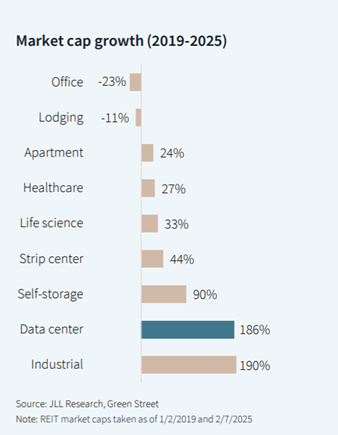

Data Centers Boom for Debt and Equity Investors

JLL's Carl Beardsley on what is shaping up to be another year of exuberance.

The North American data center market is experiencing a period of extraordinary growth and tightening supply, creating both challenges and opportunities for investors. According to JLL’s Year-End 2024 North America Data Center Report, vacancy rates have plummeted to a record low of 2.6 percent, with robust data center demand across markets keeping the sector among the most favored real estate asset classes.

The scarcity of supply is becoming a critical issue, with very few blocks larger than 5 megawatts available across North America. Northern Virginia, the largest global data center market, has a mere 0.6 percent vacancy rate. This shortage is constraining sector growth and pushing tenants to secure space up to 24 months in advance.

READ ALSO: Purpose-Built Life Science Space Finds Healthy Demand

Despite supply-chain challenges, construction levels continue to climb. A record-setting 6.6 gigawatts of colocation capacity was under construction at the end of 2024, with 72 precent preleased. The pipeline of planned projects increased to an impressive 22.9 GW, indicating strong future growth potential.

Absorption rates have surged, with colocation absorption in North America totaling 4.4 GW in 2024, doubling over the last two years. Data center occupancy has increased at an astounding 28 percent CAGR since 2020, driven by insatiable demand from cloud providers, technology companies and the financial sector.

The tight market conditions have led to significant rent growth. Since 2020, rents have increased at an 11 percent CAGR. Landlords firmly hold negotiating leverage, and market conditions are unlikely to change meaningfully in the next few years.

Artificial intelligence is emerging as a key driver of growth for the sector. In 2024, AI represented about 15 percent of data center workloads and is projected to grow to 40 percent by 2030, becoming a significant source of demand for data center capacity.

Capital markets response

For investors, the data center sector remains highly attractive due to the strong fundamentals of insatiable tenant demand, limited supply and rising rents. The investment landscape saw strong appetite throughout 2024 across various deal profiles, from cash flow buyers looking to add more data centers to their portfolios to operators seeking value-add opportunities.

Core cap rates have generally been in the 6.0 percent to 6.5 percent range, reflecting volatile Treasury markets. Value-add opportunities have seen tighter cap rates, especially if buyers can access expansion capacity sooner. The hyperscale segment is expected to see increased transaction activity in 2025, as development projects near completion.

The debt market for data centers is benefiting from increased diversity in lender engagement, with balance sheet banks and private credit debt funds as primary players. Leverage can be achieved up to 70 percent to 75 percent of cost for long-term credit tenant transactions (with mezz and preferred equity available to stretch to roughly 85 percent), and the SASB and ABS markets continue to provide liquidity for large-scale investments.

As the data center market continues its explosive growth, investors who can navigate the challenges of power constraints and supply-chain issues while capitalizing on the sector’s strong fundamentals stand to reap significant rewards in this dynamic and essential real estate segment.

Carl Beardsley is a senior managing director and head of JLL’s Data Center Capital Markets team.

You must be logged in to post a comment.