Are Microgrids the Answer to CRE’s Power Struggle?

These systems can help unlock data center investments as they bridge energy demand and supply and provide resilience.

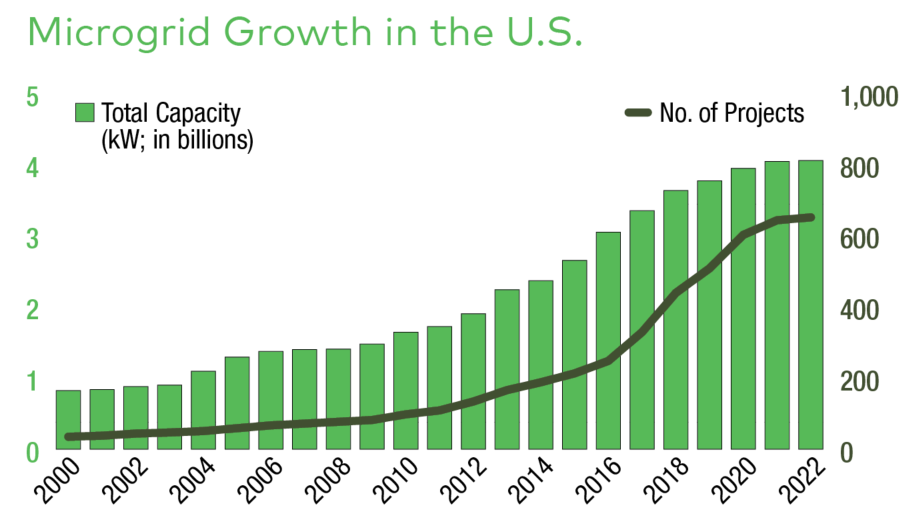

The number of microgrids at U.S. commercial real estate properties has jumped in recent years driven by the desire for greater sustainability, resilience and electrification. And the growth is expected to continue as extreme weather events escalate and aggressive corporate decarbonization goals loom.

“The commercial sector is flourishing and there’s a lot of applications where microgrids just make a lot of economic sense, mostly for customer resilience,” said Cameron Brooks, executive director of Think Microgrid, a research and policy-oriented advisory group.

Microgrids are typically a solution for energy-intensive properties, like data centers, industrial, advanced manufacturing, healthcare, retail and critical infrastructure. These localized power systems, composed of distributed energy resources like solar panels, battery energy storage, wind turbines, diesel generators, or natural gas-fired microturbines, can operate independently or be connected to the grid if the state or local grid experiences external pressure.

Bimbo Bakeries USA installed microgrids at six California facilities, according to Kevin Yavari, senior manager, corporate environmental sustainability at the company. The microgrids help reduce the company’s overall carbon footprint and contribute to the state’s efforts to increase renewable energy, Yavari noted.

Designed by GreenStruxure, a joint venture of Schneider Electric, the microgrids are resilient-ready and finely tuned to efficiently manage energy dispatching and storage, minimizing peak demand intervals, Yavari added.

The systems, which provide nearly 20 percent of the company’s California bakeries’ electric energy usage, incorporate rooftop solar arrays and solar carport structures coupled with a battery storage system, noted Chris Wolfe, Bimbo’s senior director of environmental sustainability.

“GreenStruxure has the capability to integrate additional components to transition the microgrids into ‘island mode,’ ensuring the continuity of power supply for critical bakery operations while also alleviating strain on the grid,” Yavari said.

The company is among the CRE owners and occupiers taking advantage of incentives, such as tax credits and grants, provided by some states and the federal government via the Inflation Reduction Act, which offers investment tax credits, and the Bipartisan Infrastructure Law, which provides $3.5 billion in funding for grid resilience and microgrid deployments.

“We are starting to see more growth, and one of the factors is the IRA,” noted Krystal Maxwell, a research director leading Guidehouse Insights’ Buildings Technologies Services.

Energy storage cost decreases coupled with the federal or state funding make microgrids more cost effective, according to Jana Gerber, president of North America Microgrids for Schneider Electric.

“We’ve been able to see a lot more of these types of projects pencil in a way that’s very attractive for commercial operations,” she shared.

Demand drivers

JLL notes 50 percent of U.S. microgrids began operation in the last five years. In Resilient Solutions: The Case for Microgrids, JLL cited 651 operational microgrids by 2022, nearly double the 329 recorded in 2017.

Numbers are likely higher now. Gerber said Schneider Electric has built more than 300 microgrids across the U.S. Allan Schurr, chief commercial officer at Enchanted Rock, said his company has more than 200 operating microgrids.

Roberto Rodriguez Labastida, associate director, Guidehouse Insights, expects microgrids to grow about 17 percent per year for North America between 2024 and 2032.

Much of that growth is in states like California and Texas, where increasingly extreme weather is causing power outages and economic damage. In 2023, there were 28 billion-dollar events with losses estimated at $92.9 billion, up 56 percent increase from 2022, according to Deloitte.

Power outages have increased 64 percent over the past 10 years from the previous decade, primarily due to extreme weather events and natural disasters, according to JLL. The U.S. already experiences more power outages than any other developed country. Microgrids can help mitigate the risks associated with long-duration outages.

