A New Dawn for CRE Investing?

Amid encouraging signs, some uncertainty lingers, according to panelists at a LaSalle Investment Management event.

This year is a new dawn for commercial real estate investment, with a morning sky that includes both bright spots and dark clouds. This was a metaphor used by panelists from LaSalle Investment Management speaking at a Jan. 15 press conference to describe the firm’s views on the economy, capital markets and investment priorities as they are presented in its 2025 Global Outlook report.

Bright spots include increasingly positive investor sentiments, prices more closely matching bond yields, more readily available debt and large decreases in short-term interest rates. The dark clouds include geopolitical uncertainty, slumped transaction volumes and persistently high long-term interest rates.

A gray morning sky

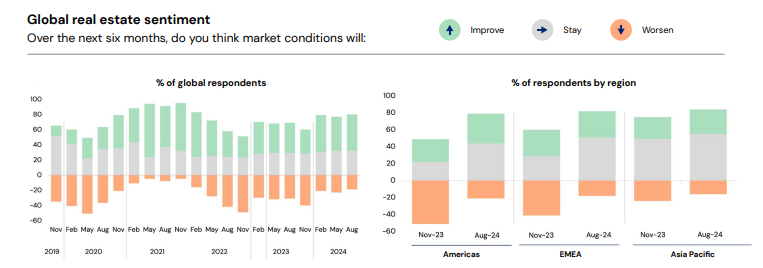

According to Brian Klinksiek, the firm’s global head of research and strategy, the positive sentiments are a good sign for the year to come, but “the sky is looking a little gray.” The views, held by participants from a November 2024 JLL Research survey, can be attributed to a perceived soft landing for the U.S. economy and easier-to-attain capital despite long-term bonds remaining unappealingly high.

“Transaction activity is still subdued, but prices and rates are much more aligned with bond market realities,” Klinksiek said. The value signal is not as strong as it was; at its core, this is about markets pricing in a reduced risk of recession, Klinksiek noted.

READ ALSO: How Geopolitics Will Shape CRE Investment in 2025

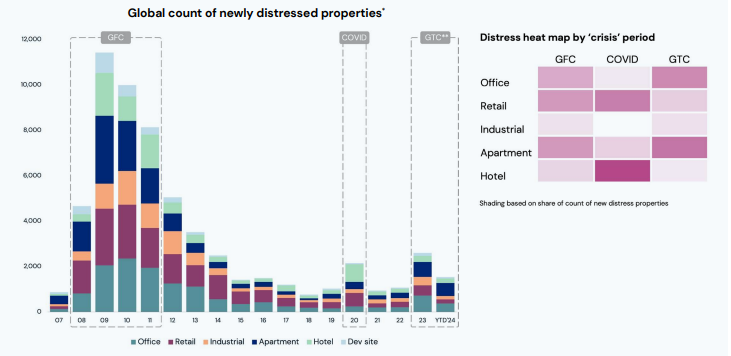

In a similar vein, the panelists stressed that despite being on the upper end of a trough for commercial real estate investment, negative markers such as distressed property volumes and capital costs are nowhere near those of the Global Financial Crisis, which saw a peak of nearly 12,000 distressed commercial and multifamily properties worldwide. By contrast, the current Great Tightening Cycle of 2023 and 2024 saw approximately 3,000, nearly half of which are office buildings and multifamily communities. Looking at this data in context, many European institutional investors are “more optimistic about the U.S. than some U.S. investors are right now,” said Tara McCann, Americas head of investor & consultant relations.

Navigating investments in the new year

Here, the darkest cloud in the distressed bunch is the office sector, which is reeling from tumbling sales prices and further rising vacancy rates. Equally detrimental has been the capital stack and asset valuations, which have fallen by 9 percent year-over-year through December 2024, according to data from CommercialEdge.

But LaSalle has its raincoat on. “(Office) is continuing to go through pain, but some opportunities will continue to come out of that if you play the right markets,” advised Jeff Shuster, president of LaSalle Value Partners US.

Richard Kleinman, Americas Head of Research and Strategy, likened both investing in office and commercial real estate more broadly to getting breakfast at a diner in New York City, where some menu items far outshine others. These include medical buildings and industrial outdoor storage, alongside flex logistics spaces.

For their parts, industrial demand is both “oversubscribed and undersubscribed,” while investors need to be more selective about retail, a sector that’s seen a recent surge in construction starts.

Even elements of the office sector are promising prospects, provided that the asset is modern and conveniently located with a strong tenant roster. “We prefer amenities in and around the building, within a 24/7 lifestyle market,” Brad Gries, the firm’s head of Americas told Commercial Property Executive. Los Angeles’ Century City and Park Avenue in Manhattan have caught the firm’s eye, according to Kleinman. “It’s all about demand, and where we see tenants looking for space,” Kleinman said.

You must be logged in to post a comment.