This Market Tops the Nation for Data Center Absorption

It’s the first time any region surpasses Northern Virginia, according to CBRE’s research.

For the first time, Northern Virginia is not the preeminent location for data center absorption, according to a new report from CBRE.

Atlanta is the new leader in the amount of space leased compared to the amount vacated, achieving 705.8 megawatts of positive net absorption in 2024, according to the firm’s North American data center trends report.

Last year, Atlanta absorbed nearly 39 times more space than at year-end 2023 (18 MW). The market recorded the highest volume of colocation leasing activity ever, spurred by GPU-as-a-Service tenants.

GPUaaS is a cloud-based service that allows on-demand access to high-performance graphics processing units, or GPUs.

A colocation data center facility allows businesses to rent space to house their servers, networking equipment and storage devices. It will enable them to place their hardware in a third-party data center while maintaining ownership and control over their equipment, unlike a cloud service where the provider owns the infrastructure.

Astounding numbers

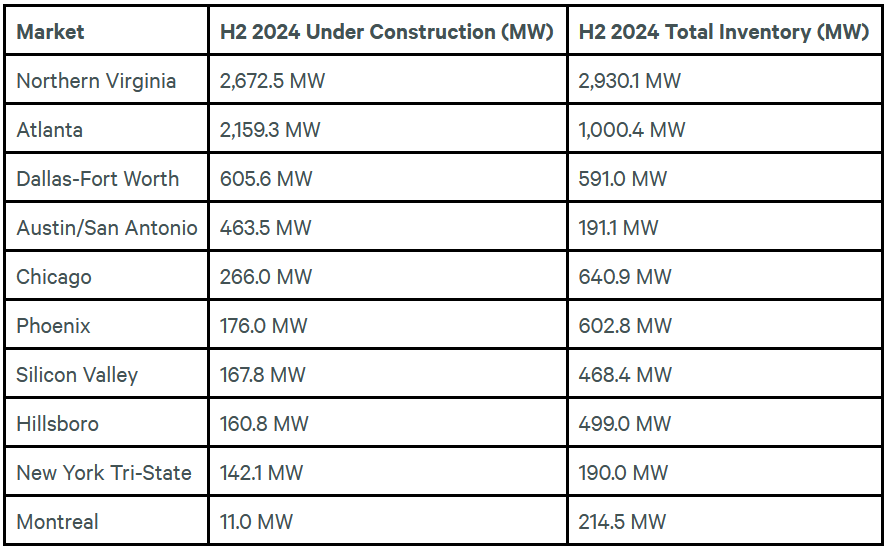

The data center inventory numbers in the Atlanta market are astounding. Last year, it increased by 222 percent to 1,000.4 MW as the market accommodated demand by ramping up data center space under construction.

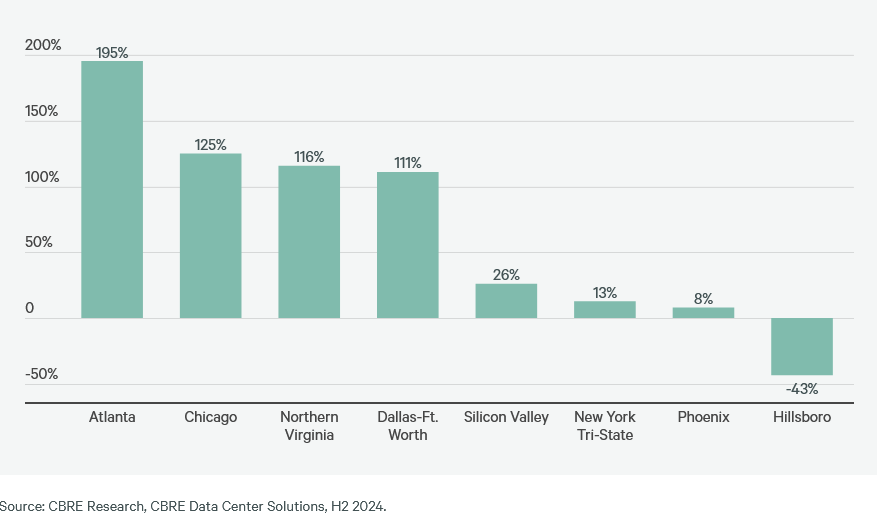

In the year’s second half, the market saw 2,159.3 MW under construction, representing a 195 percent annual increase in under-construction totals. That tops the eight primary North American data center markets in CBRE’s report.

