Jamie Woodwell

CRE Lending Picks Up the Pace

Highlights of MBA’s latest quarterly update.

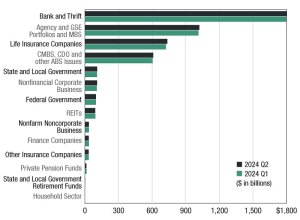

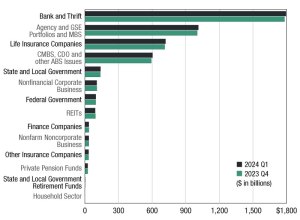

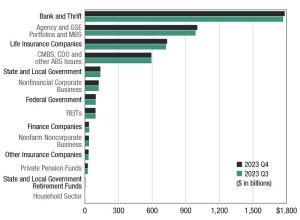

Commercial and Multifamily Mortgage Debt Outstanding Increased Modestly in Q2

Read the Mortgage Bankers Association’s latest quarterly report.

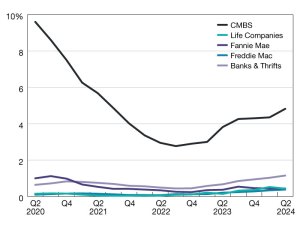

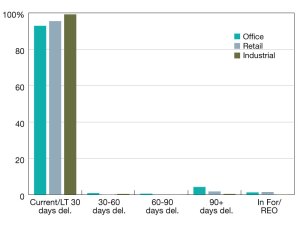

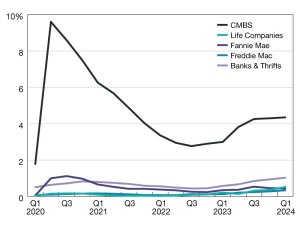

Commercial Mortgage Delinquency Rates Increased in Q2 2024

Based on the Mortgage Bankers Association’s latest commercial delinquency report.

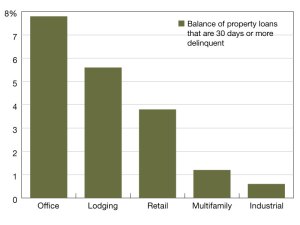

Delinquency Rates for Commercial Property Loans Declined Slightly in Q2 2024

The delinquency rate for most property types declined, with the exception of loans backed by office properties.

Commercial and Multifamily Mortgage Debt Outstanding Increased in Q1 2024

The amount of commercial mortgage debt outstanding increased in the first quarter of 2024, despite slow mortgage originations activity.

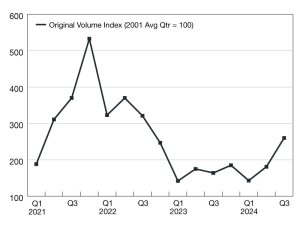

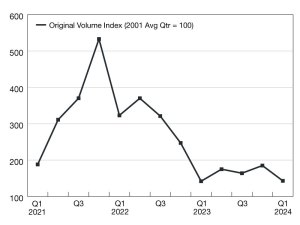

Q1 Commercial/Multifamily Borrowing Unchanged From a Year Ago

Originations fell 23 percent from the fourth quarter of 2023.

Commercial and Multifamily Mortgage Debt Outstanding Increased in Fourth-Quarter 2023

Details from the Mortgage Bankers Association’s latest report.

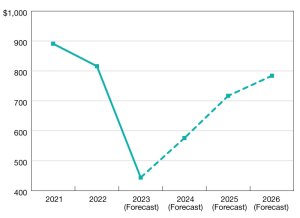

CREF Forecast: Borrowing and Lending Expected to Increase to $576B in 2024

Commercial and multifamily mortgage originations are expected to increase 29% from 2023’s estimated total.