Are Real Estate Taxes Deductible?

By Lori Shrout, EA, Manager, Gumbiner Savett Inc.

The California Franchise Tax Board will be requiring property parcel numbers for taxes deducted on an itemized list. What do these new rules entail?

By Lori Shrout, EA,

Manager, Gumbiner Savett Inc.

The California Franchise Tax Board has announced that they will be requiring, for the 2012 tax year, a listing of property parcel numbers for any property taxes deducted as an itemized deduction. In anticipation, they have recently published guidance on the issue of Real Estate Taxes reminding us that real estate taxes are deductible only if certain conditions are met.

The tax must be based on the assessed value of the real property. Any flat fee, not charged as a percentage of your home value, would be non-deductible. Examples would be flood or fire district fees, landscape maintenance fees, sewer service fees, etc.

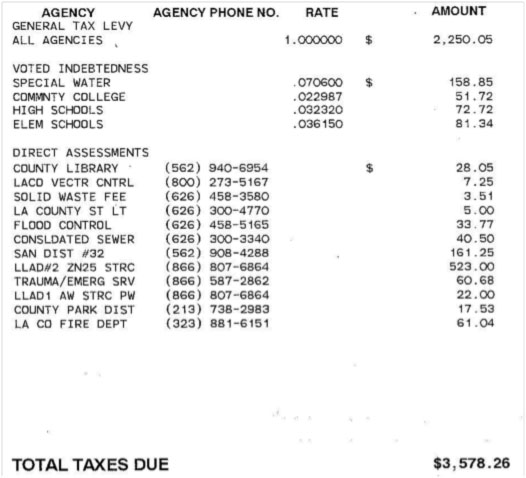

Your county tax invoice likely lists many line items that add up to your total property tax due. The image on the right is a sample of what that detail may look like on your tax bill.

Your county tax invoice likely lists many line items that add up to your total property tax due. The image on the right is a sample of what that detail may look like on your tax bill.

General Tax Levy: Notice the General Tax Levy, and the items under the section Voted Indebtedness are all calculated as a percentage of the property value.

Direct Assessments: Now see the section Direct Assessments. These items are all a flat fee, with no “rate” listed. This portion of the tax bill does not meet the definition of a tax, and would not be deductible. This remains true even though your payments are made directly to the taxing authority.

These are not new rules. This guidance reflects current law.

This FTB guidance fails to mention that if your property is a business-use property, such as a rental property, the non-tax portion of your real estate taxes would likely be deductible as a business expense.

Lori Shrout is a manager at Gumbiner Savett Inc., one of the largest CPA and business advisory firms in Southern California.

You must be logged in to post a comment.