As for new developments in the market, AWS plans to invest $11 billion in new data center development. Meanwhile, Lincoln Property Co.’s acquisition of a DXC data center shows it plans to redevelop it into a 30 MW colocation facility.

Ryan Mallory, Flexential’s COO, told Commercial Property Executive that Atlanta is emerging as the new “data center alley.”

GA Power/Southern Co. recently brought the Vogtle reactors online, delivering approximately 4GW of power capacity and unlocking significant development potential, Mallory said.

READ ALSO: Data Center Demand Keeps Surging Despite Challenges

“Additionally, Georgia has implemented robust sales tax incentives to attract high-paying jobs to communities hosting data centers,” he added. “This powerful combination of abundant power, available land and supportive communities has firmly placed Georgia on the technology map.”

However, Georgia is not the only market experiencing this surge.

In Texas, markets such as Dallas-Fort Worth, Austin and San Antonio have grown remarkably in the past 24 months, according to Mallory.

“These cities benefit from reliable power, a favorable tax environment, a high-quality workforce and communities that welcome the data center industry—a sector known for its high-paying, low-impact nature,” he said.

Overall, the exceptional quality of the product and the availability of land and power differentiate the U.S. market, Mallory added. “With historically high-growth regions slowing or pausing data center development, there has never been a better time to be in the data center business in North America.”

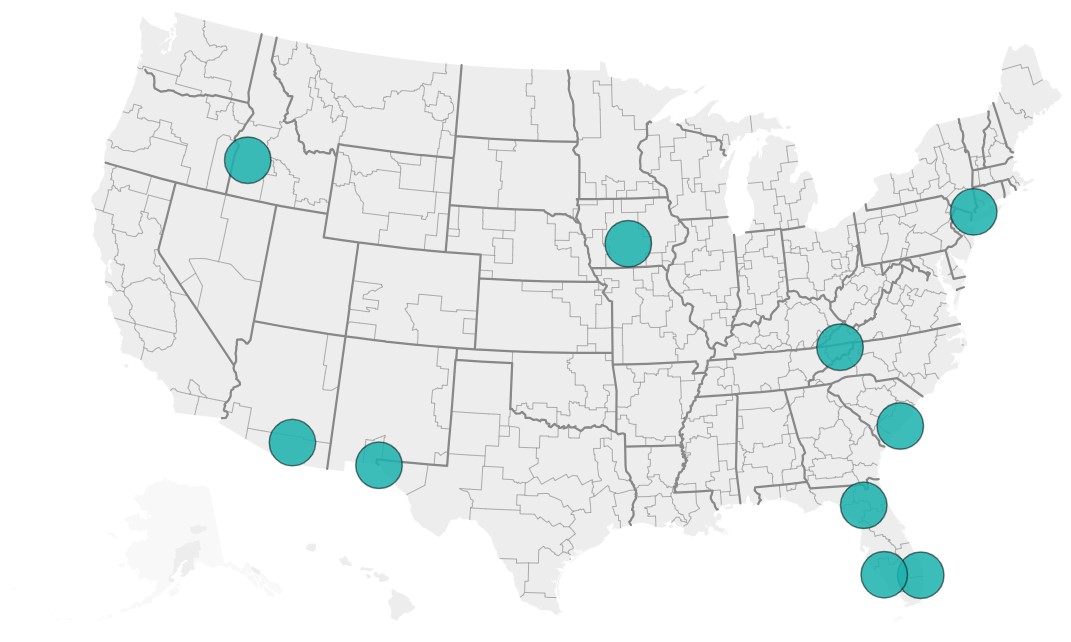

CBRE said tax incentives, available land and greater power accessibility make markets such as Charlotte, Northern Louisiana and Indiana potential growth areas for hyperscale and colocation providers.

