Atlanta, Nashville Gain as Workers Flock to the Southeast

Southeast markets claimed eight of the top 10 positions in the Bureau of Labor Statistics February job growth rankings. Yardi Matrix Analyst Justin Dean takes a deeper look into why these markets are attractive for workers right now.

By Justin Dean, Real Estate Market Analyst, Yardi Matrix

The Southeast continues to lead the country in job growth, as the region claimed eight of the top 10 positions in February’s metro rankings released by the Bureau of Labor Statistics (BLS).

Orlando led the nation with 4.3 percent year-over-year increase in employment, well more than double the national 1.7 percent growth rate. Orlando was followed by Sarasota, Fla., Provo, Utah; ,and Boise City, Idaho, each of which saw a 4.2 percent increase. All told, Florida metros claimed six of the top 10 metros, according to the BLS. The final two metros in the top 10—Nashville (No. 6 at 4.1 percent) and Atlanta (No. 10at 3.7 percent)—are also in the Southeast.

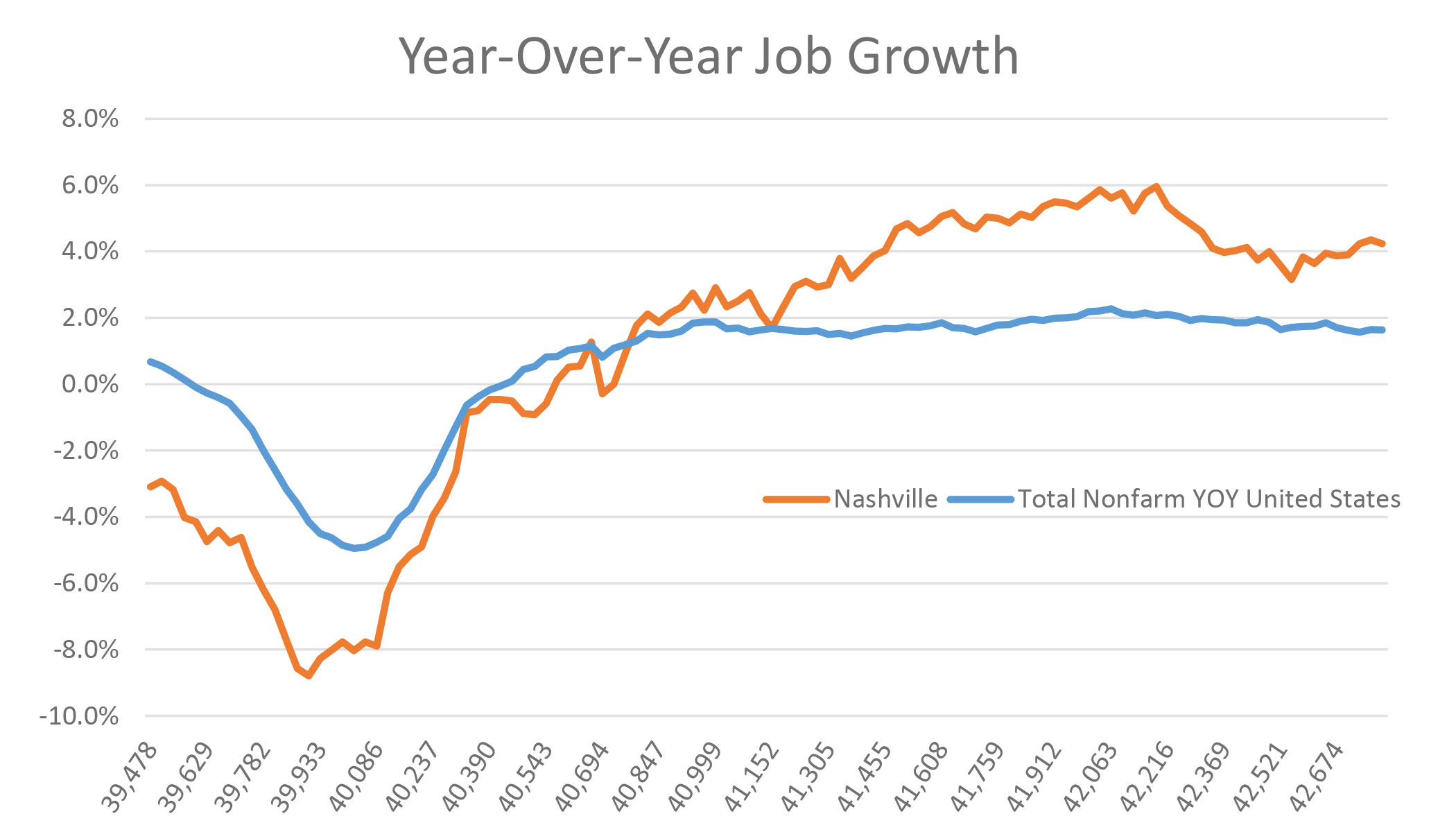

Nashville has been on a roll in recent years, topping a 3.0 percent growth rate since June 2011. The 38,600 jobs added in the 12 months ending in February were broadly based, led by the professional and business services (7,200) and leisure and hospitality (6,400) segments.

The continued employment growth in the Music City has begun to have a substantial effect on wages, as employers compete for talent and the pool of unemployed workers shrinks. Since 2012, the number of employed workers has increased by 20.9 percent, according to BLS, while the population has grown by only 9.8 percent, according to the Census Bureau. That has prompted average hourly wages in Nashville to spike by 9.0 percent year-over-year through February, up $2.09 to $25.25.

This wage growth supports increased apartment rents, though rent growth has been decelerating since last summer. Year-over-year rent growth fell to a five-year low of 2.5 percent in March, after spending most of the previous two years in the 5 to 7 percent range, according to Yardi Matrix. The drop is most pronounced in the higher-end lifestyle units, where rent growth has fallen to 1.3 percent year-over-year.

