much power,” Jeff Howell, chief growth officer with ENCOR Advisors, told CPE. “Everyone is anxious about not purchasing enough power capacity for their regular applications, and now layering intelligence on top of that takes it to a whole new level.”

Given the power constraints globally stemming from AI, the industry needs breakthroughs in computing efficiency because relying on carbon-free technologies such as wind, solar and nuclear are too slow and won’t meet demand over the next decade, Howell said.

“In Canada, for example, we have world-class nearly carbon-free electricity, but need to dip into oil and natural gas to keep up with data center demand in what was previously a flat electricity market,” Howell added.

“This progress can’t be slowed,” DiMambro told CPE. “These centers are the beating heart of AI, housing the high-performance servers and hardware that make it all possible. As many have already pointed out, increasing efficiency in technology often simply results in increased demand, and the need for smarter, greener data centers will be even more important.”

You must be logged in to post a comment.