Orange County Office Asset Trades for $38M

Pacific Tree Capital picked up the Class A building in a high-priced deal.

Pacific Tree Capital has purchased 2525 Main, a 143,269-square-foot office property in Irvine, Calif., form J+R Group for $37.6 million. Cushman & Wakefield represented the seller.

Sold for approximately $262 per square foot, 2525 Main ranks among the highest price-per-square-foot sales for a multi-tenant office building valued over $20 million nationwide post-pandemic. In 2014, J+R Group acquired it from Menlo Equities for $36 million, CommercialEdge data shows.

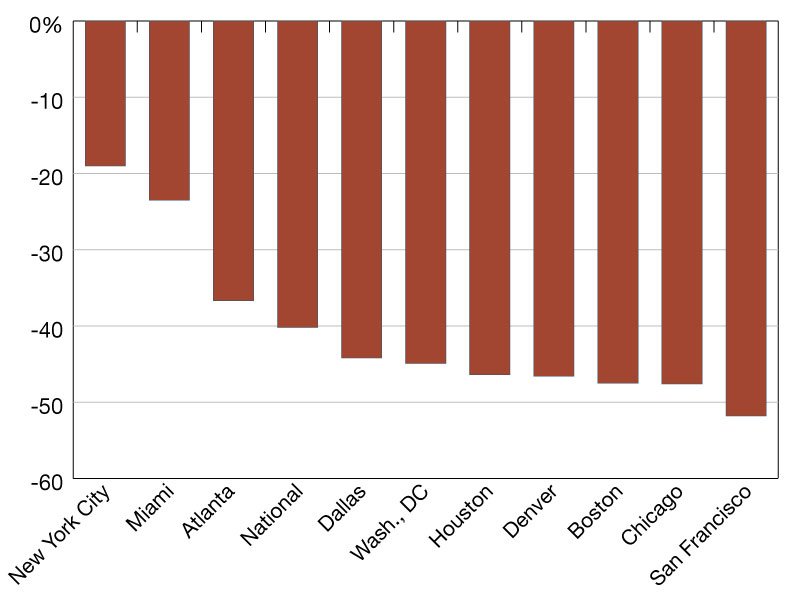

In 2024, the U.S. office market saw a total of $41 billion in sales, with properties changing hands at an average of $174 per square foot, according to a recent CommercialEdge report. Austin, Miami and Manhattan registered the most expensive deals, prices averaging $396, $365 and $364 per square foot, respectively. Los Angeles ranked sixth, properties in the metro selling for $272 per square foot on average.

A downtown Irvine office building

Completed in 1982 and renovated in 2016, the Class A property at 2525 Main St. is less than 1 mile from Interstate 405 and John Wayne Airport. The five-story asset includes a 41,000-square-foot data center, as well as an on-site cafe, according to CommercialEdge information.

The building’s roster features nine tenants, among which SMS Data Center, Seagra Technology Inc., OSI Digital and Better Tax Relief, the same data provider shows. The property was 98 percent leased at the time of the sale.

Cushman & Wakefield Vice Chair Jeffrey Cole, Senior Director Nico Napolitano, Managing Director Kevin Nolen, Senior Director Jason Kimmel and Brokerage Specialist Kristen Schottmiller led the team that facilitated the deal for the seller.

You must be logged in to post a comment.