A Closer Look at Tech Layoffs’ Impact on Office Leasing

How economics and hybrid work are pushing technology companies to rethink their space needs.

Spurred by layoffs, post-pandemic impacts on space requirements needed for a changing workplace and economic headwinds, technology companies, once the leading office occupier in the U.S., are leasing less space leading to significant drops in tech leasing.

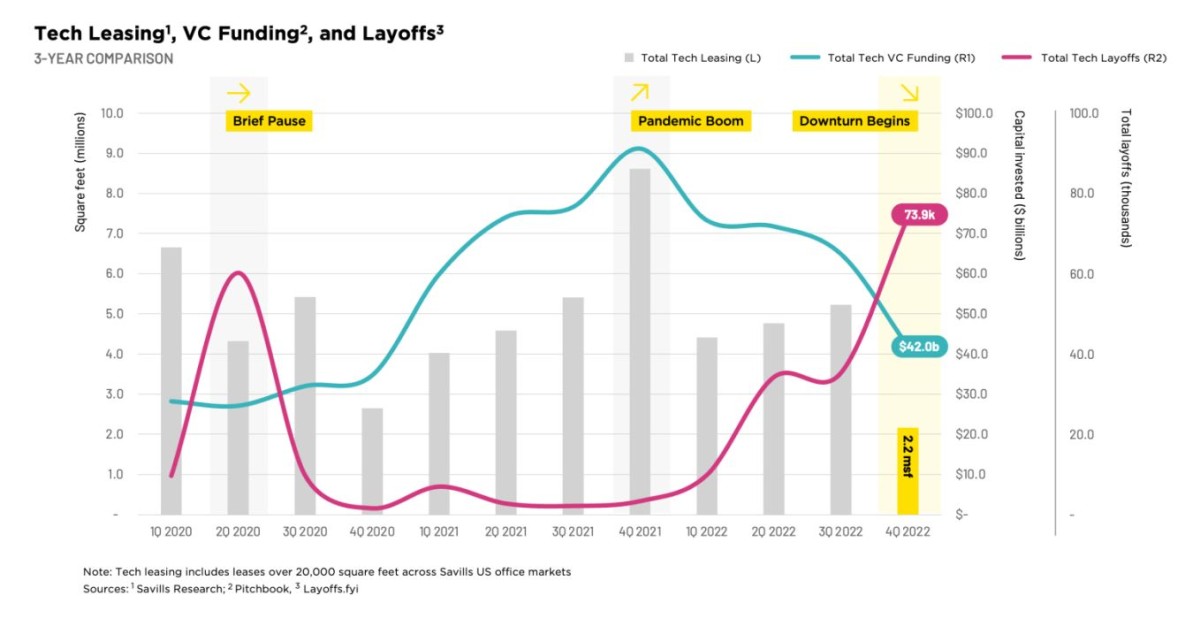

According to the latest Savills The Tech Tenant report, the technology industry leased 2.2 million square feet of office space in the fourth quarter of 2022, the lowest quarterly volume leased in the last five years. The space, which includes leases over 20,000 square feet across U.S. markets tracked by Savills, was down 57 percent from the average quarterly total of 5.1 million square feet leased through the pandemic before the fourth quarter of 2022. It was down 74 percent from the quarterly average of 8.6 million square feet two years prior to the pandemic.

Office leasing within the tech sector dwindled at the close of 2022, as venture capital funding stalled, industry layoffs surged and companies continued contemplating how to use office space going forward. Chart courtesy of Savills

A recent CBRE report found finance and insurance firms replaced technology companies for the highest share of the top 100 U.S office leases last year, accounting for 25—or more than double their share in 2021 and nearly one-quarter of the top 100’s total square footage of 30.3 million square feet leased in 2022. Citing the impact of hybrid work on the sector, CBRE said tech firms accounted for 17 of the top 100 leases last year, down from 36 in 2021. CBRE noted overall leasing was down versus 2021 when the top 100 U.S. office leases totaled 30.7 million, stating rising interest rates and higher construction costs likely influenced larger occupiers to stay in current space and renew rather than incur build-out costs with a new lease.

