Alternative Financing Is CRE’s New Lifeline

Preferred equity and private credit appear to be here to stay, and insurance companies are stepping up.

For at least the first half of 2024, commercial real estate will continue to depend on alternative sources of funding. Preferred equity investors and private direct lenders will attempt to fill the funding gaps left by wary banks and institutional investors. Meanwhile, life insurance companies, a stalwart yet conservative provider, will be as key to commercial financing as ever.

“There has been a significant secular shift in the sources of financing for commercial real estate borrowers over the past 18 months,” said Brian Good, CEO of private direct CRE lender iBorrow.

Regional banks and other institutions that have traditionally backed commercial assets have pulled back. Originations by small and local banks fell 53 percent year-over-year in the second quarter of 2023, according to MSCI Mortgage Debt Intelligence. That makes preferred equity investors and private lenders increasingly important for CRE borrowers.

“The mid-market has notoriously been much slower to adapt, but even that sector is beginning to come around to the new reality,” said Eric Brody, managing partner, ANAX Real Estate Partners, a real development and finance company. “While some players may be cautiously waiting for economic conditions to improve, many are actively navigating the challenges.”

In September, Morgan Stanley published an outlook piece that predicts the private credit market (for all assets) will grow to $2.3 trillion by 2027—up from $1.4 trillion at the start of 2023 and from $875 billion in 2020. That bodes well for CRE even after traditional lending sources return in full strength.

“This incredible growth is opening new pathways for borrowers and investors to fund their projects, and positioning private lenders to play a greater role in the CRE space than ever this year,” said Good.

Preferred equity and mezzanine debt are also playing a bigger role in CRE capital stacks.

“From an investor’s point of view, preferred equity returns today are perceived to be closer to standard equity joint venture returns without the risk. That said, the supply of quality opportunities where the desired preferred equity returns are available will likely fall short of demand,” said Daniel Levitt, executive vice president of capital markets, Ryan Cos., a national developer and operator.

Meanwhile, private capital, including family offices and high net worth individuals, have become a larger factor in equity investing.

“We’ve seen a marked increase in demand for bridge loans with shorter terms and more flexible structures that allow borrowers to tap into the private direct lending sector,” Good mentioned.

These investors can conduct due diligence on an expedited basis, said Good, allowing them to close on loans more quickly than traditional institutions.

“In terms of equity, we expect that most, if not all, equity placed in 2024 will be in the form of preferred equity,” Good remarked. “In most situations, borrowers need to recapitalize their existing deals due to delays or push from their existing lenders for a pay-down on their existing balances. New investors in deals are typically viewed as rescue capital, and they like the idea of having a preferred or prioritized position.”

While debt from both banks and insurance companies is still available, structuring and interest rates represent major challenges.

“Banks often need deposits or additional recourse, and insurance companies have tightened up on loan-to-value and debt service coverage ratios,” said Levitt. “My expectation is both traditional debt and equity will be more plentiful, and at rates and terms more acceptable to borrowers, by the second half of 2024.”

Life insurance

That said, life insurance lenders are perhaps poised to be the most competitive source for permanent commercial real estate debt in 2024.

“Life insurance companies are the backbone of the permanent lending market,” mentioned Levitt. “Unlike the Great Recession, there is still liquidity with life insurance companies, but at conservative terms. A key indicator for the rebound of the real estate investment market will be life insurance companies loosening up in the latter half of 2024.”

These lenders have long been attracted to the stability and long-term nature of commercial real estate markets, and they use their own balance sheets to offer attractive terms to borrowers. But they have worked hard to build high quality and diverse assets—of both debt and equity investments.

“Although their capital is typically cheaper for a borrower, they have the most rigorous underwriting and, as such, will generally invest on a more limited basis vs. private debt or private equity investors,” said Good.

So, while life insurance companies are replacing risk-averse banks and hesitant institutions in many transactions, they will be most competitive in lower leverage situations, noted John Harrington, principal and founding partner, HKS Real Estate Advisors, a full-service finance company. “On a deal-by-deal basis, we can see an influx of mortgage origination from life insurance companies,” Harrington said.

Subsectors matter

The office sector’s financing troubles seem unlikely to ease any time soon. “Office-backed loans have been making up a substantial portion of CRE delinquencies over the past few months as office owners nationwide continue facing several struggles, such as the demand for flexible office spaces and continued desire for a remote work environment,” Brody said.

The capital outlook for industrial investors, on the other hand, is more optimistic.

“The industrial segment has maintained the most consistent access to capital throughout the recent stretch of difficulty for the broader CRE market and has continued to see solid growth in rents,” said Good. “It is now the superior asset class, performing better than multifamily.”

However, even that bright spot has some dim areas. During the third quarter of 2023, vacancy rates increased in several key markets, including: Chicago, the Twin Cities, Cincinnati, Columbus and Kansas City, Kan., Good noted. “We’re advising our own borrowers to communicate with us early and often if they encounter challenges in the industrial sector so that we can help them continue to execute on their business plans,” he added.

Likewise, speculative developments or projects in regions with economic instability are more likely to face hurdles, said Brody. “The ability to secure funding often hinges on the perceived risk and potential returns associated with each specific subsector, and those facing greater uncertainties may experience more challenges in the current economic environment.”

A return to normal?

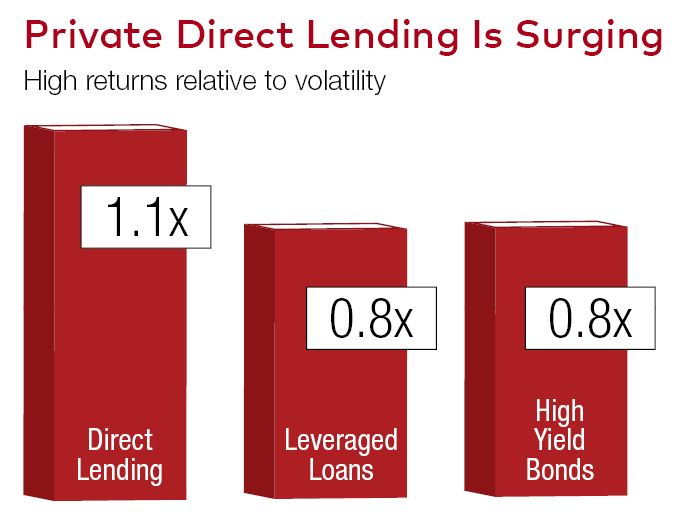

With the Fed signaling that it is easing its stance on interest rates, there is a sense that relief to the tight capital conditions and the sluggish pace of transactions is on the horizon. Traditional equity and debt sources should return joined by some new sources that like the returns that direct lending offers.

“We are optimistic for 2024 and expect opportunities to arise as borrowers, who have been holding on to properties for 12 to 18 months due to interest rate increases, begin to make decisions on their maturing loans,” Harrington said.

You must be logged in to post a comment.