Austin’s Still a Hotspot, Despite Declining Deals

How the market’s fundamentals shifted in late 2023, according to CommercialEdge.

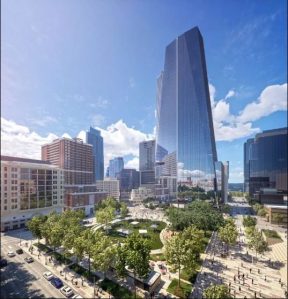

Sixth and Guadalupe is a 599,234-square-foot mixed-use development that came online in November. Rendering courtesy of Kairoi Residential

Austin’s office fundamentals started to cool as we approached the end of 2023, with deal volume dropping since the third quarter. Despite the deceleration in office investment, the metro still maintains its position as a magnet for developers, with its under-construction office pipeline securing the fourth spot among peer markets.

As of November, Austin had 5 million square feet of office space under construction across 35 properties, or 4.6 percent of the existing inventory—above the national figure of 1.7 percent. Among other similar markets, the metro’s under-construction pipeline relative to total stock outpaced that of Nashville (4.5 percent) and Charlotte (3.2 percent) and came in second after San Diego, which led with 4.7 percent.

Notable projects boost Austin’s pipeline

Austin’s under-construction pipeline was lower than in Dallas (6.1 million square feet) and San Diego (5.2 million square feet), but surpassed Atlanta, Houston, Charlotte and Phoenix— which had the smallest underway pipeline, totaling 1 million square feet.

Year-to-date through November, developers delivered 2.7 million square feet of office space across 34 properties, amounting to 2.5 percent of the total stock. Notable completions in the metro included the the 599,234-square-foot Sixth and Guadalupe, a Class A+ mixed-use property developed by Lincoln Property Co. Kairoi Residential and DivcoWest began site work on the project in late 2019. The development that came online in November was financed with a $272 million construction loan originated by Quadreal Finance.

Another recently completed property is Domain 9, a 332,865-square-foot Class A office building developed by Atlanta-based Cousins Properties, situated within The Domain submarket of North Austin. The project was fully leased ahead of its completion by Amazon, which announced in 2021 its plans to add 2,000 new jobs at the Austin Tech Hub.

The Republic, a 816,560-square-foot office project underway, is expected to be delivered in 2025. Image courtesy of Neoscape

Construction starts in the metro totaled 884,430 square feet spread across 16 properties, representing 0.8 percent of stock. The value surpassed Phoenix’s and Atlanta’s 0.4 percent, but was lower than the one recorded in Dallas (1.0 percent).

In January 2023, Apple moved forward with its $1 billion Parmer Lane campus. As the tech giant completed the first phase of the 33-acre, 12-building project in 2022, the company announced its plans for the second phase of the office complex. The newest addition will consist of a $120 million building dubbed Capstone Phase Two AC09, with completion expected in early 2025.

One of the largest office projects underway is The Republic, a 816,560-square-foot Class A+ high-rise in Austin’s downtown developed by DivcoWest, along with Lincoln Property Co. and Phoenix Property Co. This project is also slated for completion by early 2025.

Waterline, a 700,000-square-foot mixed-use project developed by Lincoln Property Co. and Kairoi Residential, is another significant property currently underway. With a planned height of 1,022 feet, the Class A+ tower is set to become the tallest building in the state. Construction commenced in late 2022, financed by a $742 million loan from Blackstone Group; completion is expected by September 2026. Meanwhile, Jay Paul Co.’s Springdale Green, a two-building office project totaling 832,800 square feet that broke ground in 2021, will come online this month.

In April, Redcar closed Redcar Fund II with $418 million in equity commitments. Proceeds will be used to support the firm’s expansion in Austin and its strategy of investing in urban commercial real estate and converting underperforming industrial assets into creative office properties.

Sales volume drops, prices still high

Year-to-date through November, 2.9 million square feet of office space spread across 45 properties changed hands in Austin, for a total of $496 million. On a quarter-over-quarter basis, the deals volume went up in the second quarter of 2023, totaling $215 million, while in the third quarter investments dropped to $98 million.

Compared to other gateway metros, Austin ranked third, outpaced by The Bay Area ($1.06 billion) and Phoenix ($948 million). The lowest sales volume since the start of the year was recorded in Dallas ($158 million).

Office assets in the metro changed hands at an average of $316.4 per square foot year-to-date through November, way above the national figure of $192.8 per square foot. Austin secured the third place among gateway metros, the most expensive office market being San Diego ($402.3 per square foot), followed by The Bay Area ($331.4 per square foot).

The $142 million purchase of the VA Outpatient Clinic was the largest office deal in Austin. Image courtesy of CBRE

The largest office deal since the beginning of the year was Boyd Watterson Asset Management’s $142 million acquisition of the VA Outpatient Clinic in Southeast Austin. Healthcare Property Advisors sold the 272,636-square-foot medical office property that is operated by the U.S. Department of Veterans Affairs.

Notable transactions also included the $87 million purchase of Fifth + Tillery, a 187,155-square-foot office property in Austin’s East submarket. The property was acquired in August by CapMetro from CIM Group.

In February, Aquila Commercial paid $71 million for Hartland Plaza, a Class A, 181,855-square-foot office building located within the West Central submarket. The low-rise property was also sold by CIM Group.

Austin’s vacancy increases, coworking sector still steady

Year-to-date through November, Austin’s office vacancy reached 21.2 percent, one of the highest across gateway markets. The rate has fluctuated since the start of the year, increasing from 19.1 percent in January to 22.0 percent in April, then decreasing to 19.8 percent in June; afterwards, the index had an upward trajectory.

Across other similar markets, Austin’s vacancy rate was surpassed only by Houston’s (25.4 percent). Charlotte’s (15.7 percent), Nashville’s (16.6 percent) and San Diego’s (17.7 percent) were all below the national figure of 18.1 percent.

IBM signed a 320,000-square-foot lease at Hines Domain Northside, a two-building project to be completed by 2027. Image courtesy of Hines

Significant leases in Austin include IBM Corp.’s 320,000-square-foot lease at The Domain, where the company already occupies 800,000 square feet housing 6,000 employees. The tenant will relocate to two upcoming office towers within Hines’ development, which will be known as Hines Domain Northside, and will total 500,000 square feet.

As for coworking, the metro registered 1.1 million square feet of shared space, more than San Diego (1 million square feet), Raleigh-Durham (861,208 square feet), Nashville (664,279 square feet) and Charlotte (518,576). Across gateway metros, Dallas led with 2.4 million square feet, followed by Atlanta with 2.1 million square feet.

Year-to-date through November, WeWork had the largest footprint of coworking space in Austin, with operations totaling 398,450 square feet. The company was followed by Regus, with 153,961 square feet, and Spaces, with 128,736 square feet.

In April, flex office provider Expansive announced the opening of Expansive Austin Highland, a 48,000-square-foot coworking location in central Austin. The company purchased a 53,415-square-foot office property in 2022 and began a multimillion-dollar improvement plan, with opening scheduled for May 2023.

You must be logged in to post a comment.