Khamile Armhynn Sabas

2018 REIT Results

The projected proportion of earnings to be paid as dividends, cycling among REIT subcategories.

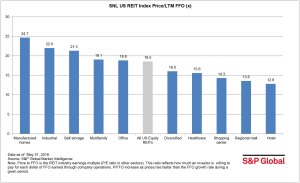

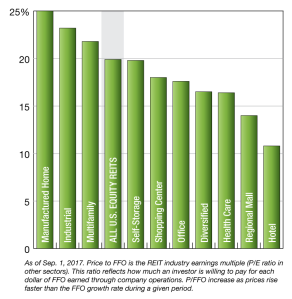

Manufactured Home REITs Outperform Market

The sector had the largest last-12-months funds from operations multiple of all publicly traded U.S. equity REITs, at 24.7x, according to S&P Global Market Intelligence data.

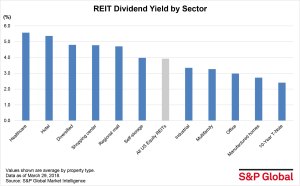

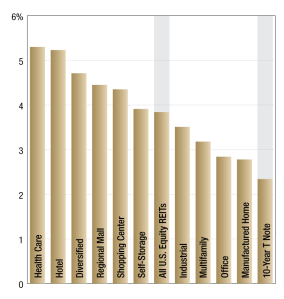

Health-Care REITs Hit Highest Dividend Yields

The hotel and diversified REIT sectors also had strong one-year average dividend yields, according to S&P Global Market Intelligence data.

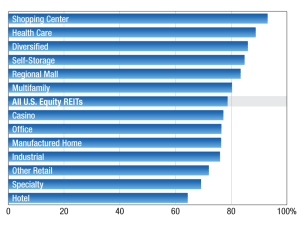

Specialty REITs Top Capital Raising in 2017

Among publicly traded U.S. equity REITs, the specialty sector raised the greatest amount of capital last year, according to S&P Global Market Intelligence data.

REIT Dividend Yields

The Health Care sector posted the greatest one-year average dividend yield among the group, at 5.3 percent, outperforming the broader SNL U.S. REIT Equity Index by 1.5 percentage points.

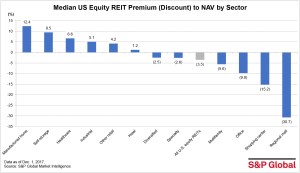

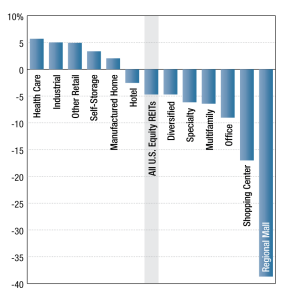

Regional Mall REITs Trade at Largest Discount to NAV

Retail REITs continue to be challenged, with the regional mall sector and shopping center sector trading at discounts of 30.7 percent and 15.2 percent, respectively, according to S&P Global Market Intelligence data.

REIT Returns

As of Nov. 3, publicly traded SNL U.S. REIT Equity Index posted a 13.7 percent one-year total return.

REITs

At the company level, Healthcare REIT Community Healthcare Trust Inc. traded at the greatest premium to NAV, at 38. percent.

Specialty REITs Raise Most Capital Year-to-Date

The specialty sector raised $25.9 billion in capital year-to-date through Sept. 29, with communications REITs raising more than 40 percent of that total, according to S&P Global Market Intelligence data.

REIT Values

As of Sept. 1, 2017, the manufactured homes sector led all publicly traded U.S. Equity REIT sectors in terms of the last twelve months funds from operations (LTM FFO) multiple.