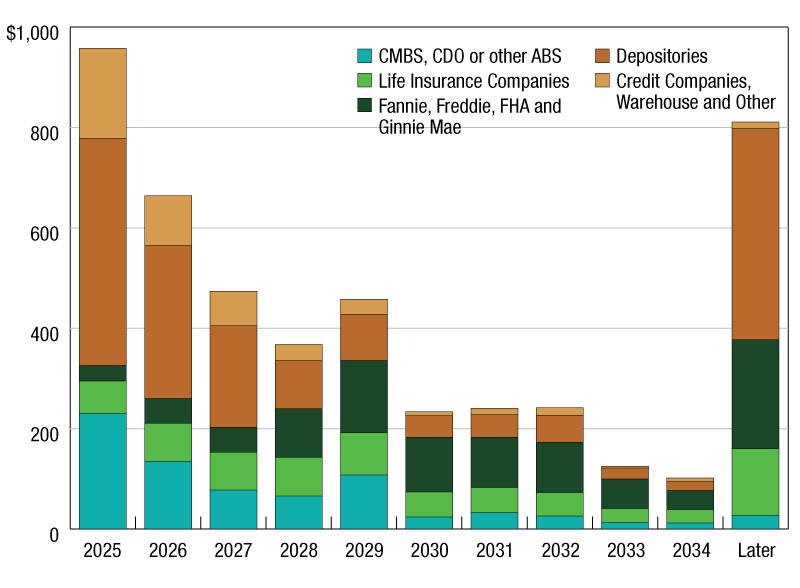

20 Percent of Commercial and Multifamily Mortgages Mature in 2025

An update from the Mortgage Bankers Association.

One-fifth or 20 percent ($957 billion) of $4.8 trillion of outstanding commercial mortgages held by lenders and investors will mature in 2025, a 3 percent increase from the $929 billion that matured in 2024, according to the Mortgage Bankers Association’s 2024 Commercial Real Estate Survey of Loan Maturity Volumes, released recently at its 2025 Commercial/Multifamily Finance Convention and Expo.

The loan maturities vary significantly by investor and property type groups. A total of 14 percent of mortgages backed by multifamily properties (not including those serviced by depositories) will mature in 2025, as will 18 percent of those backed by retail and healthcare properties.

READ ALSO: Capital Ideas: So What If the Fed’s Not Independent?

$452 billion (25 percent) of the outstanding balance of mortgages serviced by depositories, $231 billion (29 percent) in CMBS, CLOs or other ABS and $180 billion (35 percent) of the mortgages held by credit companies, in warehouse or by other lenders will mature in 2025. Just $31 billion (3 percent) of the outstanding balance of multifamily and health care mortgages held or guaranteed by Fannie Mae, Freddie Mac, FHA and Ginnie Mae will mature in 2025. Life insurance companies will see $64 billion (9 percent) of their outstanding mortgage balances mature in 2025.

The dollar figures reported are the unpaid principal balances as of Dec. 31, 2024. Because most loans pay down principal, the balances at the time of maturity will generally be lower than those reported here.

To learn more or to purchase a copy of the report, please click here.

—Posted on February 28, 2025

You must be logged in to post a comment.