Growing Inventory Caps Rent Growth in Austin

The metro’s economy is strong and population is booming, but a heavy new supply of apartments is limiting rent growth.

By Anca Gagiuc

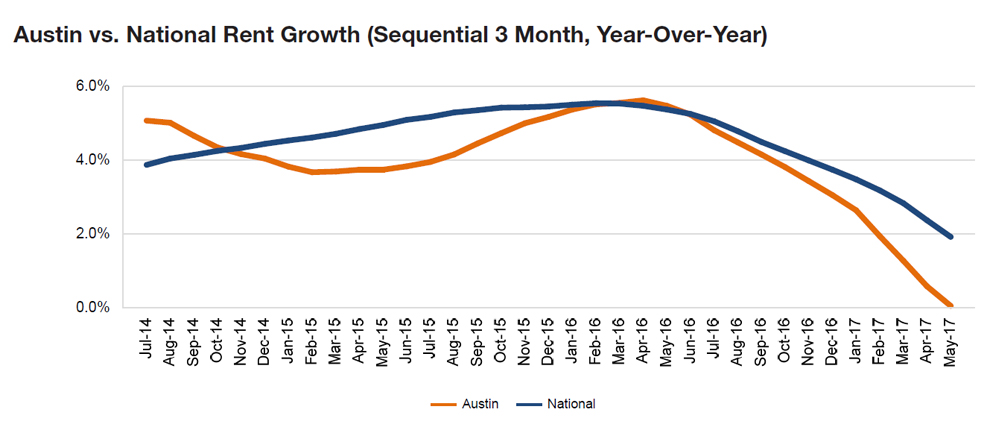

Austin’s economy is strong and population is booming, but a heavy new supply of apartments is limiting rent growth. Rents in the metro were flat year-over-year compared to a 1.5 percent national growth rate as of May. The metro attracts Millennials to its urban core, as well as Baby Boomers retiring to the Texas Hill Country. However, with more than 16,000 units under construction, Yardi Matrix forecasts a modest rent growth of 1.1 percent in 2017, as the heavy new supply is absorbed.

The Texas capital’s economy is centered around government, the University of Texas, and a large number of technology firms, led by hometown company Dell Technologies. Major projects include the 700-acre master-planned Mueller site, which will house 13,000 residents and generate 13,000 permanent jobs and 10,500 construction jobs. In addition, Dell Seton Medical Center has begun operation and plans to hire 15,000 people. Rapid population growth and affordability challenges are leading the city to pursue infrastructure projects and development aimed at easing urban congestion.

Transaction volume reached another record of $2 billion in 2016, but began 2017 with slower activity levels, as only $300 million worth of properties traded in the first five months of the year. Transaction volume has decreased faster for the more expensive Lifestyle properties than for Renter-by-Necessity communities, in part reflecting the weaker rent performance of Lifestyle assets.

You must be logged in to post a comment.