CRE Lending Activity Sees Strong Recovery

This momentum is expected to extend into 2025, CBRE anticipates.

Fourth-quarter lending momentum is expected to continue this year due to strong fundamentals across most sectors, significant capital and maturing debt, according to the latest research from CBRE.

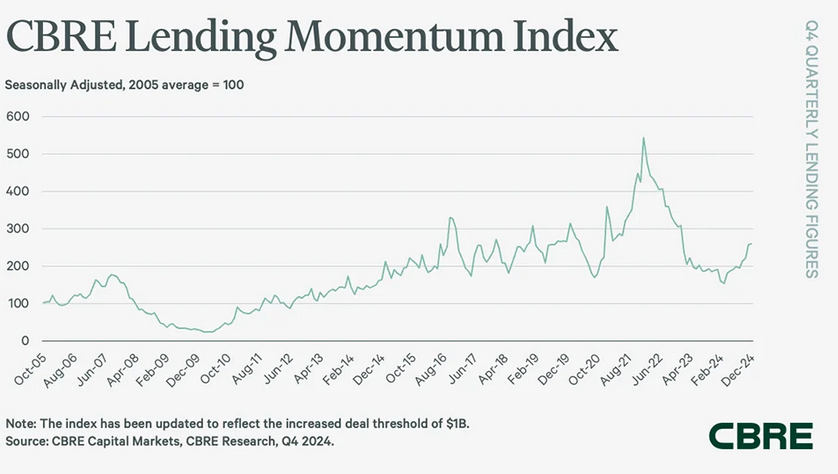

The firm’s index measuring lending activity and sentiment rose 21 percent from the third quarter of 2024 and 37 percent year-over-year. For the fourth quarter, the index measured 259, exceeding the five-year pre-pandemic average of 229.

There was a 184-basis-point spread on closed commercial mortgage loans in the fourth quarter 2024, marking a 49-basis-point decline year-over-year and a 1-basis-point increase from the third quarter of 2024.

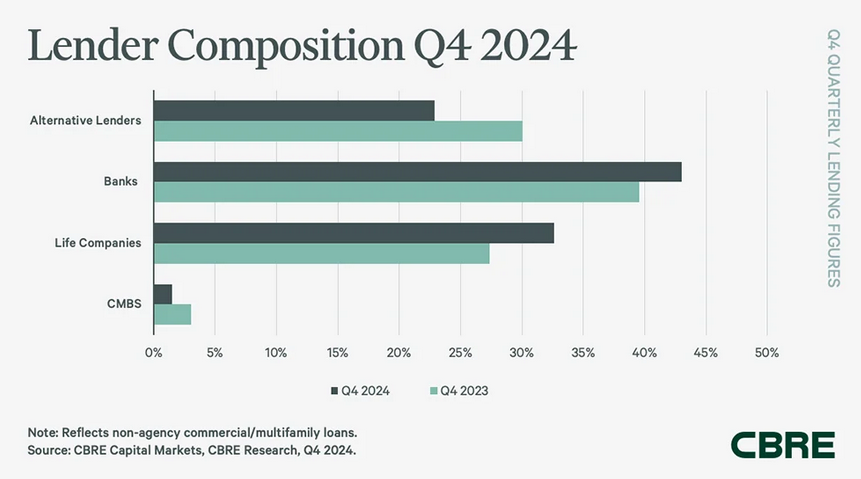

The percentage of CBRE’s non-agency loan closings for banks in the fourth quarter rose to 43 percent compared to just 18 percent in the third quarter and a 40 percent share a year earlier. Loan payoffs, efforts to clean up balance sheets and a more favorable regulatory outlook boosted banks.

Last month, a CREFC index also suggested optimism.

Tight loan spreads

For multifamily loans, spreads narrowed by 12 basis points during the quarter to 156 basis points. That was the tightest spread since the first quarter of 2022, primarily due to compression in agency loan spreads.

Capital remains abundant for Class A properties with high-quality tenants, Robert Martinek, director at EisnerAmper, told Commercial Property Executive.

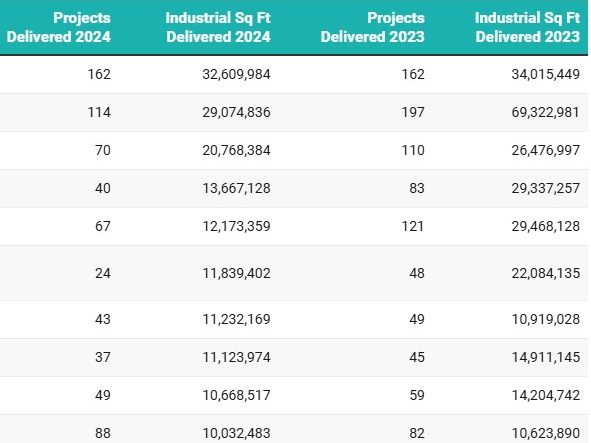

“Although 2024 saw a substantial amount of new inventory entering the market, it is anticipated that in 2025 we will see a decline in new construction,” Martinek said.

READ ALSO: The Trump Effect on Tariffs, Taxes, T-Bills

“As vacancy rates decrease, leasing will probably continue its upward momentum. Loans that were restructured during the pandemic will soon come due, and we can expect sustained lending activity.”

He said the biggest question moving forward is where interest rates will be.

“The jury is still out, as some market participants see the new administration’s tariffs as a roadblock,” according to Martinek. “However, if inflation slows, we should see additional rate cuts. This should lead to improvement across most real estate sectors and increased commercial lending.”

Fed cuts create positive yield curve

Dillon Freeman, Fidelity Bancorp Funding Senior Commercial Loan Officer, told CPE the latest Federal Reserve cutting cycle has produced a positive yield curve, presenting an attractive opportunity for banks to revisit deploying longer-term loans.

“The attractiveness of lending collateral to the Fed via reverse repo transactions has fallen relative to the yield earned on new loans,” he said. “Banks have seen a fall in non-interest income as loan originations have subdued. The need for income added to a widening spread between cap rates and lending costs could see banks re-entering the market after limited activity over the last 18 months to 24 months.”

While many are still sitting on the sidelines, waiting for a more favorable lending environment, a transition from hesitation to adaptation is occurring, reflected in the latest surge in lending activity, according to Lisa Flicker, head of real estate & senior managing partner at Jackson Lucas.

“Investors have moved past the era of ‘extend and pretend,’ and the strong recovery in lending activity signals a shift to a new phase—one of ‘hope and cope,’” Flicker told CPE. “As higher rates continue to be the new normal, the market adjusts accordingly.”

You must be logged in to post a comment.