Colin Yasukochi, executive director, CBRE Tech Insights Center, said tech companies had strong growth in recent years as they responded to e-commerce and other pandemic-related trends that boosted revenues and led to increased hiring and office leasing. But now, faced with a combination of macroeconomic issues, including reduced revenues as the post-pandemic economy started to normalize, and a move toward more hybrid work, tech companies are looking harder at excess office space and shrinking their real estate portfolios.

“The growth built into their previous office space commitments is unlikely to materialize in the next five years. They don’t need to hold onto all that space,” Yasukochi said. “We’re seeing a lot of space come back to the market.”

READ ALSO: US Cities Lead the World in Tech

Brad Tisdahl, CEO of Tenant Risk Assessment, said the tech industry is right-sizing businesses to the new landscape.

“Tech got very big and there was more capital moving around and more opportunity for them to move around and take on new bets,” he said. “Tech has been shedding workers and as a result making headlines to reduce space in a lot of markets.”

In October, for example, Meta, the parent of Facebook and Instagram, announced it was exercising an early termination clause and giving up 200,000 square feet of space at 225 Park Ave. South in Manhattan. Meta had previously halted plans to expand space at 770 Broadway and in the Hudson Yards development on Manhattan’s Far West Side. Meta cut back on space in other tech hubs around the U.S. in recent months, including deciding to sublease nearly 600,000 square feet at 400 W. Sixth St. in Austin, Texas. In January, Meta said it was giving up 435,000 square feet at 181 Fremont St. in San Francisco that housed Instagram employees. Meta also terminated a 457,000-square-foot-lease in a two-building Silicon Valley office campus. In the Seattle market, Meta said it would sublease a six-story building near downtown Seattle and a 325,000-square-foot space in Bellevue, Wash.

READ ALSO: Top 10 Markets for Office Deliveries in 2022

David Nelson, Regional President, Brokerage, Northern California/Nevada, Kidder Mathews. Image courtesy of Kidder Mathews

Meta is not the only major tech player to backtrack on office plans in the Seattle area in recent months. Google notified the City of Kirkland, Wash., that it was not going to buy a 10-acre car dealership property, where it was planning a major redevelopment and space for as many as 6,000 employees. Microsoft said it would not be renewing a 561,494-square-foot lease in downtown Bellevue.

David Nelson, regional president, brokerage, Northern California/Nevada for Kidder Mathews, noted office vacancies are high in San Francisco, hitting about 25 percent, and subleasing activity is also significant, with about 8.9 million square feet available in subleases so far in the first quarter. He said 2022 ended with about 9.5 million sublease space available.

Shadow space

Nelson raised another issue, a trend he calls shadow space—offices that are still being leased but not currently occupied or subleased. Nelson said that’s harder to track.

“The overall slowdown in San Francisco was really underway prior to the layoffs as the pandemic has really taken a toll on the office market there,” Nelson said, adding “It’s been hard getting people back to the office.”

READ ALSO: Designing the Suburbs of the Future

Nelson said it’s unclear whether companies will renew the same amount of square footage when some of that shadow space currently under lease comes up for renewal because of the impact of remote and hybrid work. He expects that most companies that haven’t abandoned the market will renew, though possibly for less space.

Max Saia, director of investor research at VTS, a New York-based technology platform that provides data insights and solutions to the commercial real estate industry, said leasing difficulties in the Bay Area are expected to continue throughout the year. He doesn’t expect to see signs of meaningful office demand recovery in San Francisco until 18 to 24 months from now.

