How Rebuilding From LA’s Wildfires Is Impacting CRE

Topping an estimated $250 billion, the disaster is the costliest in U.S. history.

To start with some of the big numbers, the early January fires in the Los Angeles region—the most damaging ones in U.S. history—caused at least an estimated $250 billion, only roughly $30 billion to $45 billion of which will be covered by insurance.

Put another way, even that conservative estimate of the economic damage adds up to about 4 percent of California’s GDP.

That’s the beginning of the context for Rising from the Ashes: Assessments on the Impacts to CRE Post the LA Wildfires, a new report from JLL Research.

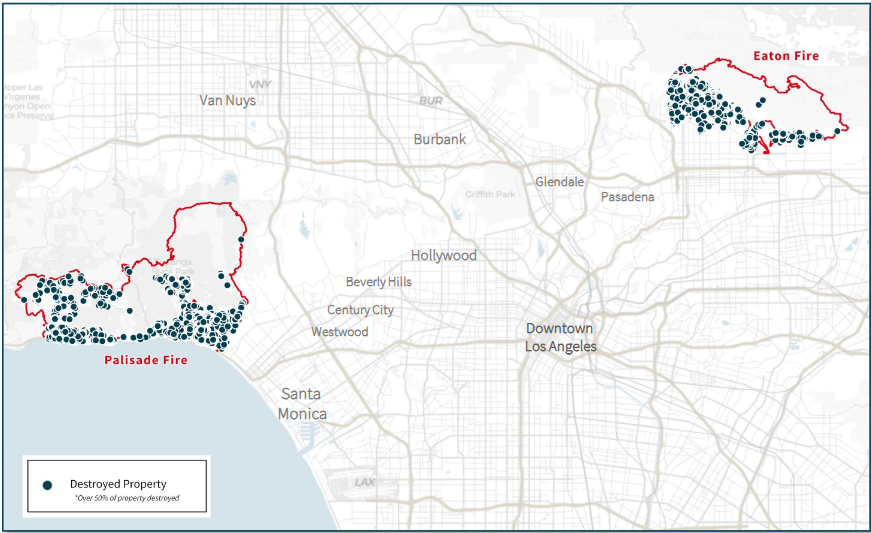

As day after day of news video footage from the fire zones showed, the heaviest property damage was to single-family residences, nearly 11,000 of which were destroyed, representing more than half of the SFR stock in the two fire zones (Palisades and Eaton). In addition, more than 300 multi-housing structures were destroyed.

On one hand, the 11,000-odd housing units destroyed or significantly damaged represent just 0.4 percent of the market’s housing stock, yet the estimated 24,000 families displaced by the fires have to live somewhere.

READ ALSO: 5 Overlooked Insurance Gaps That Could Hit Your Bottom Line

And JLL reminds us that Southern California was already a long-term supply-constrained market. As higher-income families relocate to single-family rentals, others will spill over into the multifamily sector. “Already the exacerbation of Los Angeles’ multi-housing supply shortage will result in elevated rent growth in the medium term,” according to the report.

Impact to retail, office, industrial

Though less publicized, the region’s retail, office and industrial commercial real estate sectors were also hit. About 200 commercial buildings, predominantly retail properties and food-and-beverage establishments, were destroyed. They represent, JLL stated, nearly half of the retail establishments and about one-third of the total retail space in the fire zones.

In the near term, home centers and hardware retailers could benefit. “Longer term,” JLL added, “mixed-use developments may be a way to address both the housing shortage exacerbated by the fire as well as replace the lost retail space, which has not been growing for a long time.”

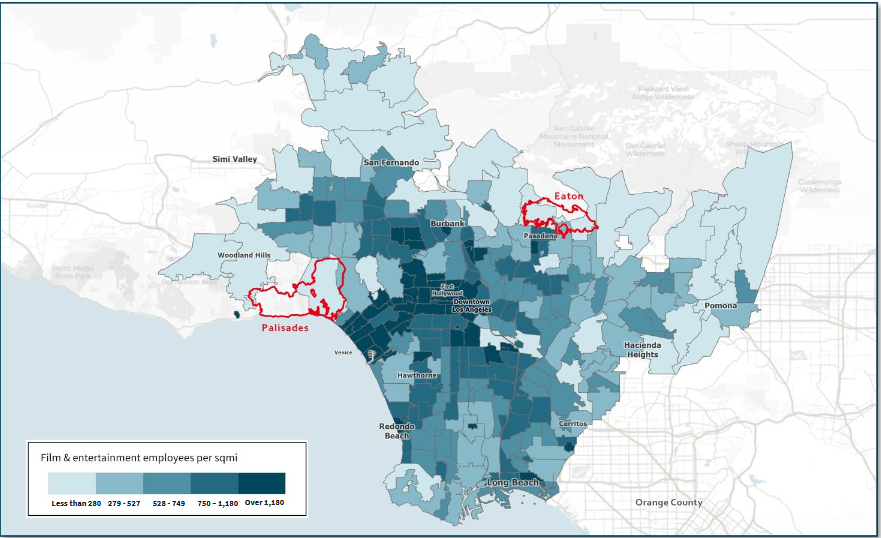

The fires’ effects on office space are expected to be indirect, potentially by displacing office workers, especially in the professional and technology services sector and the media and entertainment sector.

The impacts on industrial real estate could be more direct, with rebuilding efforts boosting the demand for warehouse space and IOS properties.

Additionally, JLL reported, home appliances, furnishing and day-to-day necessities must be replaced, further bolstering the need for warehousing. “This will help lower industrial vacancies in and around the affected areas, particularly in the San Fernando Valley and San Gabriel Valley markets where total vacancy currently stands at 4.2 percent and 5.8 percent, respectively.”

Given the efforts by the state government to streamline rebuilding, JLL noted, the real challenges lie in physical construction. “Due to significant demand, labor and materials will be expensive, further complicating rebuilding efforts.”

Finally, those generally higher replacement costs for commercial real estate have the potential to make existing buildings more attractive for investors.

You must be logged in to post a comment.