August Pricing Continues to Underperform

Despite a 0.3 percent monthly decline from July, apartment pricing has the best trend among the five major property segments.

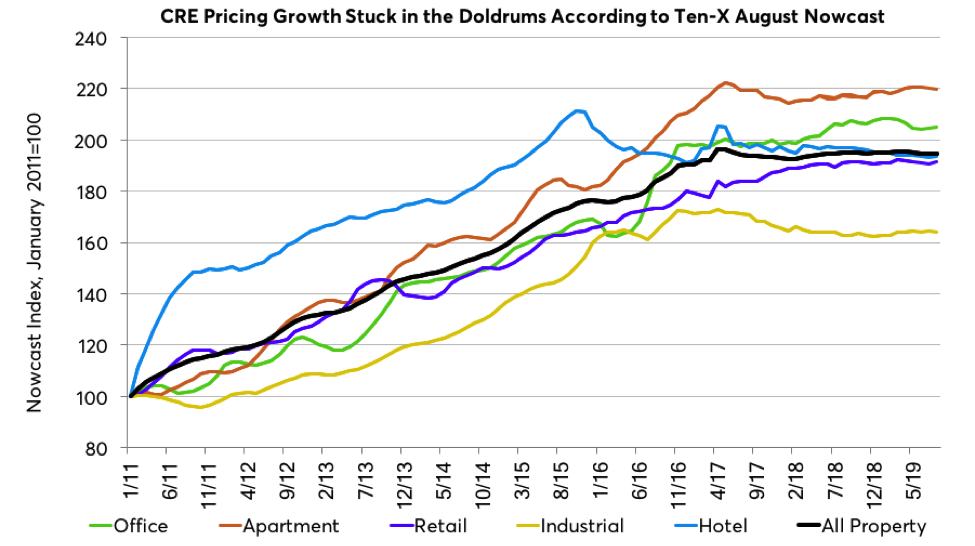

US commercial real estate pricing remains in the doldrums according to the Ten-X Commercial Real Estate Nowcast. The Ten-X All Property Nowcast increased 0.1 percent month-over-month in August but stands 0.1 percent below its August 2018 level, the first annual decline since mid 2018. The overall picture remains one of stasis: the All Property index and each of the individual property segment indices show pricing flat over the past year and a half.

Despite a 0.3 percent monthly decline from July, apartment pricing has the best trend among the five major property segments. Even with August’s setback, apartment pricing is up 0.9 percent from last year. However, this compares to a much stronger advance posted in recent months, indicating some flagging. Apartment property pricing was weakest in the Northeast in August and on a longer-term trend basis.

The hotel segment was the mirror image of the apartment segment in August. Despite a 0.2 percent monthly increase, hotel pricing has had the weakest longer-term trajectory and stands 1.8 percent below its level last year. All regions except the Midwest posted monthly gains in August, however every region is down from a year ago, with the Northeast the weakest.

Retail property pricing continues to decelerate, despite August’s 0.5 percent increase. That was the first gain in five months, yet annual growth still slowed to just 0.3 percent, the slowest pace in this cycle. There remains much regional disparity in retail pricing; while the Southeast, with its strong demographic support is up a solid 8.2 percent year-over-year, the Northeast is down 3.6 percent and the Midwest down 0.5 percent.

Industrial property pricing has recovered slightly from its weakness last year, with the Ten-X Commercial Industrial Nowcast up 0.6 percent from a year ago. Indeed, on a monthly basis, industrial property pricing fell 0.3 percent in August according to the Nowcast, its second decline in three months. Fear of recession, heightened by the yield curve inversion and tied partially to the trade war situation is a major negative on this cyclical segment.

The Ten-X Commercial Office Nowcast shows pricing off the highs of earlier this year but the sector posted its second consecutive monthly increase. On a regional basis, office pricing is up on annually in the Northeast and Midwest and down in the other parts of the country.

Peter Muoio is the chief economist at Ten-X.

You must be logged in to post a comment.