The deceleration in lifestyle units is the result of an absorption problem on the high end. All but 300 of the nearly 8,200 units completed in the prior two years in the metro were in the lifestyle segment. Meanwhile, another 9,500 lifestyle-quality units are under construction, which could continue to dampen rent increases in the higher-end segment.

The saving grace for Nashville’s high-end multifamily market is the strong wage growth and gains in the high-paying professional and business services segment. While absorption of luxury units might be a short-term issue, the continued growth of employment and wages should ease the pain in the long-term.

The situation is much the same in Atlanta, which added 97,800 jobs year-over-year through February, up 3.6 percent. Employment gains in Atlanta were led by the professional and business services (22,700) and leisure and hospitality (18,200) sectors. Wage growth, while not quite at Nashville’s level, was also robust. Average hourly wages in Atlanta have increased $1.06 to $27.60 over the 12 months leading into February, a 4.0 percent increase and solidly above the 2.8 percent national average.

Also like Nashville, nearly all new supply in Atlanta is concentrated in the lifestyle class. However, rent growth in Atlanta (4.0 percent overall year-over-year and 3.2 percent for lifestyle) hasn’t cooled off quite as much as Nashville.

The key difference is that new supply in Atlanta represents a much smaller percent of total stock than it does in Nashville. Deliveries in Atlanta over the last two years represented a 4.1 percent increase in total stock, compared to 7.1 percent in Nashville, according to Yardi Matrix. In 2017 alone, new supply as a percent of stock will reach a staggering 8.0 percent in Nashville, compared to 3.5 percent in Atlanta. Submarkets in Atlanta where supply growth is highest, such as Midtown and Buckhead, might be the most affected, even though demand in those areas is strong.

Job growth in Nashville and Atlanta is much more broad-based than the rest of the country. Nationally, the education and health care segment accounted for 546,000 jobs year-over-year, or 23.3 percent of the total. Growth in the two metros in that segment was strong, but because other employment sectors also performed well, it represented a small share of total gains: 13.3 percent in Nashville and 13.1 percent in Atlanta.

You must be logged in to post a comment.