How Generative AI Is Reshaping Bay Area CRE

The footprint is projected to grow by 200 percent over the next two years, according to Cushman & Wakefield’s forecast.

AI is reinvigorating the San Francisco office market, according to a new report from Cushman & Wakefield. Over the past three years, artificial intelligence-based companies have dominated the tenant list. These firms continue to prioritize an ‘office-first’ culture, with employees spending four to five days a week on-site.

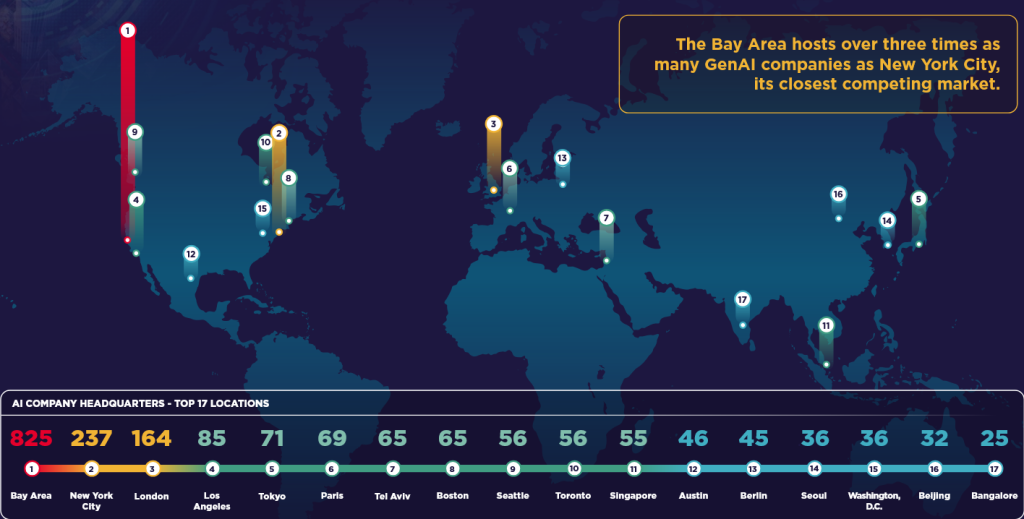

There are more than three times as many AI companies (825) in the Bay Area as the next most concentrated market, New York City, with 237.

Even more so, Cushman & Wakefield anticipates a 200 percent growth for GenAI companies over the next two years in the Bay Area. In its latest report, AI Genesis | The Role of Generative AI in Transforming Bay Area CRE, Cushman & Wakefield broadly defines AI and includes semiconductor companies and other tech companies deploying AI.

