Amazon’s Challenge to Institutional Real Estate

Amazon's top picks for its second headquarters are showing real estate investors how they can find value in select non-gateway markets, argue CenterSquare Invesment Management's Scott Crowe and Uma Pattarkine.

Scott Crowe, Chief Investment Strategist

Amazon’s search for a new headquarters (HQ2) has demonstrated the redefining of corporate America’s view of geographical location. This shift has transcended into other sectors, arousing a chorus of corporations relocating their headquarters. Wall Street-based money manager AllianceBernstein is moving its headquarters to Nashville, Greenwich-based Starwood Capital Group plans to move its headquarters to Miami and USAA, a financial services provider linked to the military, plans to staff close to 1,000 technology workers in Phoenix.

In CenterSquare’s 2016 research piece “Beyond the Gateway,” the firm defined the shifting opportunities in real estate that favored top-tier secondary markets (markets like Denver, Atlanta and Pittsburgh). In 2018, we were not surprised to find a significant overlap between these primary secondary markets and Amazon’s choices for HQ2. While investors this cycle have exhibited a strong preference for gateway markets such as New York, Washington and San Francisco, there is another subset of MSAs that offer many of the attractive attributes of gateway markets but without the inflated prices.

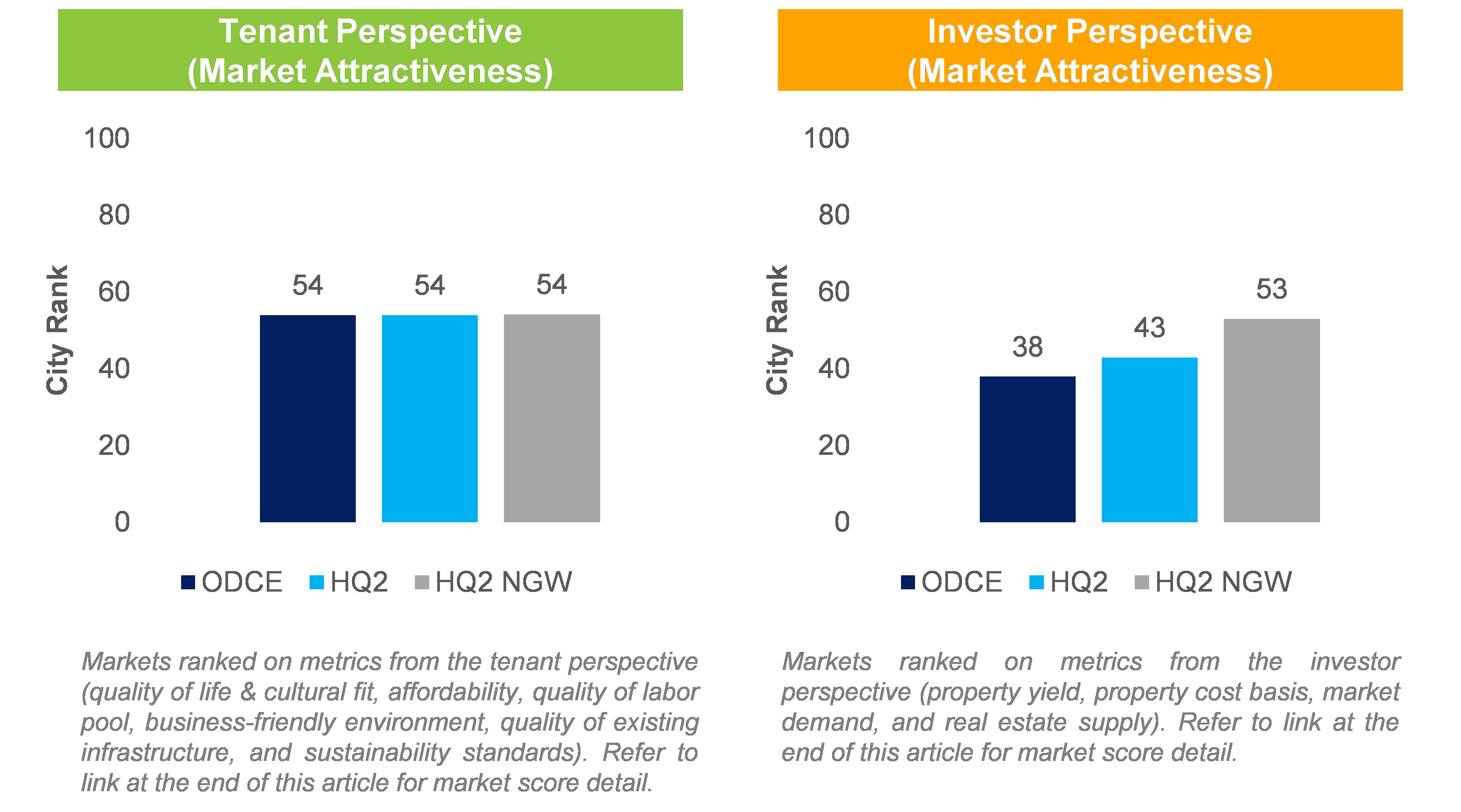

In the analysis below, CenterSquare shares a comparison of Amazon’s HQ2 cities with the more traditional real estate capital allocation reflected in the NCREIF Fund Index – Open End Diversified Core Equity (ODCE). The analysis indicates that institutional investors’ real estate allocations may be at risk of becoming outdated, while opportunities to allocate capital to emerging centers of growth can come at an attractive price.

Source: ODCE: Average rank of largest 20 US markets included in the ODCE Index; HQ2: Average rank of U.S. markets included in shortlist for the Amazon HQ2; HQ2 Non-GW: Average rank of U.S. non-gateway markets included in the shortlist for HQ2. All markets ranked among top 50 U.S. MSAs.

Geographical Comparison

The majority of capital this cycle has been deployed in gateway markets, which dominate the ODCE markets (47 percent gateway markets and 53 percent non-gateway markets). HQ2 markets, however, have a larger concentration of non-gateway markets (63 percent non-gateway markets and 37 percent gateway markets). As we outline below, our analysis suggests that this is due to the fact that select non-gateway cities are able to offer corporations and their employees many of the attractive attributes of gateway cities without the price tag.

Tenant Perspective

Uma Pattarkine, Investment Strategy Analyst

