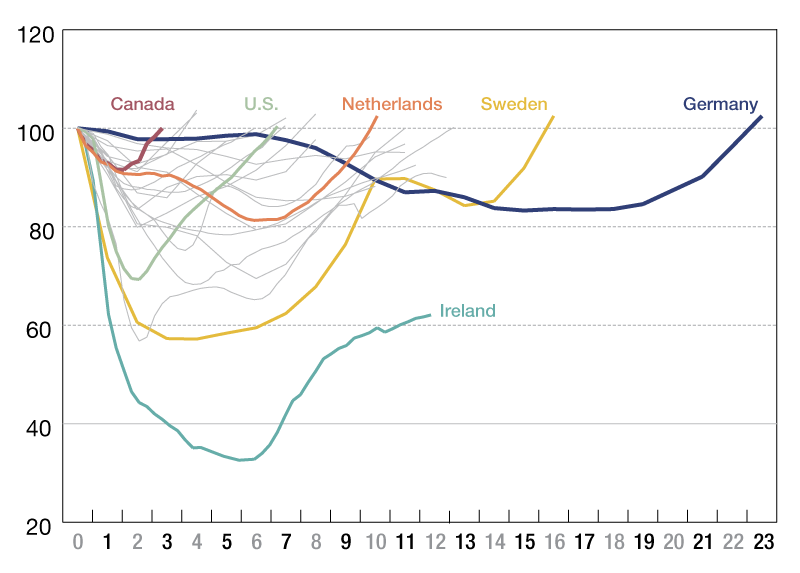

Asset Value Index

While downturns may be hard to escape, diversification and income returns have in the past provided investors with some protection.

Peak to recovery, by years

With inelastic supply and a strong correlation to economic growth, real estate has always been a cyclical asset class, with periods of expansion followed by sometimes painful corrections. That every cycle is different poses a challenge for investors, and it has proven extremely hard to predict turning points.

This graphic uses data from MSCI’s Global Annual Property Index, as well as several other national-market indexes, to compare past downturns in which asset values fell by more than 5 percent. The results show that, while corrections have occurred relatively infrequently, they have varied considerably in their magnitude and duration.

While downturns may be hard to escape, diversification and income returns have in the past provided investors with some protection.

Insights and data provided by MSCI Real Estate, a leading provider of real estate investment tools. A Vice President in MSCI’s global real estate research team, Reid focuses on performance measurement, portfolio management and risk related research for asset owners and investment managers. Based in Sydney, he covers APAC as well as global markets.

You must be logged in to post a comment.