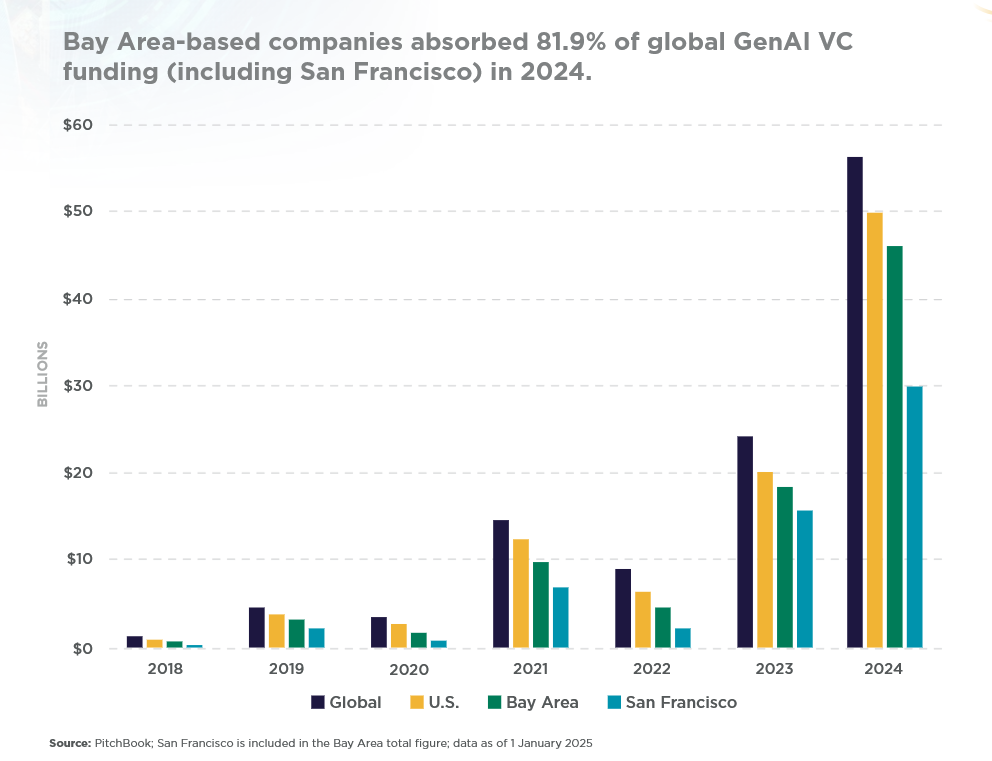

Last year, 82 percent of global Gen AI venture capital landed in San Francisco.

Robert Sammons, Cushman & Wakefield senior research director and co-author of the report, told Commercial Property Executive that what had primarily started in San Francisco proper has spread more recently across the Bay Area region.

“Silicon Valley is certainly in the spotlight, largely because of AI divisions at the Big Tech players that are headquartered there, but also increasingly because of standalone AI companies popping up in the area,” Sammons said.

Given the depth of tech talent in the Bay Area, the focus will likely remain within the region, he anticipates. “However, like most tech sectors in the past, the GenAI phenomenon will likely spread to other markets as well—we already see that in major global cities such as New York and London. Thus far, it’s the search for talent leading that charge, but in the future, it could be about cost savings.”

READ ALSO: Why AI Firms Are Taking a Measured Approach to Office Leasing

Sammons said what surprised him most about the report was the sheer number of GenAI companies based in the Bay Area region—from the very early seed stage to the later stage to divisions of Big Tech.

“It’s still overwhelmingly a Bay Area phenomenon,” he said. “Also surprising was that there was more GenAI leasing activity in Silicon Valley than in San Francisco in 2024 as well as more unique job postings in Silicon Valley than in San Francisco in 2024.”

An office market rebound

The concentration of artificial intelligence companies in the San Francisco Bay Area is helping drive a market rebound, being a catalyst to lift the region of its real estate downturn, according to Avison Young VP Tyler Paratte, based in the San Francisco office.

“The correlation between companies receiving funding and leasing office space has drastically improved, leading to increased office attendance, revitalizing downtown cores and creating expanded opportunities for adjacent industries as these companies grow.”

Paratte said San Francisco has historically been a boom or bust market, heavily dependent on the technology industry.

“Not only does the data show the market is recovering, but there’s also a shared sentiment of being on the precipice of a boom, with AI being the engine that renewed momentum in the Bay Area,” he said.

AI firms’ leasing activity

JLL also sees a heavy influx of AI-based companies. Its data focuses on firms dedicated to the AI vertical. According to Chris Pham, JLL senior analyst, the Bay Area’s dominance in AI is echoed in JLL’s research in leasing activity and job posting trends.

He told CPE that new AI deals in the Bay Area comprise nearly 40 percent of the AI deal count this year, primarily from new startups. San Francisco alone saw 30 percent of the deal count last year from AI startups. Monthly AI job postings have nearly doubled year-over-year as companies emphasize AI positions.

He said AI companies occupy different property types beyond just office space, which accounts for 49 percent of leasing activity. Lab space accounts for 23 percent, flex space for 10 percent and industrial for 18 percent.

“AI is centered mainly in the Bay Area, eclipsing all U.S. and global markets for several reasons, including that it has the highest location quotient for AI in the U.S. at 9.5 (meaning AI talent is 9.5x more concentrated compared to the national average).

The Bay Area has 20.2 percent of U.S. AI talent, far ahead of Seattle (9 percent) and New York City (7 percent). The Bay Area is also near major AI research institutions, innovation companies and venture capital.

“[The Bay Area] has a strong talent pipeline from local universities, including UC-Berkeley and Stanford which are among the top 5 institutions for AI graduates,” Pham said.

The Bay Area has been a proving ground for tech startups for more than 30 years, so we’re excited to see the growing demand for AI, Katy Redmond, JLL senior managing director & tech sector lead of leasing advisory, told CPE.

“This growth is a leading indicator for optimism for other AI hub markets for startups and innovation, such as New York City, Seattle and Washington, D.C.,” she said.

In 2024, AI companies leased 420,000 square feet in New York City, including new secondary offices opened by San Francisco-based startups.

You must be logged in to post a comment.