A Look at Phoenix’s Large-Scale Industrial Projects

Arizona's largest city is overflowing with massive developments. Here’s what that means for the market.

As the race for space endures, Greater Phoenix continues to establish itself as a critical industrial market. Supported by rapid population growth, optimal geographic position, a business-friendly environment, strong infrastructure and available developable land, the city is on track to becoming a crucial location for logistics and manufacturing businesses alike.

“Greater Phoenix has become one of the top markets in the Western U.S. for e-commerce, and a national leader in manufacturing—especially in the semiconductor industry,” Greater Phoenix Economic Council’s Senior Vice President of Business Development Thomas Maynard told Commercial Property Executive.

Leasing activity reached a historical high in Phoenix over the last year, with nearly 26 million net square feet of industrial space leased across the metro, according to a JLL report. Activity was highest in the Southeast Valley, with 47.8 percent of the deals signed in the region, while the West Valley saw 42.9 percent of closed deals in 2021, the same report highlighted.

Development is at full steam

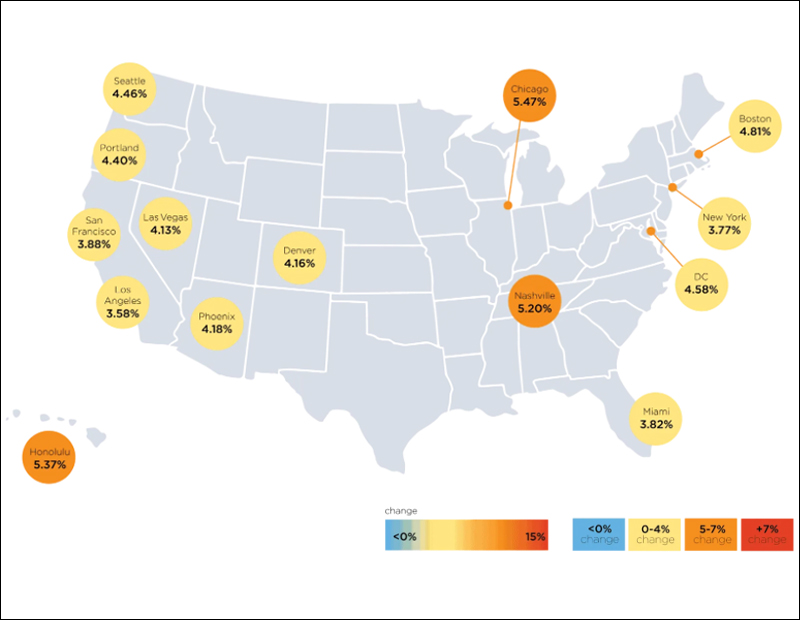

The demand for industrial space is unlikely to stop anytime soon and developers are taking note. Phoenix has led the nation in construction activity over the past couple of months. As of January, the metro had roughly 35 million square feet of industrial space underway, accounting for 12.5 percent of its existing stock, CommercialEdge data shows.

Most submarkets across the metro have at least one major development in the pipeline. “Phoenix industrial is really firing on all cylinders, and it makes every submarket be in demand,” David Krumwiede, senior executive vice president at Lincoln Property Co., told CPE.

Deer Valley has Taiwan Semiconductor Manufacturing Co.’s $12 billion project, the Loop 303 is active with several global e-commerce and logistics users, and home improvement giant Lowe’s recently announced plans to occupy more than 1 million square feet at CRG’s 4 million-square-foot industrial space in Mesa, just south of the Phoenix-Mesa Gateway airport.

“This is a massive game changer for the East Valley. Even Tucson is feeling the demand pull with its attractive cost and labor base,” Krumwiede said.

Additionally, GPEC’s Maynard noted that large-scale manufacturing developments, such as TSMC’s chip plant, have a huge impact on Phoenix’s economy. “Depending on the sub-industry, for every single manufacturing job added in the Greater Phoenix area, 2.5 to 3.5 additional jobs are introduced to the economy,” Maynard said.

