Port Activity Rebounds

Amid diversified supply chains and trade policy volatility, Savills expects shippers’ short-term strategies to continue.

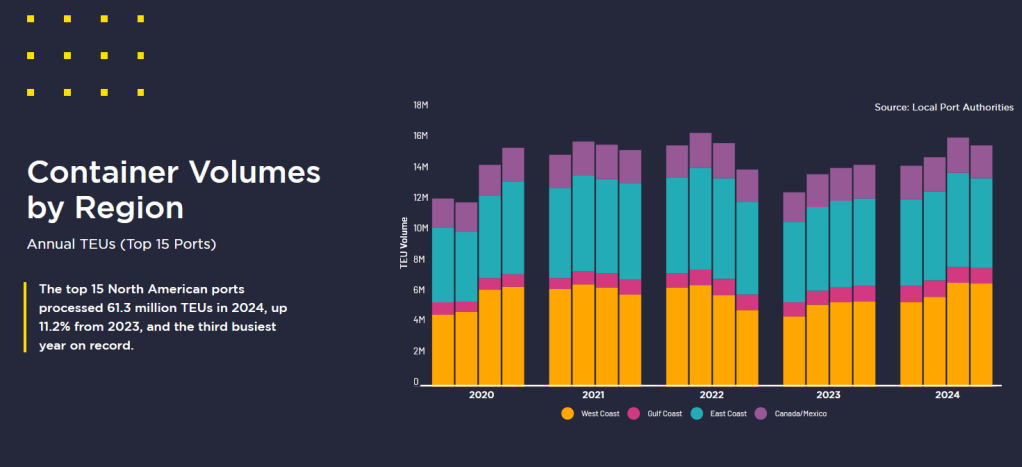

Container volumes rose 11.2 percent to 61.3 million TEUs across the top 15 ports last year, marking 2024 as the third-busiest year on record in North America, according to Savills’ new report.

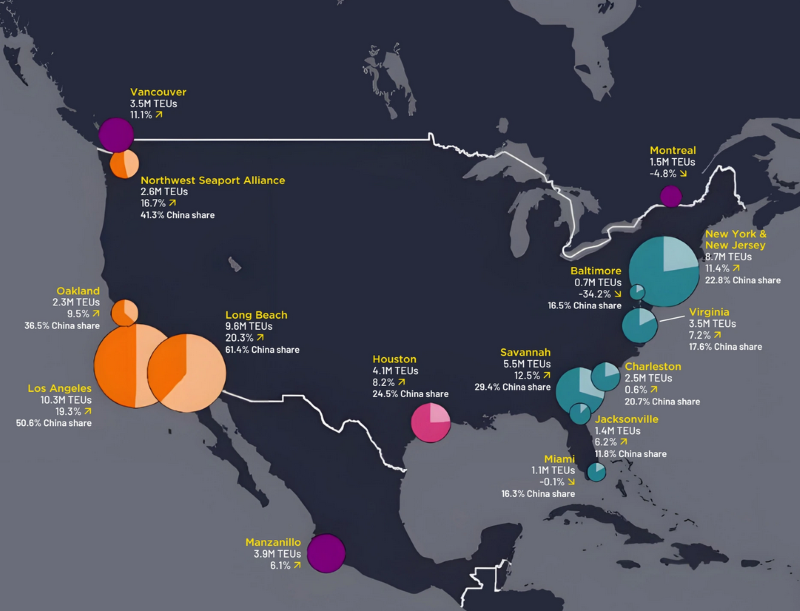

Los Angeles and Long Beach saw the most significant growth as they benefited from shippers that diverted cargo ahead of the first ILA strike in nearly 50 years, as well as efforts to move freight ahead of labor and tariff uncertainties. Baltimore and Montreal were the only ports that saw decreased volumes.

Savills anticipates that short-term strategies such as front-loading will continue in 2025, if trade policy volatility remains. Additionally, as supply chains diversify, trade will be reduced between U.S. ports and China.

“The data confirms importers are front-loading freight, yet warehouse leasing has been slow,” Mark Russo, vice president of industrial research for Savills, told Commercial Property Executive.

“We expect a demand recovery in port markets in 2025, driven by inventory movement and ultimately dependent on the consumer’s health.”

Danny Williams, executive managing director at Newmark, concurred that the front-loading of imports due to tariffs and cargo re-routes from Gulf and East Coast distributors has bolstered LA-LB’s TEU import volume in recent months.

“Longer rail dwell times, however, suggest a good portion of this cargo is destined for markets outside of Southern California,” Williams said.

READ ALSO: Industrial Sector Transitions as Supply Shrinks

A moderate uptick in touring and leasing activities can be observed, according to his colleague, Dain Fedora, head of Southwest U.S. research at Newmark.

“However, occupiers are still proceeding with caution due to remaining uncertainty surrounding tariffs, inflation, etc.,” he said.

Port development activity brisk

CRG recognized the increasing demand for logistics and distribution space near major ports early on, making strategic investments in key markets like Savannah, Mike Demperio, the company’s executive vice president of the Southeast region, told CPE.

The Cubes at West Port and The Cubes at Interstate Centre II are examples of the company’s commitment to support supply chain efficiencies in proximity to the Port of Savannah, according to Demperio.

The Cubes at West Port is a 764-acre master-planned industrial park in Bryan County, Ga., approximately 25 miles west of Savannah. The development will include a 1 million-square-foot industrial facility for Lecangs.

The Cubes at Interstate Centre II is a 300-acre development within the broader Interstate Centre industrial park in Bryan County, Ga., approximately 25 miles west of Savannah.

“The project was designed to accommodate growing demand for logistics and warehouse space, driven in part by the recent expansion of the Port of Savannah, located about 30 miles east,” Demperio said.

CRG’s first building at the development, the 700,000-square-foot Building A, was leased to McKesson Medical-Surgical in November 2021. The second warehouse, the 465,250-square-foot Building E, has been completed, while Buildings B and C are currently under construction.

A fifth building is also planned. Upon completion, The Cubes at Interstate Centre II will comprise nearly 4.3 million square feet of Class A industrial space.

“As container volumes continue to rise, we anticipate strong demand for well-located, state-of-the-art distribution centers to help companies mitigate congestion and labor challenges while optimizing access to major transportation networks.”

Houston, Jacksonville, Georgia markets stay active

JLL reported that there have been substantial transaction volume increases in Houston (20 percent increase year-over-year) and Jacksonville (48 percent increase year-over-year), according to Trent Agnew, senior managing director & industrial group leader at JLL.

Notable deals such as Stonepeak acquiring over 1.8 million square feet of industrial space in Jacksonville and purchasing Houston’s Independence Logistics Park demonstrate strong interest from diverse investors who believe these markets will outperform the broader industrial market, including core funds, separate accounts and infrastructure funds, he said.

“Looking ahead, we anticipate a marked increase in activity in established markets like New Jersey and Southern California,” Agnew told CPE.

“As leasing demand accelerates in 2025, following the container growth experienced in 2024, and rents bottom out, these markets will offer an attractive entry point for investors who have been historically priced out.”

Earlier this year, Avison Young reported on two speculative Class A industrial buildings totaling 540,408 square feet that are coming to the new Northeast Georgia Inland Port.

Alliance Industrial Co. will break ground this quarter on the Alliance 985 Business Park, which is slated to be delivered in early 2026 at 3605 Atlanta Hwy Flowery Branch, Ga.

Avison Young has arranged the sale of the 66.75 acres of land needed for the development. The first building will be 113,536 square feet, and the second will be 426,872 square feet.

You must be logged in to post a comment.