Companies are competing for top talent in today’s tight labor market, and Amazon is no exception. Today’s talent pipeline is attracted to cities that provide a thriving culture and, increasingly, a high quality of life—all factors represented favorably in HQ2 non-gateway markets. As talent increasingly moves to this new subset of preferred secondary markets, companies are following suit. In addition to benefiting from the workforce in these secondary markets, companies are also benefiting from lower prices. This is not only via lower rents driving lower occupancy costs, but also via the more business-friendly environments created by non-gateway local governments trying to attract companies.

CenterSquare looked at several factors to generate an overall “Market Attractiveness” score from a tenant perspective. The firm’s observation is that ODCE markets outperform HQ2 and HQ2 non-gateway markets in terms of quality of life and cultural fit, sustainability and infrastructure; whereas HQ2 and HQ2 non-gateway cities have a similar quality of labor pool to ODCE but significantly outperform in terms of affordability and business-friendly environments.

Investor Perspective

Amazon’s list of prospective HQ2 locations, given their bias toward non-gateway cities, offers investors a higher property yield and a lower dollar per square foot investment price than ODCE markets. From a supply and demand perspective, HQ2 and non-gateway cities also compare favorably to ODCE markets. One of the hesitations of institutional investors to look beyond gateway markets has traditionally been supply. However, a unique feature of this cycle is that low development yield hurdles and high asset values have resulted in many gateway cities experiencing increased supply, despite the conventional view of higher barriers to development.

CenterSquare looked at several factors to generate an overall “Market Attractiveness” score from an investor perspective, such as property yield, property cost basis, market demand and real estate supply. The results show that Amazon’s HQ2 and HQ2 non-gateway cities, in comparison to ODCE, offer investors similar market fundamentals at more attractive values.

With asset prices in gateway markets appearing full and investors seeking new opportunities, CenterSquare sees value in targeting select non-gateway markets. Many of these markets are expected to see strong growth because they combine a pro-business environment with a high quality of life at a lower price point, attracting top talent and employers. Not only do these markets satisfy tenant demands, they also provide investors with a lower basis and higher yield, without having to compromise on fundamentals. The shortlist of top 20 cities in Amazon’s competitive site selection has sent a strong signal of the shift in corporate America’s priorities regarding geographical location, and should encourage investors to continue to look “beyond the gateway” to identify opportunities within commercial real estate.

In the analysis above, CenterSquare scored each market on key characteristics using private real estate indices and census data to derive an overall score for each city. The full report and more information on the methodology is available here.

You must be logged in to post a comment.