Lincoln Property, Goldman Sachs Land $133M for Phoenix Campus

Affinius Capital issued the refinancing loan.

The joint venture between Lincoln Property Co. and Goldman Sachs Alternatives have secured a refinancing loan for the second phase of Park303, a 2.4 million-square-foot industrial park in Glendale, Ariz. Affinius Capital provided the note that amounts to $133 million, according to Maricopa County public records.

Previous debt included a $164 million construction loan originated by Allianz in 2022, CommercialEdge information reveals. The note was due to mature last month.

Located at 16400-16500 W. Glendale Ave. and 7200 N. Sarival Ave., the property is in a Foreign Trade Zone, about 27 miles northwest of downtown Phoenix. Northern Parkway, connecting to Loop 303 and U.S. Route 60, is less than a mile away, while Luke Air Force Base operates within 5 miles.

READ ALSO: Phoenix Maintained Industrial Strength in 2024

Completed in phases between 2021 and 2023, Park303 encompasses 3.7 million square feet of industrial space across 210 acres. Its first facility—also marking Phase One—is a 1.3 million-square-foot building that was sold to BentallGreenOak for $186 million in a record-breaking deal.

Phase Two comprises three facilities of 1.3 million square feet, 629,835 square feet and 483,300 square feet, with 40-foot clear heights. The industrial park features a total of 430 dock doors, together with 778 trailer and 1,556 parking stalls. Amenities include speculative office suites and an outdoor area with pickleball and basketball courts, as well as an entertainment area and barbecues.

A few months ago, Park303 landed its first tenant as Logisticus Group leased the entire 483,300-square-foot facility. The 3PL company plans to use the space to provide services to an alternative energy firm.

The Lincoln-Goldman Sachs partnership

To date, Lincoln has developed or redeveloped more than 72 million square feet of industrial space throughout the world, according to its website. The company teamed up with Goldman Sachs for some of its projects.

Last December, the duo purchased a 45.6-acre site to build a 497,160-square-foot industrial project in Hendersonville, Tenn., close to Nashville, Tenn. Upon completion in 2026, the park will comprise five facilities.

Two months before that, Lincoln and Goldman Sachs secured a financing package for Waterstone, an 894,000-square-foot industrial project in metro Austin, Texas. Affinius Capital, together with Bank OZK, provided the funds.

2024’s lending momentum carries on

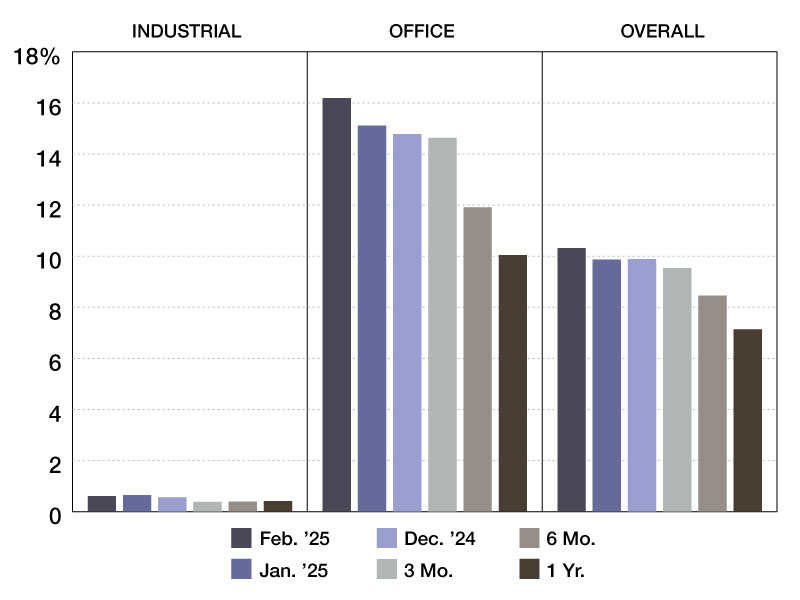

Despite the current economic uncertainty, CRE lending continues its upward trajectory based on 2024’s momentum. CBRE’s index that measures lending activity and sentiment spiked 21 percent quarter-over-quarter, landing at 259 in December. The figure was also up 37 percent year-over-year.

In Greater Phoenix, industrial debt continued to flow from some of the largest commercial lenders. Earlier this year, institutional investors advised by J.P. Morgan Asset Management issued a $93.8 million acquisition loan for CIP Real Estate’s record purchase of Broadway 101 Commerce Park. Canyon Partners sold the 809,230-square-foot campus.

You must be logged in to post a comment.