READ ALSO: Can Phoenix Become America’s Semiconductor Capital?

At the same time, CapRock is transforming one of the largest remaining infill sites in Central Phoenix with its development of West 202 Logistics, a 3.4 million-square-foot spec industrial building just off the new South Mountain Freeway or Loop 202.

“Adjacent to two major transportation routes, Interstate 10 and Loop 202, the development will provide a new level of access and efficiency for businesses with a last-mile strategy,” Nicholas Ilagan, senior vice president of asset management at CapRock, told CPE.

CapRock broke ground on West 202 Logistics in February, with development slated for completion by the first quarter of 2023. The facility will include eight buildings ranging from 228,000 to more than 1 million square feet, with clear heights between 32 and 40 feet. Each building is designed with varying depths and is divisible to accommodate multiple tenants, Ilagan detailed.

Large-scale developments versus small users

While some of the large-scale developments are built to accommodate smaller tenants, Krumwiede argued that there aren’t a lot of developers building smaller boxes for smaller tenants. Yet, demand is high for projects in the 300,000-square-foot and smaller range as well.

What’s more, according to a NAIOP Industrial Space Demand Forecast, concerns over access to space has led to large firms occupying extra buildings to avoid future problems. Many of these larger companies sign leases long before the space is built. However, smaller firms don’t have the ability to pile up space, making it harder for them to expand in the future.

Across the Phoenix metro, most of the industrial land already belongs to developers planning large-scale projects, and it’s becoming increasingly harder for small users to own land if they want to build and own their own facility. However, for a healthy market, it is important to ensure that there is space for a variety of tenants.

“Large-scale projects and smaller projects are somewhat complementary to each other because they help provide diversity for a wide range of tenants within the market. A healthy market has options, so we do need to be mindful to develop product of varying types and sizes that is useful for different users,” Daniel Zawisha, research analyst at JLL, told CPE.

READ ALSO: Phoenix Is Thriving. Here’s Why.

Bidding on future growth

Although Phoenix has a large amount of land available for development, as construction activity continues to grow—from the West to the Southeast Valley—development will slowly stretch further out to Buckeye or down to Casa Grande, Zawisha noted.

According to 2020 Census data, Buckeye was among the nation’s 10 fastest-growing cities over the past decade. The city registered an 80 percent growth with its population reaching more than 91,000 residents. Positive demographic trends also fuel the growth of a talented labor pool, which ultimately drives investment.

“When a large industrial user considers a site, they look at the labor base. If the right mix of age, education and earning expectations are there, they’ll pick the site. If not, they won’t locate there no matter how good the logistics are,” Krumwiede said.

One of the major gains Buckeye has seen over the past year is KORE Power Inc.’s 1 million-square-foot lithium-ion battery cell manufacturing facility, dubbed KOREPlex, the first lithium-ion factory wholly owned by a U.S. company. The factory, slated for completion by the second quarter of 2023, will bring around 3,000 jobs to Arizona.

The city of Buckeye also has plans to designate roughly 2,650 acres for employment uses along State Route 85, the Phoenix Business Journal reported. The area would largely include warehouses, manufacturing and business park facilities. If rezoning plans are approved, the 2,650 acres will complement an existing employment corridor, which also includes KORE Power’s project, according to the same publication.

Finally, what could really elevate Phoenix as an industrial market is BNSF Railway Co.’s proposal for a 3,500-acre intermodal complex in the West Valley, Krumwiede said. The facility would include a logistics center and an intermodal facility near State Route 60 and the existing BNSF rail line, a Phoenix Business Journal article reported. According to the Arizona State Land Department in Phoenix, the auction will take place on March 30 and the minimum bid price is roughly $49 million.

“BNSF would catapult this market even further. It would crystalize what we’ve been hearing about Phoenix as a prime inland port—like the Inland Empire—but with much better fundamentals,” Krumwiede said.

You must be logged in to post a comment.