April Showcases Weak Pricing Growth

The Ten-X Commercial Apartment Nowcast posted the strongest results of the major real estate categories, increasing 0.5 percent and building on March’s 0.4 percent gain.

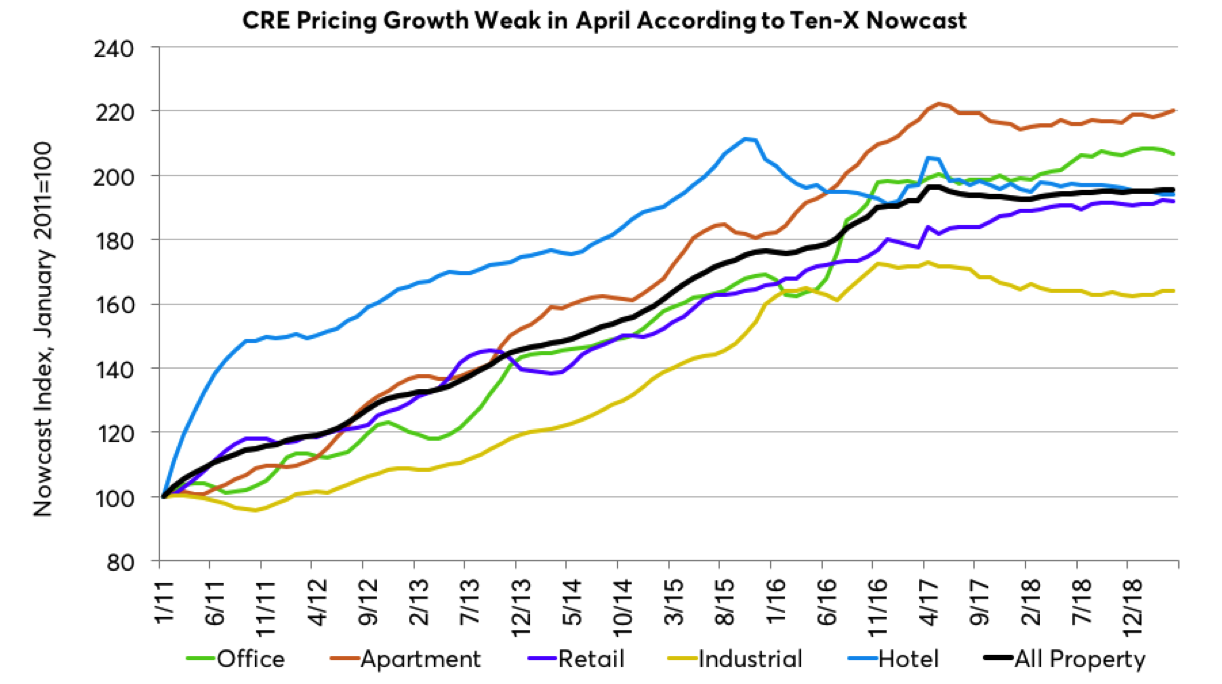

The first look at how commercial real estate prices have started off the second quarter shows continued lethargy. The Ten-X Commercial All-Property Nowcast declined 0.1 percent in April from the previous month, leaving the index of CRE pricing up just 0.8 percent from a year ago. Pricing remained soft across all the property segments in April.

Office was the most noteworthy segment in April. The Ten-X Commercial Office Nowcast dropped 0.8 percent in April, following March’s 0.2 percent decline, bringing the office pricing index to just 2.6 percent above the year-ago level. Office pricing was weakest in the Southwest, which had been running particularly hot, with monthly declines in the Southeast and West as well. The Northeast and Midwest posted gains in the month.

Recently released data by Smith Travel Research showed the weakest annual growth pace for RevPAR for this cycle in the first quarter and the Ten-X Commercial Hotel Nowcast reflects this with weaker pricing for hotel properties. The Hotel Nowcast declined 0.1 percent month-to-month in April leaving the price index up just 0.8 percent year-over-year. According to the nowcast, hotel pricing has been flat since early 2016, when RevPAR growth peaked for the cycle. Pricing was down in all regions except the Midwest.

The Ten-X Commercial Retail Nowcast fell 0.2 percent in April, bringing the price index to its lowest annual pace of growth in this cycle, up 0.9 percent. The national drop in April masked regional differentiation, with the Southeast and West posting healthy increases, a moderate gain in the Southwest and declines in the Northeast and Midwest.

Industrial pricing was essentially flat year-over-year, according to the Ten-X Commercial Industrial Nowcast, with a 0.2 percent monthly gain pushing pricing into positive territory following a decline that began in mid-2017. Industrial fundamentals remain solid but have downshifted in recent quarters from their previously robust state, with vacancies rising slightly and rent growth slowing. Industrial pricing was weak in April across all regions except the Northeast, which has been the most robust area recently.

The Ten-X Commercial Apartment Nowcast posted the strongest April results, increasing 0.5 percent and building on March’s 0.4 percent gain. This places the apartment pricing index up 2.1 percent, in line with the recent range. The apartment nowcasts were up in all regions save the Midwest. Despite the monthly dip, the Midwest nowcast has been the strongest, up 7.9 percent year over year in April.

Peter Muoio is the chief economist at Ten-X.

You must be logged in to post a comment.