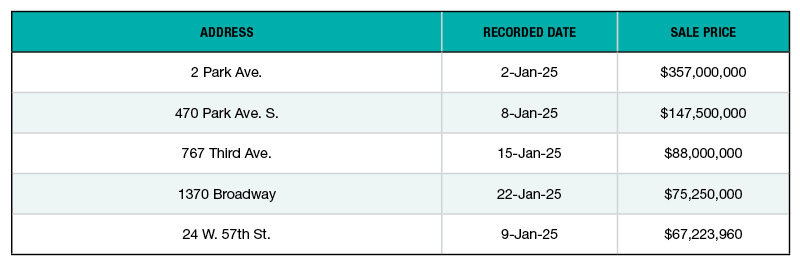

Top 5 NYC Office Building Sales—January 2025

The metro’s top deals for the sector rounded up by PropertyShark.

Sale Price: $357 million

Morgan Stanley sold the 852,731-square-foot office building in the borough’s NoMad neighborhood to Haddad Brands. The deal was announced in early December as what would have been the largest office sale of the year in New York City, according to The Real Deal. The 1928-built asset previously changed hands for $565 million in 2007, when Morgan Stanley picked it up from L&L Holding Co.

Fried Frank advised Haddad Brands during negotiations, with the seller planning to occupy the property. The asset was last upgraded in 2011, rises 345 feet and includes 41,465 square feet of retail space

Sale Price: $147.5 million

A week later, another NoMad property changed hands: Williams Equities acquired the 227,053-square-foot office asset at 470 Park Ave. S. from SJP Properties and PGIM Real Estate. The buyer secured acquisition funds in the form of an $100 million senior loan via a consolidated note that replaced a previous $56 million debt, and a $10 million second loan, both originated by MetLife Real Estate Lending.

The 17-story building previously traded in 2018 for $245 million. Originally completed in 1925 and last updated in 2012, the office property features 19,000 square feet of retail space. Its tenant roster includes M&T Bank, Kiko USA and Array Architects, among others.

Sale Price: $88 million

Nathan Berman’s Metro Loft Management picked up the Turtle Bay property from Sage Realty. Eastdil Secured negotiated on behalf of the seller. Metro Loft Management secured a $55 million acquisition loan from Bank Hapoalim International.

The 286,212-square-foot office building rises 40 stories and dates back to 1980. Tenants here include Acacia Research Corp., Harvest Capital Credit Corp. and The Cole Group, among others.

The buyer formed a joint venture with Quantum Pacific Group to convert the half-vacant property to residential, under the City of Yes housing reform, according to The Real Deal. The 286,212-square-foot office building rises 40 stories and dates to 1980.

Sale Price: $75.3 million

American Exchange Group purchased the 234,846-square-foot property, also known as the Fischel Building, from Invesco Real Estate. The buyer closed the acquisition through Sentry Realty, its real estate arm, in partnership with 60 Guilders. Fortress Investment Group provided acquisition financing totaling $66 million through two loan agreements.

The deal closed at a significant discount when compared to the previous sale in 2014, when Invesco paid $186 million. Located in the borough’s Garment District, the 16-story asset was completed in 1922 and includes 5,000 square feet of retail space.

Sale Price: $67.2 million

The Central Midtown office building changed hands from APF Properties to Soloviev Group. The seller marketed the property as a development site after it defaulted on a $48.9 million CMBS loan.

Soloviev Group owns multiple plots in the area, as well as the office tower across the street. While it remains unclear what will happen to the new asset, the buyer will likely build a luxury condominium asset, according to Commercial Observer.

Also known as The New York Gallery Building, the property is totaling 110,808 square feet and includes 88,722 square feet of office space and 13,246 square feet of retail space. Originally completed in 1928 and upgraded in 2009, the 20-story building is leased to Galerie St. Etienne, Michelle Roth Design Studios and luxury brand Riflessi, among others.

—Posted on February 25, 2025

You must be logged in to post a comment.