Bryan Reid

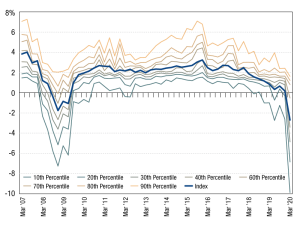

Performance Spread in Australian Retail Property Widened

Australian retail property registered an all-time low total return of -2.7 percent for the quarter ending March 31, 2020.

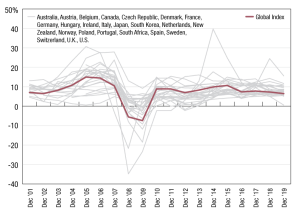

Global Index and National Market Total Returns

The index has now seen a full 10 years of positive total returns since the recovery from the financial crisis; however, COVID-19 has the potential to mark a turning point.

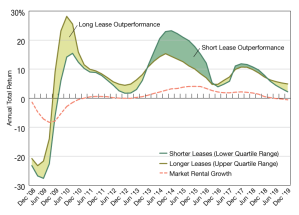

U.K. Quarterly Property Index

This analysis, using data from the MSCI UK Quarterly Property Index, shows lease length has historically been one such cyclical factor.

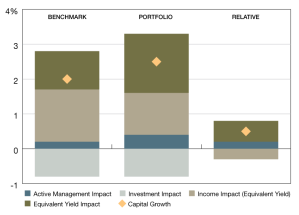

Capital Growth

Could breaking capital growth into its components help tell a more detailed story of property portfolios’ performance?

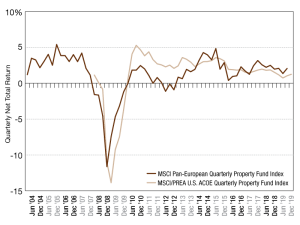

Pan-European vs. U.S. Funds

Pan-European funds underperformed compared to U.S. funds in the years following the financial crisis and during the European Sovereign debt crisis, but that in more recent years, Pan-European fund returns have been out-performing U.S. funds.

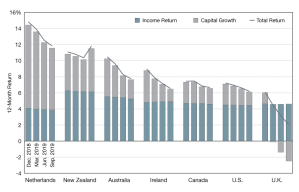

General Softening Trend in 2019

Across most of these markets, there was a softening in total returns, as capital growth moderated.

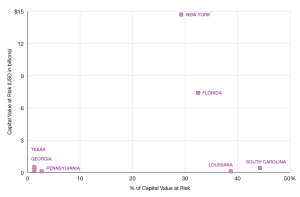

Largest Exposure by State

Climate related weather events can increase operational costs, devaluate property, and in some extreme cases, lead to asset stranding.

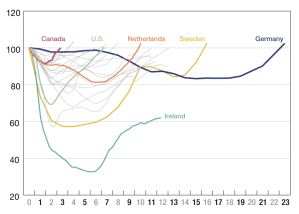

Asset Value Index

While downturns may be hard to escape, diversification and income returns have in the past provided investors with some protection.

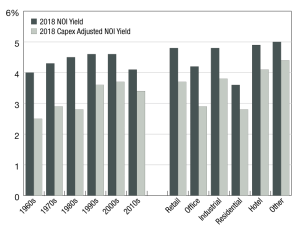

NOI vs. Capex Yield

Variables such as age, location and property type can influence how much capex is required to operate an asset.

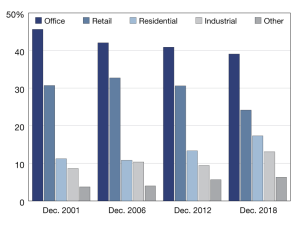

Global Annual Property Index

In 2001, office and retail accounted for 46 and 31 percent, respectively, of capital value in the MSCI Global Annual Property Index. However, now they account for less than two-thirds.