Doug Mackenzie, vice president of resilience for JLL, has seen primary demand from data center clients followed by industrial users, particularly logistics clients that are seeking electrification generally through solar to charge EV fleets. Global companies have committed that 5.5 million vehicles will be electric by 2030, and EV commercial fleets could increase eightfold in just the U.S. market in five years.

Bimbo Bakeries USA, for example, plans to incorporate 50 EV trucks into its fleet annually. GreenStruxure will be able to leverage the microgrids and add EV charging components at the facilities to provide power to the fleet, Yavari said.

Advanced manufacturing plants spurred by onshoring of semiconductors and batteries also require increased power.

“There’s a lot of demand in the industrial and advanced manufacturing space,” Mackenzie said. “They have very similar needs where they’re very energy-intensive. It’s hard to go find 100 megawatts of power anywhere these days. There’s a willingness to pay for energy resilience and backup power.”

“Microgrids can not only solve power constraints on day one, they can also be a more efficient and cost effective way to solve energy, autonomy and resilience needs for those types of clients.”

Investors and occupiers are seeking carbon-free real estate or sites ready for fleet charging, Mackenzie added, and he expects to see more green real estate investments.

Data center clients, he said, are “willing to look almost anywhere in the country if they can find power.”

The power of data

With the amount of power required to operate data centers climbing, it can take utilities three to five years to connect a data center to the grid. Microgrids can act as a bridge then later provide resiliency and support the grid with flexible power capacity. In some areas of the country, microgrid users can also sell excess power into the market providing a revenue stream.

“A large data center was 60 to 100 megawatts just a few years ago,” said Schurr, whose company recently launched Bridge-to-Grid microgrids to address skyrocketing power demands. “Now they’re 10 times that.”

Those data center demands are already hitting utilities and are increasing at a rapid pace, particularly with the growing importance of artificial intelligence. Dominion Energy, which provides electric power in parts of Northern Virginia—the largest data center hub in the U.S—expects the amount of electricity consumed by its customers to double over the next 15 years. Dominion said the projected data center capacity could rise from 2.67 gigawatts in 2022 to 10 gigawatts by 2035.

AI chips are more powerful and consume more power themselves, Schurr noted. “When you add more and more racks because there’s such a demand for this business function, that’s when you get these GW-scale data centers,” he said. “I suppose it’s fair to ask how long this demand boom will last but nobody has said we see the sun setting out in the future. It seems to be open-ended.”

In five years, Schurr predicted, an outside microgrid for these large data center loads could be a requirement to get connected to the grid.

Microgrid solutions and EaaS

While solar and energy use within microgrids was up 47 percent in 2022 over 2019, market intelligence firm Wood Mackenzie expects fossil-fuel microgrid solutions to continue at least for several more years until long-duration energy storge are more broadly available commercially.

Enchanted Rock’s first microgrids, Schurr said, were mostly diesel-powered but moved to a natural-gas based technology in 2014. The company was contracted by Microsoft in June 2022 to develop California’s largest microgrid that is fully supported by renewable natural gas. It will provide Microsoft’s San Jose, Calif., 96 MW data center with backup power to ensure continuous operations while reducing local emissions by up to 96 percent compared to alternatives. It is expected to come online by 2026 and further Microsoft’s goal to be carbon-negative by 2030.

“We are seeing other companies interested though we haven’t announced any yet,” Schurr explained. “But it’s one of the easiest ways to decarbonize that last bit from the on-site power use.”

In March, Schneider Electric announced they were partnering with Mainspring Energy to offer a new hybrid-energy technology that combined Schneider’s EcoStruxture Microgrid Solution and turn-key design-build services with Mainspring’s linear generator that provides power, fuel flexibility and energy resiliency for commercial and industrial customers. The linear generator can run on and seamlessly switch between various fuel types, including biofuels, green ammonia, and green hydrogen.

One of the challenges CRE firms face when considering microgrids is installation and operation costs, so they often turn to companies like Enchanted Rock or GreenStruxure, which offer Energy as a Service agreements.

“That gives the client a better way to manage those costs and it’s not considered a capital expense on their balance sheet,” said Gerber. “It’s another way to help customers decrease (the cost of) the adoption.”

It’s also more challenging in the commercial real estate environment, particularly if the occupant is in a triple-net lease, Gerber noted.

“We work through it,” she said. “It just depends on the terms of their building lease,” she added. “A lot of these property owners are also looking for ways to help their occupants with driving more sustainability into the site.”

Schurr described his company’s EasS agreements as a turnkey service no matter who puts the capital in. He said about half the company’s customers choose to own the microgrid equipment.

“They really are taking on the capital outlay and, in return, maybe earning a revenue stream from the capital they deploy,” Schurr noted. “Either way, it’s our same employees doing the same work maintaining, monitoring and managing those assets.”

Another way to trim costs is to use a standardized system like Schneider’s Microgrid Flex, combined with EcoStruxure software, an energy control center and a Battery Energy Storage System.

Geared for facilities with 60 kilowatts up to 2 megawatts, Gerber said it’s “a sweet spot for commercial real estate applications.”

You must be logged in to post a comment.