The latest VTS Office Demand Index reported the largest decline in demand for office space in January was in San Francisco, with a 37.8 percent year-over-year drop, followed by Seattle and Chicago, whose VODIs fell 30.3 and 29.9 percent year-over-year, respectively. The smallest decline was in Boston, whose VODI fell 10.5 percent from a year ago, followed by New York City and Washington, D.C., both of which declined 11.9 percent year-over-year. The VODI currently only tracks U.S. gateway markets, so no Sun Belt markets are included in its analysis.

“Although [tech] layoffs aren’t as big of a shock as the pandemic and WFH [work from home] policies, it’s something that will be a net-negative through the rest of the year,” Saia said. “Clearly the tech sector is being impacted the most in this economic downturn, and we’re seeing that reflected through rounds of layoffs. These economic headwinds will have adverse impacts for office demand—particularly with these companies having reduced headcount.”

With a strong jobs market and a record low unemployment rate nationally at 3.4 percent, laid-off technology workers may be finding related work in other industries. Though Tisdahl noted that “doesn’t provide much solace to the landlords that have a lot of tech tenants. The last six to eight months have been a real painful period of time for people in tech and for landlords that lease to tech tenants.”

Flight to quality

VTS found New York City and Los Angeles’ demand for new office space are recovering more quickly than a market like San Francisco. New York City has regained almost 50 percent of its initial pandemic decline in overall new office leasing and Los Angeles 40 percent of its overall decline, according to the VODI. By comparison, VTS notes San Francisco has only recovered 25 percent of its demand for new office leasing, likely due to the tech-dominated economy that has historically been more remote-friendly, even prior to the pandemic.

Saia said every tenant’s situation is different but “the net-trend is definitely toward reducing their overall footprint and some sort of reduction in space needs is almost a default assumption being made by our customers today.”

One trend that does seem to be continuing is the flight to quality. Yasukochi said it is more prevalent in downtown markets.

“When that does occur, typically we see companies taking less space but willing to pay more,” he said.

Steven Rotter, JLL, vice chairman, brokerage, and co-leader of the technology and media team in New York, said the flight to quality trend seems to be pairing lately with another growing trend—the push to get workers back to the office.

“All the new developments in New York, San Francisco, Austin, Miami and Chicago are the most active right now,” Rotter said.

He said employers are saying ‘We want you back in the office and the good news is we have a brand-new office, nicer, newer office space,’ as they encourage current employees to return to the office and compete with other companies to land the best talent by leasing in recently built Class A buildings with more amenities including gyms, outside spaces and full-service cafes.

Rotter said landlords of Class B buildings are also increasingly making investments in their properties to be competitive and attract tenants who want lots of amenities but don’t want to pay Class A rents.

Rotter said despite the negative headlines about the leasing market there has been improvement in recent months.

“I’m seeing major activity in the big cities and seeing hub and spoke offices in some of the secondary and tertiary markets,” Rotter said.

He pointed to markets like Los Angeles, where the studio production industry is booming and spurring office leasing and Denver, where many people moved to during the COVID-19 pandemic for a better quality of life. Other active markets he cited include Chicago and Dallas.

READ ALSO: Behind the Rise of Mass Timber Towers

In New York City, Rotter and Vice Chairman Joe Messina represented private equity firm KKR when it closed on a deal in January to lease the 220,000-square-foot space at 30 Hudson Yards that Meta declined to renew. KKR already occupied more than 300,000 square feet of space at 30 Hudson Yards.

Rotter said a big trend in New York City is large venture capital companies that have historically been located on the West Coast leasing space on the East Coast to oversee portfolio investments in New York, Boston or other East Coast markets. Rotter said his team has handled three in the last year.

As for the tech companies, Tisdahl notes there will always be some churn in the industry impacting office leasing. A tech company might be shedding workers in some capacity now but that doesn’t mean they won’t be adding, rehiring or requiring new space in the future. He pointed to Elon Musk, who made headlines in late 2021 when he moved Tesla’s headquarters out of California to Texas. In late February, Musk announced the electric vehicle company would be opening a global engineering headquarters in Palo Alto, Calif.

You must be logged in to post a comment.