An Ailing Retail Sector Gets Creative for the Holidays

Facing unprecedented challenges, retailers are embracing e-commerce and an extended shopping season.

Traffic in malls is running at 25 percent to 30 percent of what it used to be, according to retail analysts who don’t expect a significant increase during the holidays. The smart retailers are starting the season early. For some, that will mean rolling out the deals before Halloween and then continually unveiling new promotions throughout the season.

The retail sector has been severely impacted by COVID-19, with a number of stores and chains that were struggling before the pandemic closing their doors for good, said Chuck Breidenbach, managing director of MDC Retail Property Group at Mountain Development Corp.

Eastern Hills Mall in Buffalo was acquired and redeveloped in 2003 by Mountain Development Corp. The one-story, 1,000,000 square foot property features a combination of retailers, eateries and service providers and is currently being redeveloped in partnership with Uniland Development Company into a town center.

According to Breidenbach, landlords and tenants will need to work together to identify the retail concepts that are worth saving on, worth investing in, and worth applying rent reductions to in order to keep them alive and try to grow them in the future.

“This will pass. We just don’t know long it will be. The retailers that have leveraged their data and information and have really good supply chains and supply chain ration times are the ones that are probably going to survive this,” said Breidenbach.

“Retail hasn’t grappled with anything like the challenges it faces this year, and the holiday retail season will be affected as retailers adjust to changing shopping behaviors,” said John Morris, CBRE Retail Leader.

Morris expects the sector will see modest growth this holiday season. “Brick-and-mortar sales will be challenged and overall consumer confidence is tepid. However, e-commerce sales will hit new highs in 2020.”

According to research published by CBRE, overall holiday retail sales are expected to grow less than 2 percent year-over year, a slower rate than previous years. Holiday retail sales have averaged 4.1 percent growth per year since 2010.

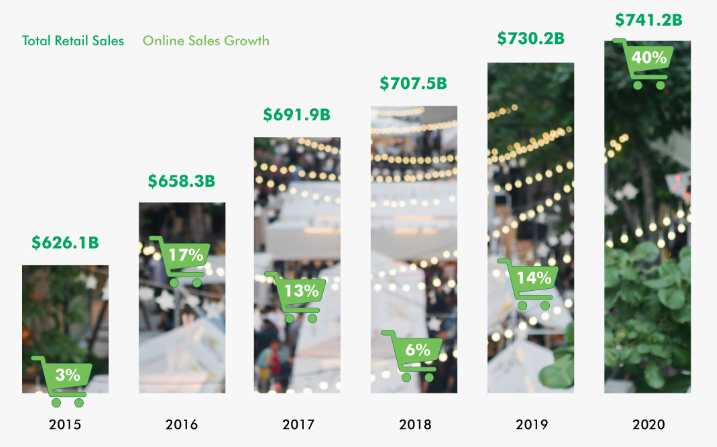

CBRE released research on holiday retail sales showing total retail sales and online retail growth. Chart courtesy of CBRE

Meanwhile, CBRE predicts e-commerce sales will surge to a record growth rate of more than 40 percent in November and December. This number would be up from the previous holiday uptick of 14 percent, recorded in 2019. With this growth in e-commerce sales, one of the biggest shifts for both retailers and consumers in 2020 will be rising carrier surcharges and escalating delivery costs during peak season.

In the new normal, if consumers procrastinate in their holiday shopping, they could face a surge in shipping prices and delayed delivery in the final rush, in addition to limited inventory.

Retailers will also rely on “in-and-out” shopping—a new strategy that allows consumers to examine merchandise and talk with sales associates in the store, while pushing payment, gift-card purchases, wrapping and returns to outdoor spaces.

The pop-up store, curbside pickup and the “buy online, pick up in store,” models have increased by more than 500 percent during the pandemic, and will continue to attract customers who want to minimize their time spent in the store. These help expand retailers’ reach and support social distancing.

Sector Insights rotates among office/medical office, industrial, retail, multifamily, self storage and hotel/hospitality.

You must be logged in to post a comment.