This, despite some saying that Deep Seek might curb data center demand.

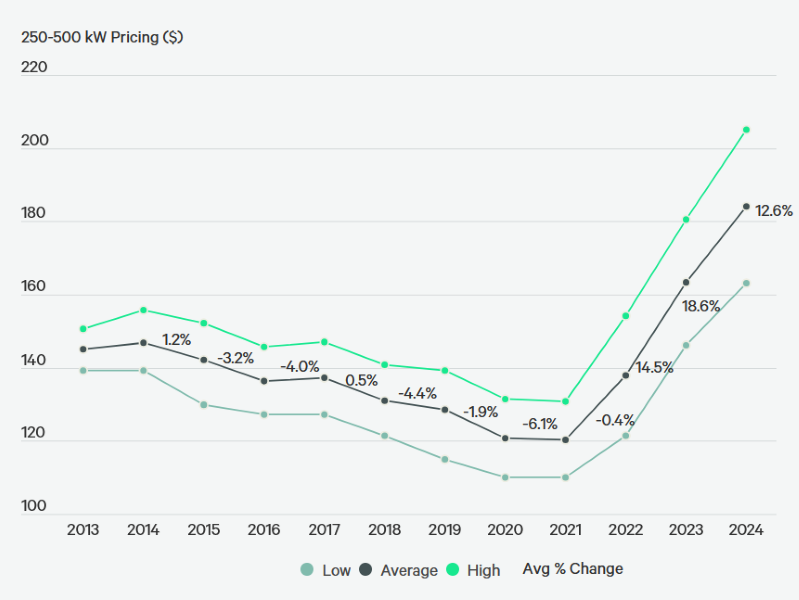

As for investment, CBRE reported that the average sale price increased year-over-year. Eleven asset sale transactions exceeded $90 million, while five surpassed $400 million.

AI impacts data center project locations

“As the demand for data centers has increased significantly, we have seen a shift in where these projects are being developed,” Todd Johnson, director of real estate development at Ryan Cos., told CPE.

“Traditionally, data centers were situated near metropolitan areas to minimize latency, but newer AI models have reduced the need for this proximity. Now, data centers are being developed in more remote locations where there is ample power supply.”

Seeking more energy

Avison Young’s data center market report for the fourth quarter of 2024 indicates that data center inventory continues to hit record highs in the U.S., with commissioned colocation power expanding nearly 50 percent over the previous 12 months. Yet, vacancy rates remain at historic lows, at just 1.6 percent.

In 2024, CBRE stated that North America doubled the data center supply under construction compared to the previous year to a record 6,350.1 megawatts. This is a 12-fold increase from the 456.8 MW under construction in 2020.

Given this growth, the energy needed to power these assets has become a focus.

As power generation and transmission timelines continue to stretch with rising demand, more data center developers are considering self-generation as a temporary supplement or a long-term solution, according to Howard Huang, a market intelligence analyst with Avison Young.

“Natural gas is gaining traction due to its abundance, affordability and faster deployment compared to waiting on grid transmission while sidestepping many of the limitations of solar and wind.”

Andrew Batson, head of U.S. Data Center Research for JLL, told CPE that the North American data center market reached unprecedented demand levels in 2024, with vacancy rates plummeting to record lows amid insatiable tenant demand and limited supply.

JLL’s research found that most markets have doubled or tripled since 2020.

“Power availability remains the primary challenge, with average wait times for grid connections extending to four years in most markets,” Batson said.

“As a result, data center development is expanding into new territories in search of power, with emerging markets seeing increased activity. In 2024, AI represented about 15 percent of data center workloads; by 2030, it could grow to 40 percent. AI will be a key source of growth for the sector.”

You must be logged in to post a comment.